The metric reveals that approximately 121,000 btc ($1.046 billion) and $1.74 billion of ETH have ended since January 1, 2025.

Removal of liquidity in 2025

Withdraw Bitcoin (BTC) and Ethereum (ETH) from centralized trading platforms reduce sales pressure by tightening accessible supply. This shift amplifies independent adoption and allows users to secure assets in non-custodial wallets. This maintains ownership and protects shields against institutional vulnerabilities such as hacking and bankruptcy.

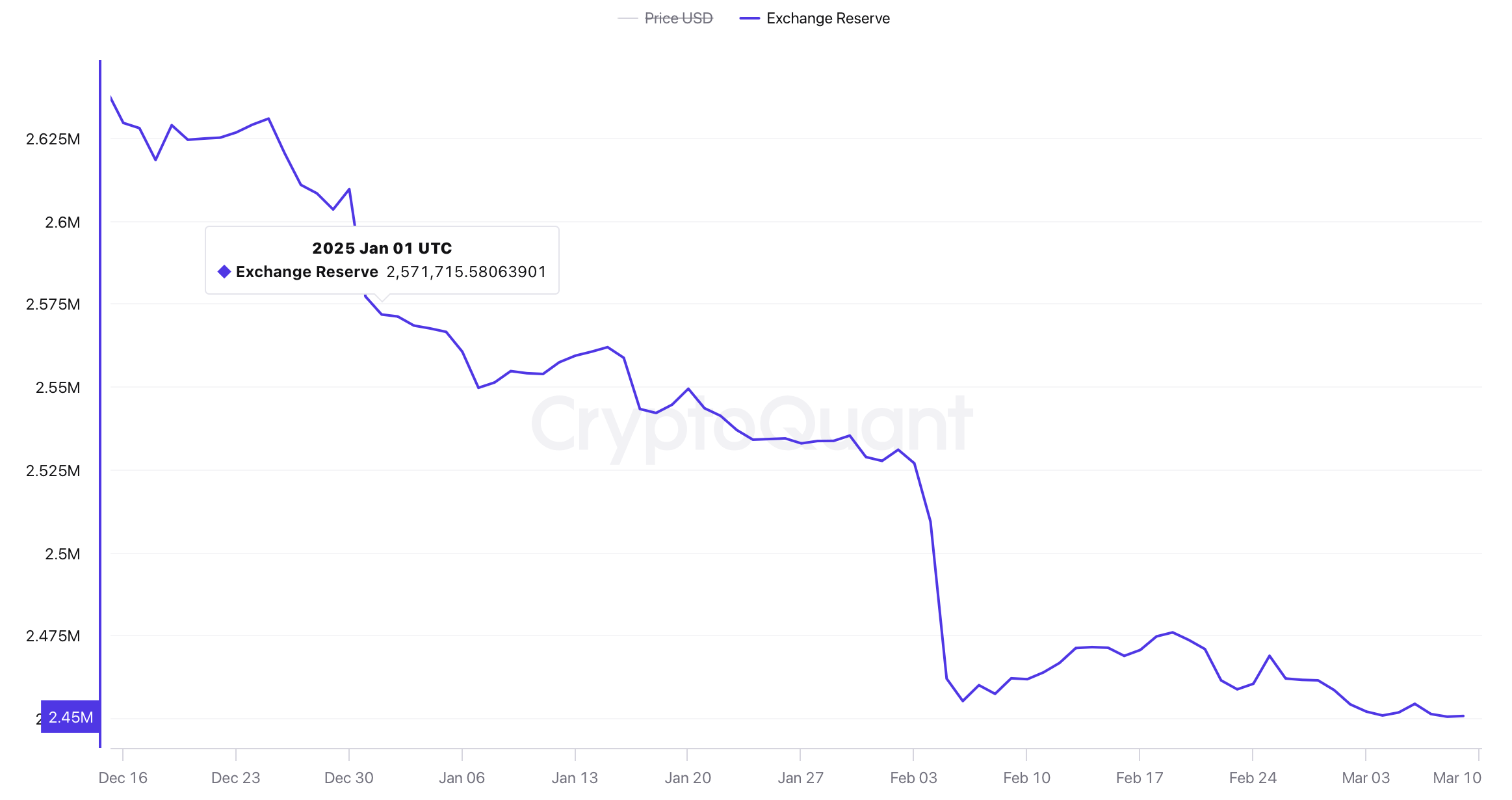

According to data from cryptoquant.com, Bitcoin reserves were exchanged between January 1, 2025 and March 9, 2025.

