According to the latest data, Bitcoin hashrates have been immersed under the second (EH/S) threshold (EH/S) threshold, which coincides with 30-day low mining revenues in mine revenue. As of Friday, Hashpris was just below $50 (ph/s) per petahash per second, indicating a noticeable decline in miners’ profitability.

Bitcoin Miner feels a bit in trouble

Bitcoin’s drop below the $80,000 threshold on Thursday proved less ideal for miners as revenues were a huge hit. As of now, Bitcoin (BTC) has risen above $83,000, so the hashpris, or 1 pH/s estimate, has seen a slight recovery, but remains at its lowest level since January 28th.

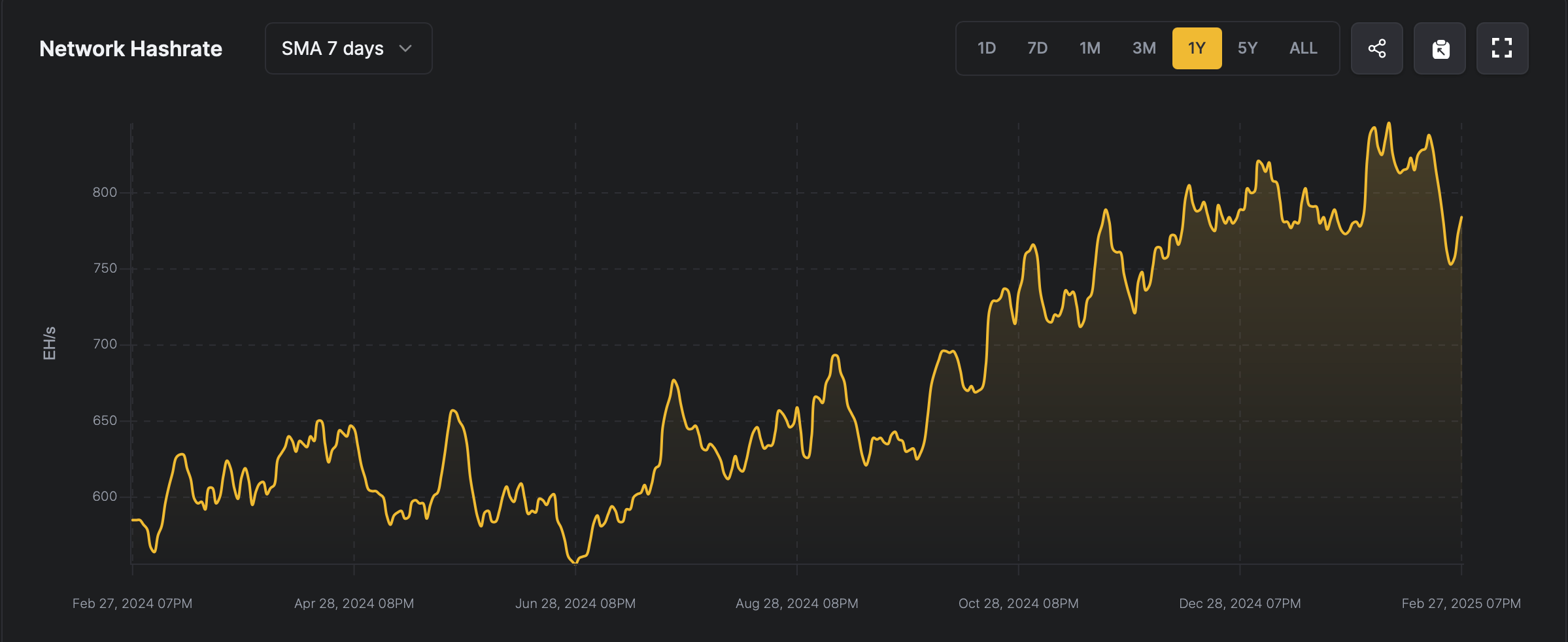

Bitcoin hashrate via HashrateIndex.com

On Thursday, the Hashpris was soaked at $45.41 per Petahash, up to $48.65 inches per Petahash as of 3:30pm Eastern time on Friday. Just 30 days ago, Hashpris was at $60.19 per ph/s, highlighting the recent challenges facing BTC miners. Bitcoin hashrate also peaked significantly in February, climbing to 852 EH/s on February 7, 2025.

However, with the current rate of 799 EH/s, the network exceeds EH/s above 50 computational strength, marking a significant shift in processing power. The reduction in hash power coincided with a 3.15% reduction in Bitcoin’s difficulty, which occurred five days ago on February 23 at block height of 885,024. Currently, the network difficulty level is 110.57 trillion, so the next adjustment is expected to take place on March 9th.

The official indicators remain incomplete as February 28th is not finished yet, but Bitcoin Miners appears to be less valuable than this month’s January. Miners generated $1.4 billion from block subsidies and fees last month, according to data collected from theblock.co. However, this month’s tally was $12.1 billion, remaining just three hours and 20 minutes before February ends.