important notes

- Whale has generated a total of $33.12 million in profits to date and currently holds $6.36 million in unrealized gains on his short entry at $111,499.

- Today’s cryptocurrency market recorded a liquidation amount of $343.89 million, with short positions of $256.95 million and long positions of $86.94 million.

- Bullish technical indicators and institutional investor accumulation activity are creating upward price pressure towards liquidation standards.

Hyperliquid traders face the possibility of their short positions of 1.23,000 Bitcoins worth $131 million being liquidated if the cryptocurrency reaches $111,770. Wallet address 0x5d2f..b7 opened a position with 20x cross leverage on a decentralized perpetual futures exchange.

Bitcoin BTC 105 537 dollars 24 hour volatility: 1.7% Market capitalization: $2.11 trillion Vol. 24 hours: $73.06B Based on TradingView data, it is trading at $106,443 as of November 10, 2025. The current price is $5,327 below the liquidation trigger. Analytics platform Coinglass warned of the whale exposure in a social media post on November 10th.

#Superliquidity liquidation map

If Bitcoin crosses $111,770, Super Whale’s short position worth $1.23,000 BTC will be liquidated. 🧐https://t.co/RO2fCIDLi1 pic.twitter.com/UUebjOsBG3

— CoinGlass (@coinglass_com) November 10, 2025

Related article: Trader bets $64.7 million on $1.73 billion crypto liquidation, sparking extreme fear

This trader has an unrealized profit of $6.36 million, which represents a 4.86% profit from the average entry price of $111,499.30. Whale’s total account value at Hyperliquid is $8.54 million.

Bitcoin Rise Causes $343 Million Market Liquidation

With Bitcoin regaining $106,000 on November 10, the cryptocurrency market recorded forced position closings of $343.89 million in 24 hours. Short positions were worth $256.95 million, accounting for 74.7% of the total. Long positions accounted for the remaining $86.94 million.

The concentration of short-term liquidations indicates continued upward pressure on prices. As Bitcoin rises, short traders are facing forced buys to exit their positions. This demand could push the price towards the $111,770 threshold, where an automatic liquidation would be triggered.

Whale’s profitable trading history

This wallet generated a total of $33.12 million in realized profits for Hyperliquid. According to trading records, the trader opened the current short through multiple entries from September 2025. Notable activity includes two major automatic deleveraging events on October 10, 2025, with positions worth $28.38 million and $18.87 million.

Whale’s strategy stands in contrast to other HyperLiquid Whale trading activity, in which another trader opened a leveraged long position worth $64.7 million on Nov. 5, betting that the price would rise.

What drives Bitcoin to the trigger?

Photo credit: TradingView

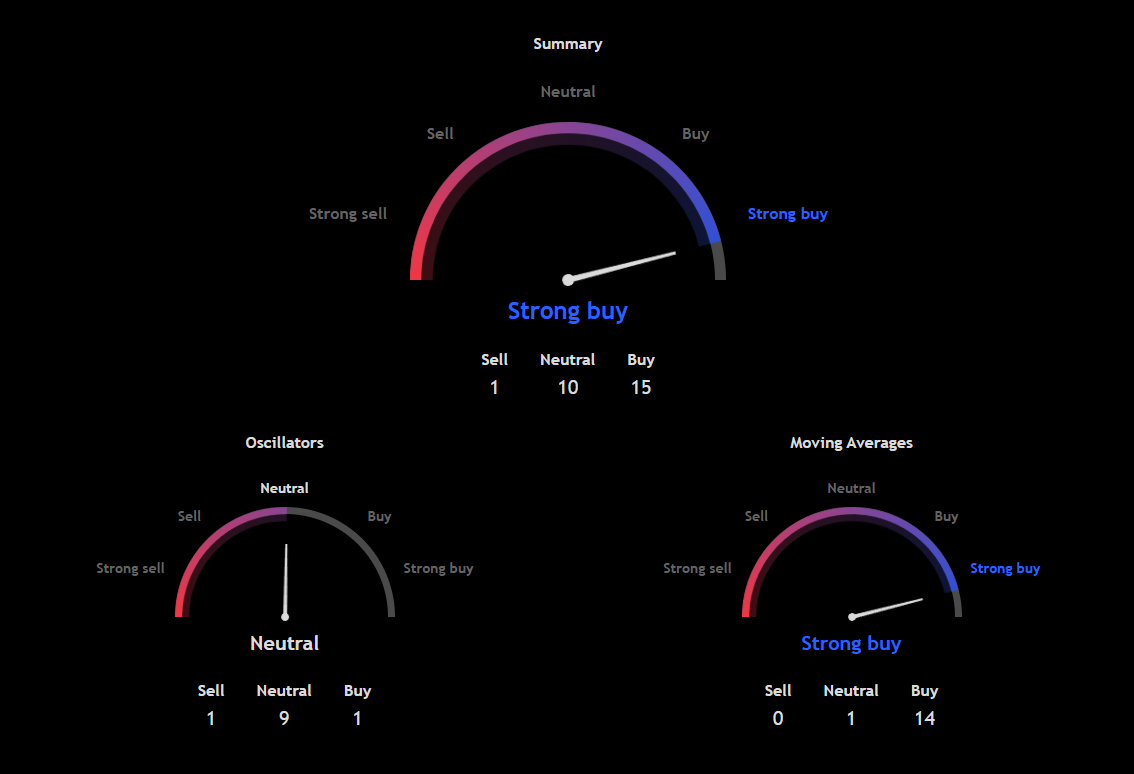

Short-term technical analysis shows that Bitcoin has bullish momentum with 15 buy signals and 1 sell signal. The relative strength index registered a reading of 66, indicating neutral to bullish sentiment rather than overbought conditions.

Recent institutional Bitcoin buying activity by companies such as Strategy is creating further demand pressure. Strategy prepared to accumulate after raising €620 million. Coupled with a large amount of short liquidations that will force buying, these factors could push Bitcoin to $111,770, where the whale’s position will be automatically closed.

Disclaimer: Coinspeaker is committed to providing fair and transparent reporting. This article is intended to provide accurate and timely information but should not be taken as financial or investment advice. Market conditions can change rapidly, so we recommend that you verify the information yourself and consult a professional before making any decisions based on this content.