Disclosure: The opinions and opinions expressed here belong to the authors solely and do not represent the views or opinions of the crypto.news editorial.

Imagine a world where every country has its own internet. For France, one for Japan, one for the US, and no one could talk to each other. Your email will not be sent across borders, social media is limited to your country and global commercial transactions. Billions of dollars of innovative dreams are stuck in walled gardens. That’s exactly where the blockchain is.

You might like it too: When AI rewrites history, blockchain technology is a line of defense | Opinion

The Illusion of Progress that Drives the Innovation Dilemma

Every technological revolution begins with an obsession. How do we push the boundaries of what is possible? In blockchain, this often means faster transactions, cheaper rates, and higher scalability. But history teaches us something different. Innovations rarely follow linear paths. Instead, technology restructuring the industry is not just expanding. They redefine the very limits that constrain them.

Please use the internet. Its early days were defined by walled gardens, AOL, Compuserve and Microsoft Network. Each attempted to build its own ecosystem and captured value by limiting interoperability. However, when the open web appeared, these walled gardens collapsed. The internet was not successful because the constraint was removed. It was successful because they redefine them – created protocols (HTTP, SMTP, TCP/IP) that allow for seamless communication without trust.

The blockchain is at a similar intersection. The obsession with scalability has resulted in fragmented solutions (rollups, sidechains, and alternative layer 1 blockchains) solving certain problems, but added complexity to the broader ecosystem. But to quickly expand, we overlook one important factor: connectivity.

Blockchain space was not intended to be a collection of walled gardens, but that’s what it did. What’s the result? A handful of important inefficiencies:

- Bad user experience: Try moving Assets from Ethereum (Eth) to Solana (Sol), Bitcoin (BTC), or Cosmos Hub (Atom). It’s like assembling IKEA furniture without a manual.

- Silred Innovation: Developers are building incredible applications, but many are limited to a single chain. result? Limited users, lack of adoption.

- Fragmented fluidity:Defi applications are struggling to work across the chain, and liquidity is being destroyed. Users need to jump over hoops (and multiple wallets) to perform simple transactions. Therefore, everyone sticks to the chain that is within their operational comfort zone.

So the real problem isn’t just how best transactions are scaled or managed per second, but also how to rethink the fundamental constraints that define the future of blockchain.

Important constraints: Interoperability, not execution

As of 2024, there are over 120 L1 blockchains and dozens of L2 solutions. According to an Electric Capital developer report, the number of active developers for all blockchain projects rose 60% in 2023, with new chains and solutions continuing to emerge.

