The 2025 cryptocurrency cycle not only saw Bitcoin reach a new all-time high, but was also a year of structural evolution. As the flow of capital between on-chain venues and centralized exchanges (CEXs) reaches its peak, the industry’s focus has shifted to how platforms source and price new assets.

A new comprehensive audit by Gate Research, covering 447 spot listings through 2025, reveals a clear discrepancy in performance between fast-follow listings and mainstream listings. The data suggests that Gates has carved out significant listing alpha, particularly within proprietary project pipelines where short-term price discovery is most intense, resulting in a median gain of nearly 81% within the first 30 minutes of trading.

Remarkably, approximately 80% of these exclusive assets opened with positive momentum right away, indicating high demand from the beginning.

Primary engine: 71% first to market

Gate’s 2025 strategy featured its role as an incubator for new supply. Of the 447 assets analyzed, 318 (71%) were primary listed. This means that Gate is the first major venue to facilitate price discovery for these tokens.

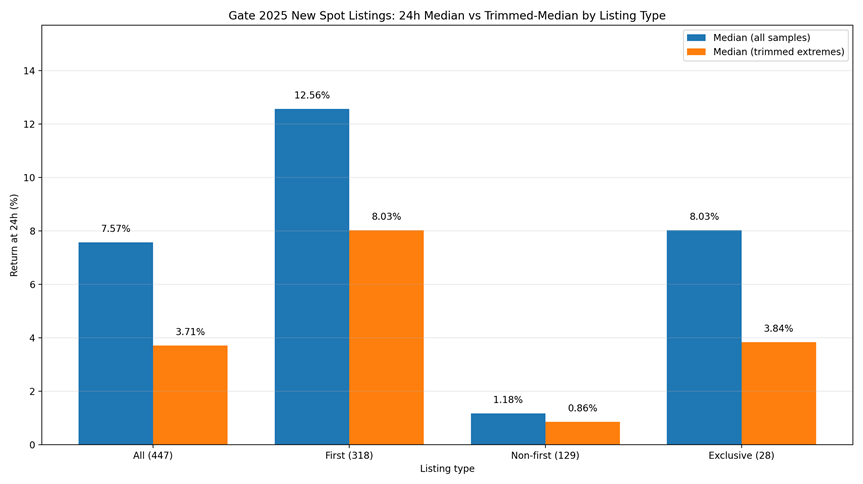

Data supports the benefits of early action. Within the first 24 hours:

- The median return for primary listings was 12.56%.

- Non-primary listings (secondary listings of existing tokens) were significantly delayed, with a median of only 1.18%.

This gap highlights Gate’s ability to capture the early heat of a project’s lifecycle when volatility and demand peak. The average 24-hour return for gainers reached an impressive 635%, while the median for the entire sample (including losers) was a more grounded 7.57%. This suggests that while the “long tail” of winners is vast, the platform also provides a stable environment for broader asset pricing.

Special “30 minute sprints”

The most aggressive alpha was found in the Gate-only subset, a group of 28 high-confidence projects. These assets didn’t just perform. They burst out of the gate.

- Median Profit: The median 30-minute profit for these exclusive products reached approximately 81%, indicating a period of intensive and profitable price discovery.

- Strike Rate: This performance was surprisingly stable, with almost 80% (22/28) of exclusive projects trading above their list price within the first 30 minutes.

- Wealth Impact: More than a third of these exclusive listings returned more than 100% in the same 30-minute time frame.

This demonstrates that Gate’s proprietary product screening process is highly synchronized with market demand and successfully identifies assets that can turn instant attention into deal momentum.

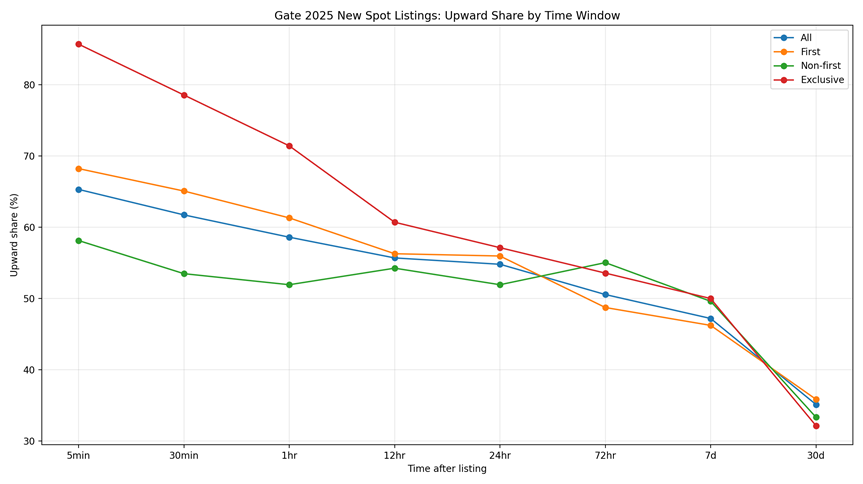

“72 Hour Pivot”: A Trader’s Roadmap

This report provides an in-depth analysis of the post-listing lifecycle and identifies key turning points for investors.

Typically, by the 72-hour mark, the IPO rally has dissipated and the market has transitioned from momentum-based trading to a regime of few winners, many profiting. The median 30-day return falls to -25%, confirming that the most practical wealth effect is concentrated in the first three days of listing.

From AI infrastructure to community culture

Gate’s positioning in 2025 was less about market timing and more about a deliberate focus on a specific narrative. The exchange trajectory was defined by three main themes.

Traffic gateway (e.g. Pi network)

Projects like Pi Network (PI) have demonstrated Gate’s ability to handle large-scale, community-driven transportation assets. After listing, PI soared nearly 60 times in seven days, proving that the gate’s liquidity layer can absorb concentrated demand from millions of external users without breaking the price discovery mechanism.

The story of AI infrastructure and x402 (e.g. Unibase)

As AI evolved from simple wrapper apps to core infrastructure, Gate stayed ahead of the curve. x402 contender Unibase (UB) has shown remarkable resilience. Despite increased market volatility in October, UB continued to trend higher with an ATH of $0.086, up 500% from its launch, demonstrating the longevity of the technology-driven listing.

Attention economy (e.g. Mubarak and useless)

In the world of hyper-speed memes, timing is everything. Gate’s nimble listing of Mubarak early in the hype cycle led to a 120% gain in one day. By acting quickly when a cultural symbol gains attention, the platform has enabled users to capture growing stages of community consensus.

Conclusion: A platform for practical listings

Data over the past year confirms Gate’s evolution into a strategic launching pad for emerging assets. By focusing on exclusive listings, the platform has optimized its role in the early stages of the market cycle.

Looking ahead to 2026, the sustainability of this high-volume listing strategy will be critical for exchanges to remain competitive in securing liquidity and user engagement.

The post Primary List Leads Price Discovery as 80% of 2025 Limited Tokens Reach Green appeared first on BeInCrypto.