Ethereum (ETH) is under pressure and is struggling to surpass $2,300. That technical indicator still points to the cave. The BBTREND indicator has been improved but remains negative, indicating that bullish momentum is not fully developed.

At the same time, the White House crypto summit has probably increased the number of whales slightly as investors anticipate changes in regulations and the inclusion of ETH in strategic US crypto sanctuaries. For ETH to become bullish, it must break major resistance levels and maintain purchase pressure.

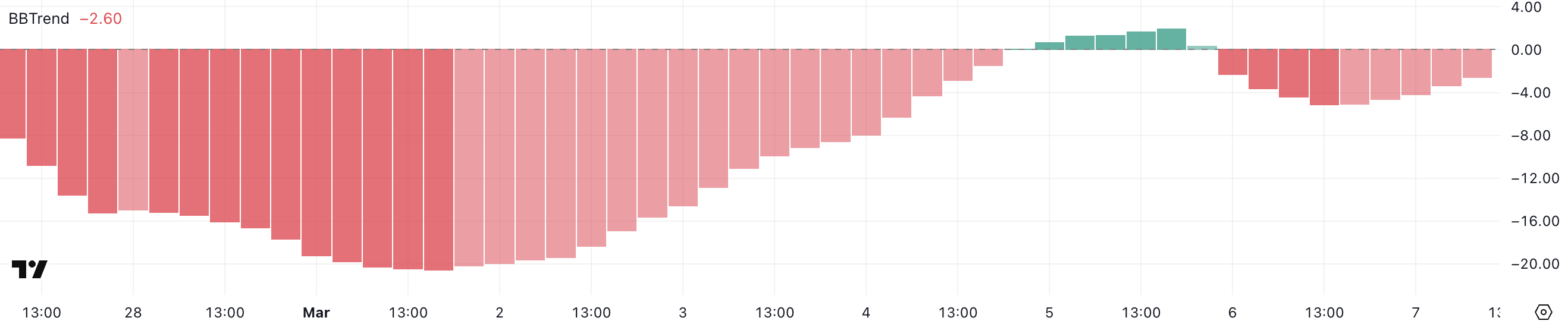

BBTREND shows that uptrends aren’t here yet

The Ethereum BBTREND indicator rose to -2.6, improving from -5.12 a day ago. Bbtrend, short for Bollinger Band Trend, is a technical indicator that helps you identify price trends and momentum by measuring price deviations from moving averages.

If Bbtrend is very negative, it suggests a strong bearish momentum, and a positive reading indicates bullish.

ETH BBTREND. Source: TradingView.

To get the bullish uptrend on Ethereum, you need to break through the higher level with BBTREND above 0. Two days ago, it temporarily tested positive, but reached 1.98 before it was lower and reversed.

If Bbtrend can push beyond the previous high level and maintain a positive level, it will see stronger momentum and increase the likelihood that Ethereum prices will maintain a bullish trend.