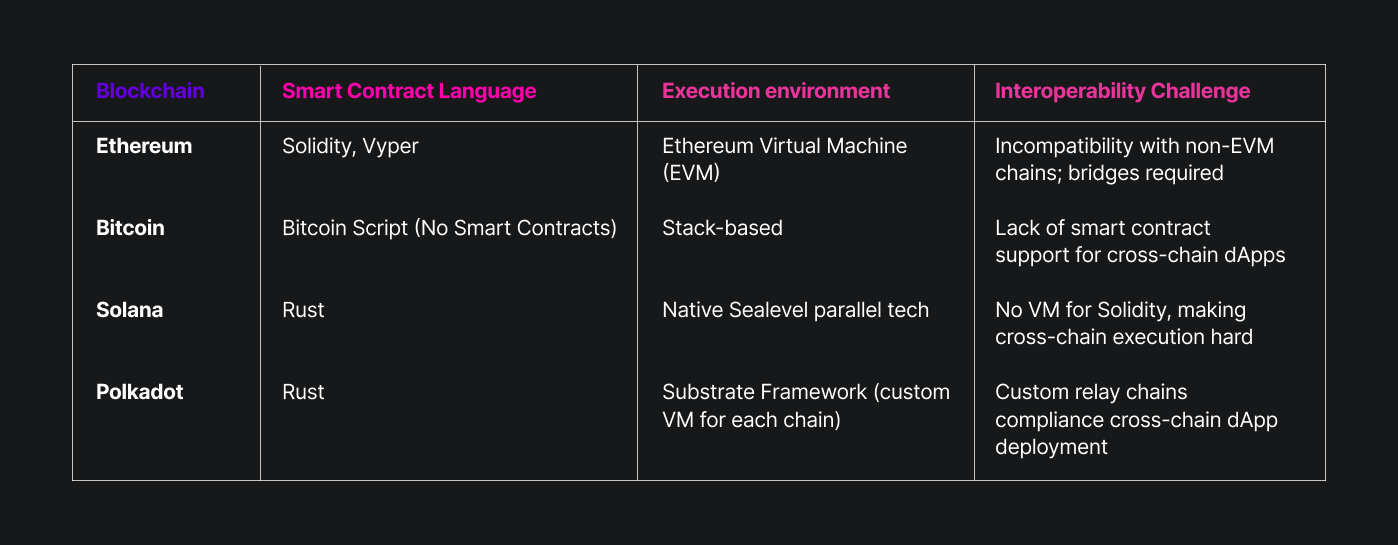

Each blockchain has its own consensus mechanism, its execution environment, and talknics that operate at its strength within a silo. For example, Ethereum uses Ethereum Virtual Machine (EVM) and Solidity for Smart Contract development, while Solana employs a different architecture in languages like Rust. This diversity creates a major barrier to seamless interactions between chains whilst promoting innovation in their own ecosystems.

Interoperability between chains with such fundamental differences in coding language, virtual machines, and execution paradigms calls for more than just filling assets. It means overcoming important architectural and technical barriers.

And to solve these problems, we literally built a bridge.

The bridge we built and why they continue to break

Wrapped tokens, liquidity hubs and cross-chain messaging systems have promised a seamless experience, but each comes with trade-offs. Security vulnerabilities. It slows down. A tedious process.

The bridge in its current form is like duct tape from leaky pipes. They work – they don’t.

Differences in coding languages and the lack of common virtual machines increase the cost of building bridges and integration layers between blockchains. Each time a developer builds a cross-chain bridge or interoperability layer, you need to explain:

- Language Translation: Conversion between Solidity, Rust, or Bitcoin scripts is not only time consuming, but also error prone. In 2023, over 60% of active blockchain developers worked on interoperability solutions, spending an average of 1.5 times more time on troubleshooting and debugging cross-chain logic than single-chain applications.

- VM compatibility: Filling up EVM and Solana history proof or Bitcoin scripts is not easy. This is not just about moving tokens from one chain to another, but also about ensuring that the logic behind a distributed application is compatible in different execution environments.

- Security risks: The more layers of interoperability you deploy between different ecosystems, the more likely it is to be vulnerable because hackers have more targets. According to the 2023 Chain Melting Report, Cross-Chain Bridge was responsible for more than $1 billion in losses due to a security breach in 2022 alone. The complexity associated with ensuring that cross-chain interactions are safe can increase the costs of insurance, auditing and continuous monitoring. In fact, blockchain projects now spend an average of $200,000 per year on smart contract audits and cybersecurity solutions, starting from $50,000 just two years ago.

Each of these hurdles increases the cost of developers and ultimately reduces the user experience due to increased gas prices, trading times, and potential errors or failures in cross-chain applications.

So, what is the future? As Vitalik Buterin, co-founder of Ethereum, said:

“The future of blockchain is not to be the best in one area, but to be the best to work together.”

New Mental Model: Composite builds interoperability

Interoperability is an enabler with a stage of complexity.

Combination refers to the capabilities of a wide range of blockchain components, such as smart contracts, protocols, and applications, which allow for seamless interaction and creating more complex and versatile functions. This modular approach allows developers to build on existing components, driving innovation and efficiency.

In the context of blockchain interoperability, complexity allows DAPP to operate across multiple chains. For example, Defi applications could leverage liquidity pools from various blockchains to provide users with better rates and more options.

Because at the end of the day, if it exists alone, a fast blockchain is useless.

Presto. Heading to build an open highway.

read more: Reports of Ethereum’s death are highly exaggerated | Opinion

Davide Megaldo

Davide Megaldo This is the CCO of Neon EVM. He has been at the forefront of blockchain innovation since late 2013. With 10 years of experience in blockchain and crypto, his areas of interest include Web3, Defi, Staking and NFT. Davide embarked on an entrepreneurial journey in 2015 and founded his first startup to allow global charities to accept Bitcoin donations. He also promoted community involvement and actively participated in local Bitcoin Meetups and crypto conferences in Europe. In 2023, Davide set out on a journey where Neon Labs leads the commercial and business side. He focuses on developing innovative business lines, fostering strategic partnerships, and driving the growth charts for neon EVMs while defending growth in both the Solana and Ethereum blockchain ecosystems.