Ethereum is approaching critical resistance at $1,675, and a bullish breakout could push prices to $1,750 amid a continuous whale accumulation.

Once Bitcoin exceeds $87,000, Ethereum is steadily gaining momentum. Over the past 24 hours, Ethereum’s market price has skyrocketed nearly 3.5% to $1,647.

This recovery rally brings Ethereum closer to its $1,675 supply zone. Will this make the ETH price more than $1,750?

Ethereum aims for a $1,650 breakout

On the 4-hour price chart, Ethereum price trends showcase bullish breakouts on the long-standing resistance trend line. Furthermore, recent recovery marks a positive cycle within the integration range.

Lateral range exchange between 23.60% and 38.20% Fibonacci levels. The lower limit is $1,577 and the upper limit is $1,675.

Now, Ethereum’s recovery run has created five consecutive bullish candles, above 50 Emmaline. However, the upward trend faces opposition from the overhead supply zone and the 100-EMA line.

Nevertheless, the short-term recovery supported by trendline breakout rally shows a positive crossover of MACD and signal lines. This increases the chances of a breakout run.

Based on Fibonacci levels, 100-EMA breakouts could be followed by a breakout in the integrated range, potentially challenging the 50% level near 200 Emma Line. This predicts that Ethereum is likely to exceed $1,750. Conversely, a potential bearish inversion could retest the 23.60% level.

Ethereum traders are hoping for a strong recovery in the future

With the growing possibility of a new bullish cycle at Ethereum, profits for traders in Ethereum derivatives have increased significantly. Open interest surged 4.83% to $191.9 billion, with funding rates positive.

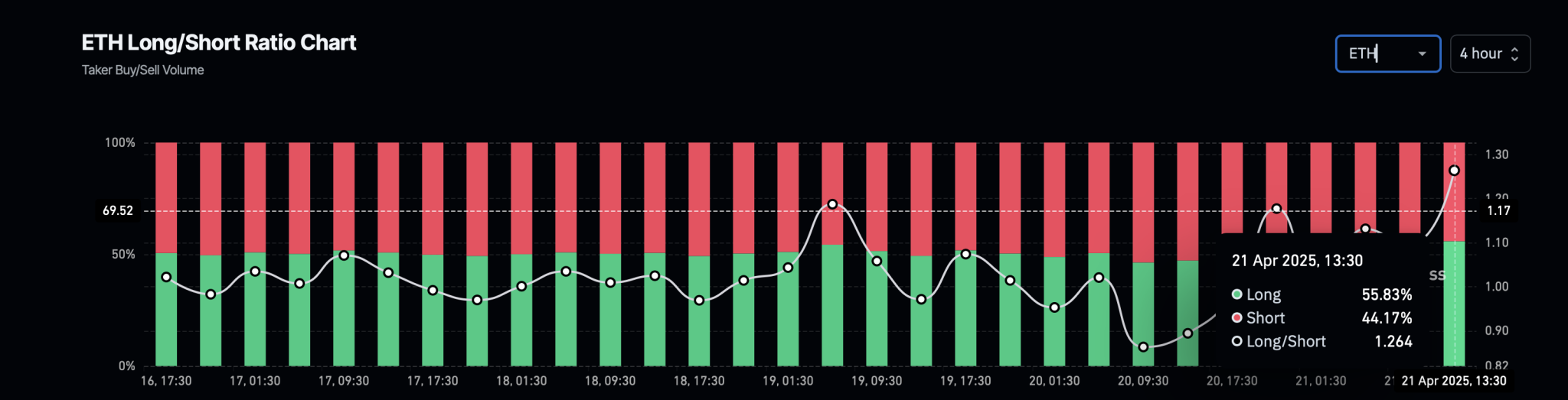

Furthermore, in the past four hours, the long position of Ethereum derivatives has skyrocketed to 55.83%, driving the long-term ratio to 1.264. This shows the rise in Ethereum bullish sentiment in the derivatives market.

Ethereum Longshort Ratio Chart

Analysts show potential bullish momentum

Crypto analyst Ali Martinez suggests that Ethereum is showing a massive recovery this week. Based on the TD sequential indicator, Ali Martinez highlights the potential bullish reversal of Ethereum.

Analysts suggest a potential change in bullish momentum as technical indicators trigger purchase signals.

#ethereum $ Big Week for eth! The TD sequential flashed the purchase signal, suggesting a potential change in momentum. pic.twitter.com/xnhvkzbxjc

– Ali (@Ali_Charts) April 21, 2025

Whale accumulates ETH

Amid the growing possibility of Ethereum’s bullish turnaround, whales are rapidly beginning to accumulate ETH. According to a recent tweet by Lookonchain, the whale has acquired 1,897 Ethereum worth $3 million. Earlier this month, the same whales retracted 3,844 Ethereum, worth $6.5 million from the Bitget Exchange.

Additionally, another whale has acquired 6,528 Ethereum worth $10.69 million, bringing the whale It holds 6,624 Ethereum worth $10.83 million. As whales continue to earn ETH, the chances of bull run increase dramatically.

Whales continue to accumulate $eth!

The Whale retracted an additional $1,897 ($3 million) from #bitget 10 hours ago.

The whale has withdrawn $3,844 ETH ($6.51mm) from #bitget from April 3rd. https://t.co/hzn9klpt6m pic.twitter.com/0hcpswzx8w

– lookonchain (@lookonchain) April 21, 2025