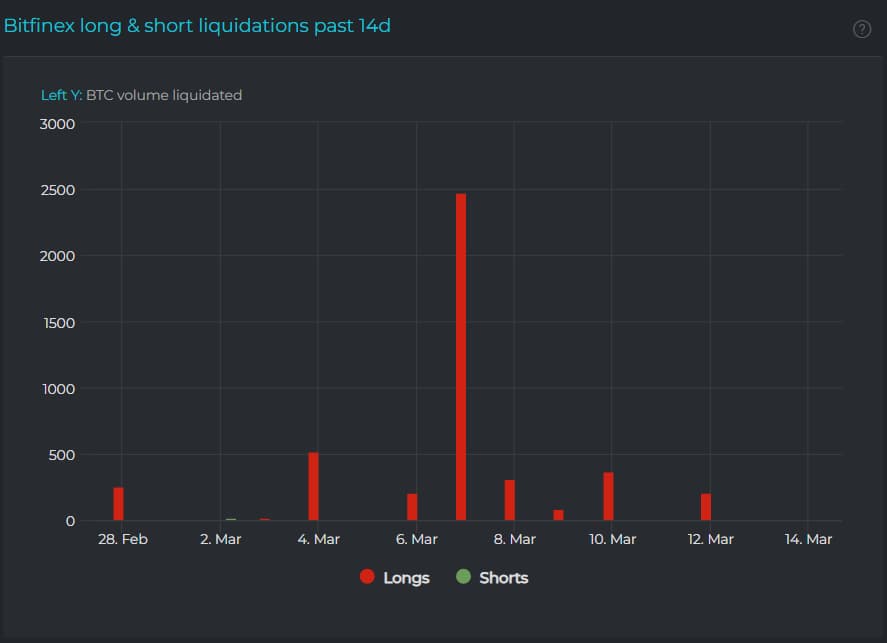

Liquidation has traditionally been used as a measure of market sentiment and direction, and traders are feeling a long squeeze heat in March 2025, judging by Bitfinex’s Bitcoin (BTC) trading.

According to Finbold data obtained from the Crypto Lending Analytics platform Data Mische On March 14th, Bitfinex saw a wave of liquidation this month.

Specifically, of the total 4,226.8 BTC liquidation, of which 4,196.9 were related to long positions, a staggering 99.29%.

Generally, such Long and short aperture This occurs when the market moves against a trader who has made a leveraged trade (trader who borrowed money to set up an investment).

Why is Bitcoin’s long position being wiped out in March?

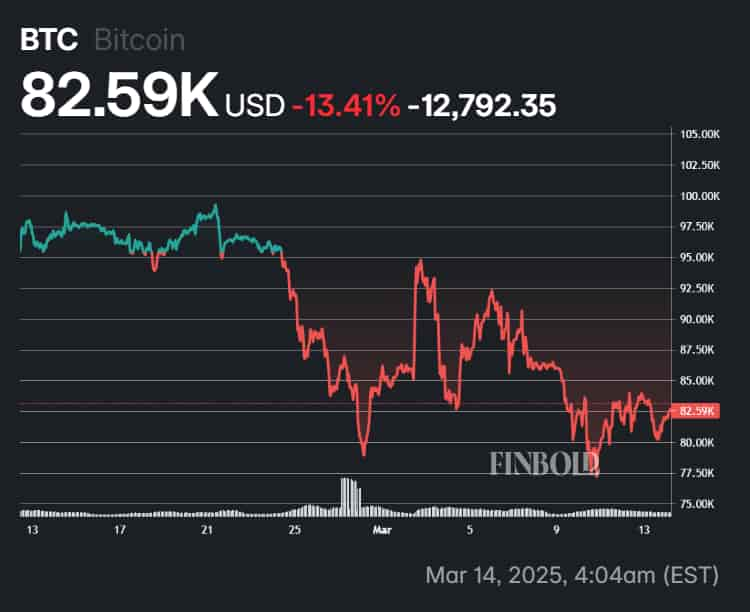

Find out Bitcoin price action for 2025 and March Long aperture It seems like a natural extension of Bloodbath in the cryptocurrency market.

BTC has shown resilience in the $80,000 to $83,000 range, but even such a level of support looks somewhat overwhelming given the multiple dips, including those heading towards $77,000 on March 10th.

Moreover, while the price range for Press Time remains impressive when compared to the historic level, it’s once again bearish considering Bitcoin has recently surpassed $109,000 in January.

Over the past 30 days, the world’s best cryptocurrency fell 13.41% to a press-time price of $82.596, but the decline’s share of the decline was a more modest 3.5%. Still, the month was over $94,000 and featured significant volatility of nearly $77,000.

What’s next for Bitcoin in 2025?

Despite high hopes that Bitcoin’s bullish cycle is not over, the coin is slowly forming a similar pattern to the summer of 2024. Specifically, between June and November, BTC continued to decline slowly, and we continued to find lower and lower values.

During the time frame, we were able to maintain a somewhat stable level of nearly $60,000, while similar to cryptocurrency performance in March. Such a trajectory was suddenly turned around with Donald Trump’s reelection in November.

The press conference will not schedule an equivalent event for the future, and will mark the end of the current chaos.

Still, previous analysis, regulatory development, institutional adoption, and a historic half-cycle have made many investors optimistic that a breakout to new highs will occur in 2025.

Featured Images via ShutterStock