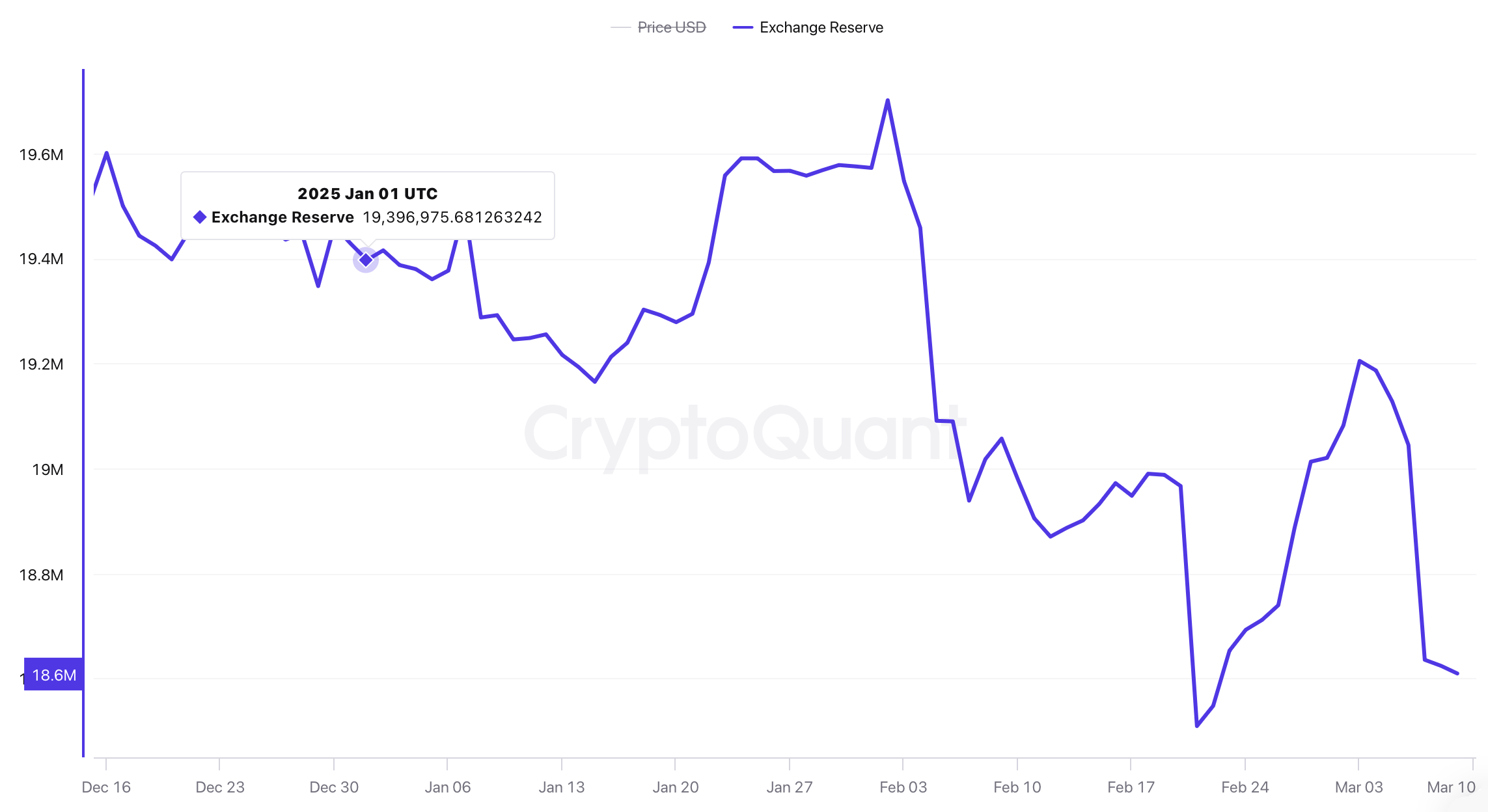

Such practices strengthen decentralized ideals and encourage strategic, long-term asset retention. For each Cryptoquant.com, 121,000 BTC ($1.046 billion) have left the exchange from January 1, 2025. The parallel data again show a concentrated platform that emitted 790,000 ETH this year, culminating with a total of $12.2 billion in Exodus.

Data from cryptoquant.com shows that we will be replacing Ethereum reserves from January 1, 2025 to March 9, 2025.

Ether bookings have plummeted to invisible levels since summer 2016, but the BTC liquidity of these platforms reflects the low July 2018. Meanwhile, Bitcoin Miner has amplified 1,000 btc ($86.5 million) since the beginning of January. By accumulating accumulation, miners rely on liquidation of newly-created coins to fund operations, curb market volatility and develop price balances.

In the long term, maintaining Bitcoin stockpiles strengthen the financial health of miners and promote operational durability amid unstable market cycles. This is also consistent with Bitcoin’s decentralized philosophy by prioritizing direct asset custody over third-party exposures.

By constraining easily tradeable supplies, ordinary owners and miners collaborate in price resilience while defending security and independence beyond central vulnerabilities. This coordinated change reflects the growing confidence in the decentralized promise of blockchains, harmonizing ideological doctrine with economic durability, and sustainably redefines the economic architecture of crypto.