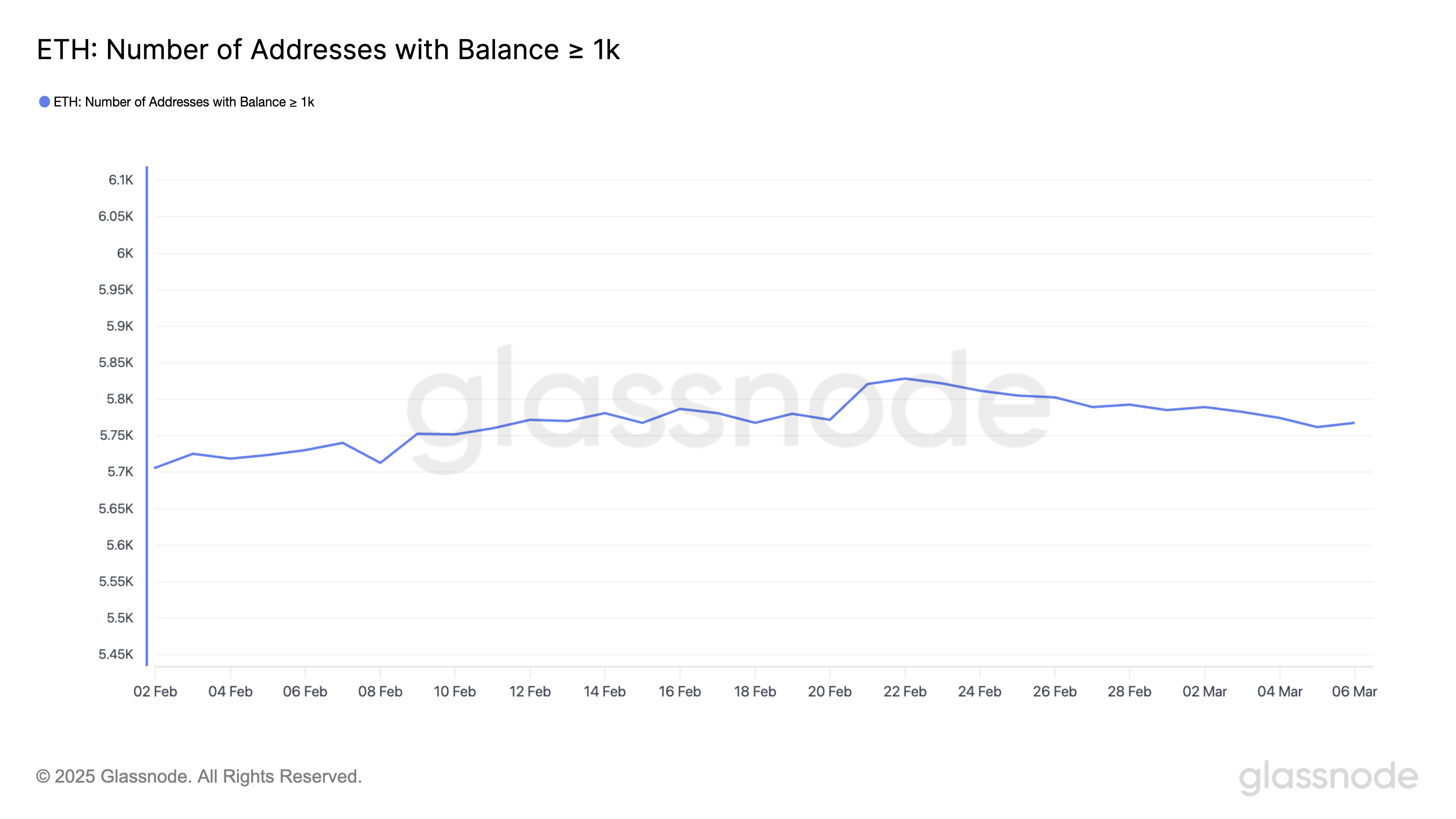

Whales have accumulated ETH, but the overall trend is still declining

The number of Ethereum whales (a deal that holds at least 1,000 ETH) rose slightly to 5,768 from 5,762 on March 5th. However, the broader trend remains downward, as it was 5,828 on February 22nd.

It is important to track these large holders, as whale activity often indicates a change in market sentiment.

ETH Whale. Source: GlassNode.

This recent increase in whale numbers could link to the Whitehau Script Summit, as key investors may position themselves ahead of potential regulatory developments and the inclusion of ETH in US strategic crypto sanctuaries.

If this increase continues, it could show new confidence in Ethereum’s long-term outlook. However, stronger bullishness requires a sustained rise in whale accumulation, reversing recent debilitating.

Will the White House Crypto Summit benefit Ethereum?

Ethereum has been struggling to beat more than $2,300 recently. Its EMA line still shows a downtrend as its short-term average is below the long-term average.

As sales pressures rise, Ethereum prices can test support at $2,077, and breakdowns below this level will be pushed at as low as $1,996, strengthening the bearish outlook.

ETH price analysis. Source: TradingView.

However, if Ethereum reverses that trend, it could challenge resistance at $2,550, potentially rising to $2,855.

A strong breakout above these levels could set a stage for ETH to regain $3,000. This is a level not achieved since February 1, 2025, indicating a new bullish momentum.