Bitcoin hit $124,533 on August 14th, following a hit following hotter than expected wholesale inflation data in July.

The July consumer price index was well in line with market expectations, but the core readout that ruled out food and energy slightly above Wall Street estimates came to 3.1%. However, the producer price index for July, which measures wholesale goods, showed the strongest monthly profit of 0.9% in nearly three years.

Around the time of writing, BTC fell 0.77% to $117,741 over the past 24 hours, with a drop of $116,859 on Friday.

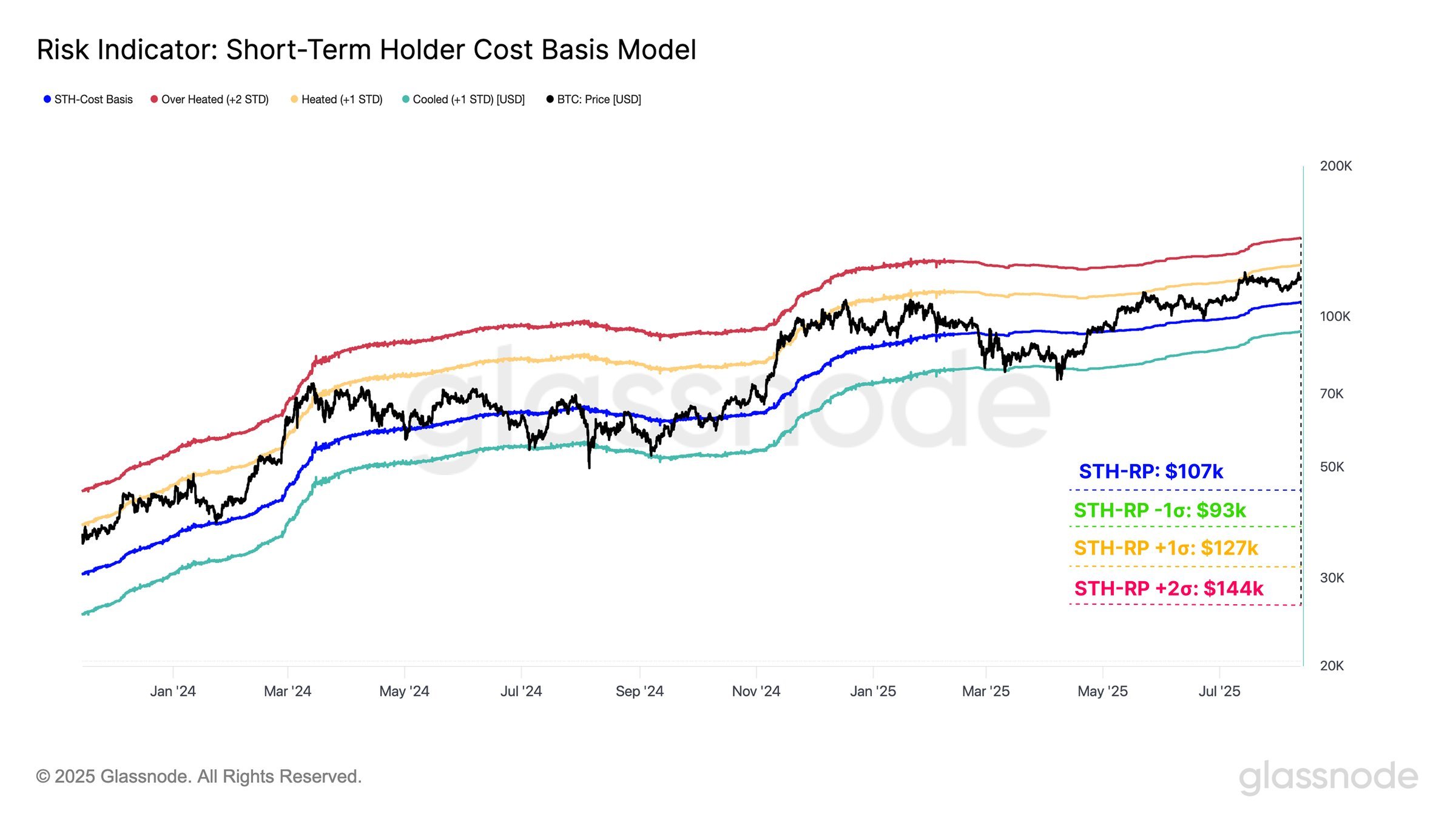

Second, the average entry price for BTC for new investors and their standard deviation bands will help identify overheated zones.

According to GlassNode data, the Realized Price (STH RP) for short-term holders of Bitcoin (BTC) is currently $107,000, representing the average on-chain acquisition price for Bitcoin (BTC).

The STH RP +1σ level is $127,000, a major important resistance for Bitcoin to overcome, with a breakout opening the pass to $144,000. The short-term holder matches the heating and overheating zones of the price standard deviation bands +1σ and +2σ, respectively.

Bitcoin has yet to reach these levels, suggesting that there may still be room for the current rally.

Fed signals were monitored carefully

Federal Reserve President Austan Ghoolsby spoke about mixed inflation numbers on Friday.

From August 21 to 23, the federal annual meeting of the world’s central bankers in Jackson Hole, Wyoming, has historically been used by the Fed to indicate policy changes and will be closely monitored by investors next week.

The market expects FOMC to vote to reduce the rate of benchmark federal funds by a quarter percentage point for September. However, there are concerns about what will happen next, with another cut odds of 55% in October, and a third move in December is only 43% likely.