According to CoinmarketCap’s data, the Bitcoin (BTC) market has made a positive change, an increase of 1.10% last week. Although there is still expectation for more price modifications, as the US President Donald Trump’s recent statement has shown the impact of the macro economy, the impact of the macro economy has made more uncertainty about the future trajectory of the Premier Cryptocurrency.

Bitcoin Bulls face the confrontation with $ 98K resistance -Can they break through?

After the market correction was extended, BITCOIN recorded voluntary market profits last week. Currently, Crypto Asset trades about $ 86,000, with little shifting the future movement.

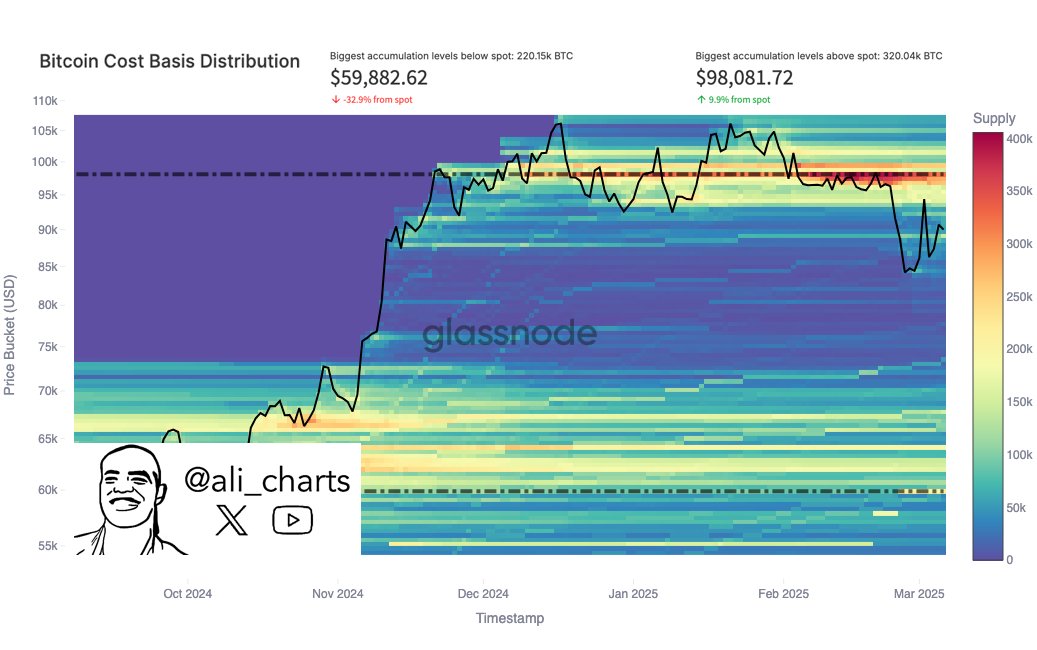

According to the chief market analyst Ali Martinez, Bitcoin’s price measures are now trapped between two major accumulation levels based on the CBD. The CBD helps to identify major support and resistance levels by showing a large amount of bitcoin purchase or selling.

Based on CBD data, Ali Martinez explains that Bitcoin will face the main resistance of $ 98,081 when it gains any more profit. This prediction comes from investors who have acquired 320,040 BTCs in this price area, and are likely to be sold to end the market with almost or zero loss after the price rebound. But if Bitcoin Bulls can go beyond this resistance level, it will open a way for more than $ 100,000 and perhaps the highest level of return.

On the other hand, if the BTC needs to resume the trend, Martinez is based on accumulation data and then emphasizes that the important support level is 220,150 BTC accumulated $ 59,882.

If Bitcoin decreases to this level of support, you can experience powerful bounce because long -term holders are likely to acquire more BTCs to defend their position. Interestingly, this analysis is consistent with other market insights that BTC may be able to receive additional modifications. But the decisive break of $ 59,882 or less will cause a huge amount of panic sales.

BTC price outlook

At the time of writing, BTC is traded at $ 85,995 after a 1.98% decrease last day. On the other hand, daily trading volume decreases by 6.38%, showing market and decrease. In the middle Positive events, such as the establishment of the US strategic Bitcoin Protection Zone, remain somewhat volatile, as the BTC market appeared as a larger market response to last week.

MorningStar’s main image, TradingView chart

Editorial process focuses on providing thorough research, accurate and prejudice content. We support the strict sourcing standard and each page is diligent in the top technology experts and the seasoned editor’s team. This process ensures the integrity, relevance and value of the reader’s content.