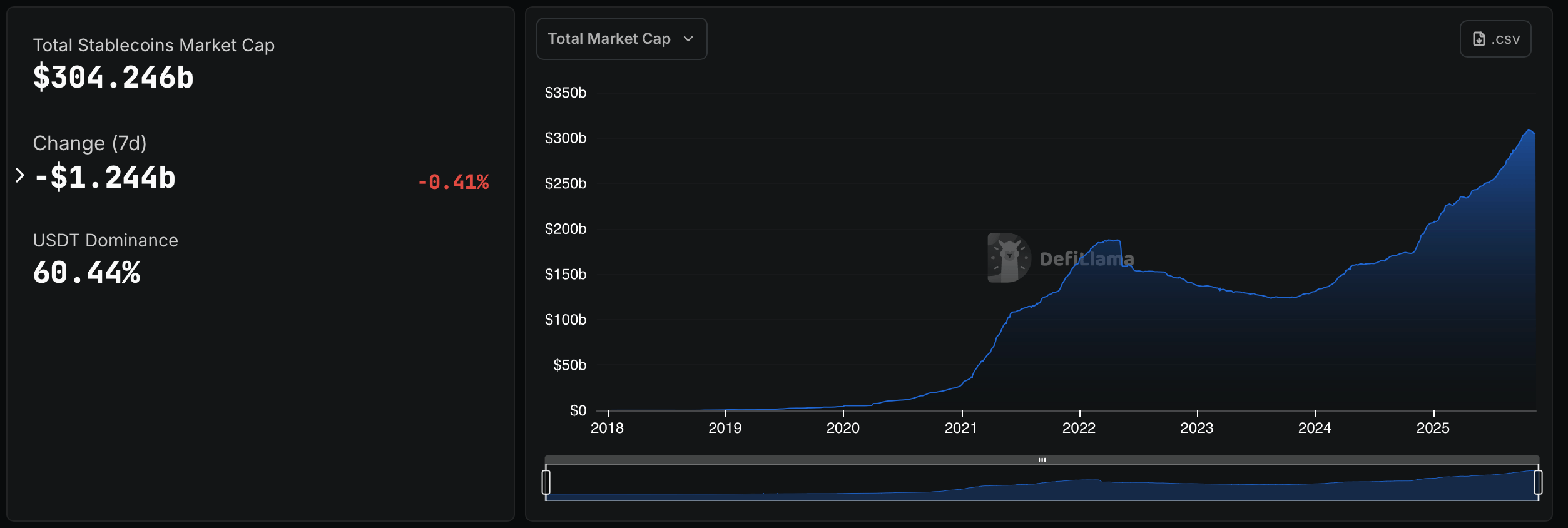

The stablecoin sector recorded a decline for the second consecutive week, slipping by $1.244 billion (about 0.41%). This situation follows on the heels of last week, when $1.925 billion quietly disappeared from the pile. When the stablecoin pool shrinks like this, it usually signals capital creeping out of the crypto space and into fiat and other corners of the market.

Two-week decline continues as stablecoins lose capital

This weekend, the fiat-pegged economy was pegged at $304.246 billion, following a 0.41% decline this week, according to stablecoin data from defillama.com. The past seven days have brought all kinds of mood swings to the stablecoin sector. Tether’s USDT remains in the top spot at $183.896 billion, but it only gained 0.16%, which is hardly a nod.

USDT’s valuation accounts for 60.44% of the entire fiat-pegged token sector’s $304.246 billion. Circle’s USDC fell 1.20% to $74.498 billion, a big sigh equivalent to the stablecoin. Ethena’s USDe, which holds $8.094 billion, is facing a sharp decline of 6.10%, clearly one of the biggest slumps of the week. USDe also took a big hit last week.

Sky’s USDS fell 0.65% to $5.747 billion, a polite little stumble. DAI, an older stablecoin from the same project and holding $4.851 billion, fell by 0.46% as if stepping on a Lego. PayPal’s PYUSD stablecoin ($3.417 billion) crashed 22.20% and was basically the only thing with caffeine in it.

In the same time frame, President Trump-backed World Liberty Financial and its USD 1 stablecoin $2.846 billion fell 1.04%, trying not to cause a stir, but still falling. BlackRock’s BUIDL, worth $2.28 billion, sank -11.62% in a completely dramatic exit worthy of slow applause. Similar to USDT, Falcon Finance’s USDf achieved a minimum effort of 0.12% at $2.03 billion.

On the other side of the Ethena spectrum, the $1.533 billion stablecoin USDtb fell 16.30% and took the most dramatic prize by a mile. Ripple’s stablecoin RLUSD shined with a clean 3.66% gain at $1.089 billion, while Circle’s USYC ended the chaos with a confident 9.54% gain at $1.077 billion, reminding everyone that the newcomer truly has hero-like energy.

Also read: Bitcoin options traders hedge dip with calls leading market-wide puts

Ethena USDtb (USDTB) plunged -16.30% to $1.533 billion and took home the award for “Most Dramatic” by Miles. Ripple USD (RLUSD) at $1.089 billion shined with a clean +3.66%, while circle USYC closed out the chaos with a confident +9.54% at $1.077 billion, reminding everyone that sometimes newcomers really do have hero-like energy.

All in all, this week ended with the stablecoin sector looking like a cast of characters, each dedicated to their own brand of theater. Some are tiptoeing, some are failing dramatically, and some are strutting with a confidence they didn’t have. Whether this capital exit cooldown becomes a trend or just a temporary mood swing, mixed signals in the sector suggest that traders are still thinking about where they want to put their dry powder next.

Frequently asked questions ❓

- What’s causing the stablecoin sector’s second weekly decline?

Capital flowed out of major stablecoins, leading to a total market decline of $1.2 billion. - Which stablecoins saw the biggest moves this week?

Tokens such as USDe and USDtb recorded the steepest declines, while PYUSD and USYC showed notable gains. - How big is the stablecoin market after the latest drawdown?

According to indicators from defillama.com, after the $1.2 billion reduction, the sector will be worth $304.246 billion. - What does the shrinking stablecoin market imply for traders?

Contract sectors often indicate funds moving from cryptocurrencies to fiat currencies or other assets.