Ethereum prices have experienced integration following deep revisions over the past month. However, key support remains in front of the price, allowing for a bullish retracement stage.

Technical Analysis

By Shayan

Daily Charts

Ethereum has undergone deep fixes over the past few months, eventually reaching a critical support range of $2,000. This level has been serving as a strong support zone since December 2023 and is of great importance as it coincides with the important optimal trade entry (OTE) level.

If ETH falls below this support, a noticeable downward trend may continue. However, given the historical demands at this level, the market is likely to consolidate, potentially a short-term bullish setback.

4-hour chart

In the lower time frame, Ethereum’s bear market structure remains intact. It is characterized by low lows and low highs, signaling ongoing seller domination. Recently, the asset has shown an increasing volatility around the area of $2,000, leading to a major liquidation of leveraged positions.

However, bullish divergence appears between Ethereum prices and the RSI indicators, suggesting a gradual increase in purchasing pressure.

Given these factors, further integration within the $2k to $2.5,000 range could result in increased volatility and short-term price rebounds.

On-Chain Analysis

By Shayan

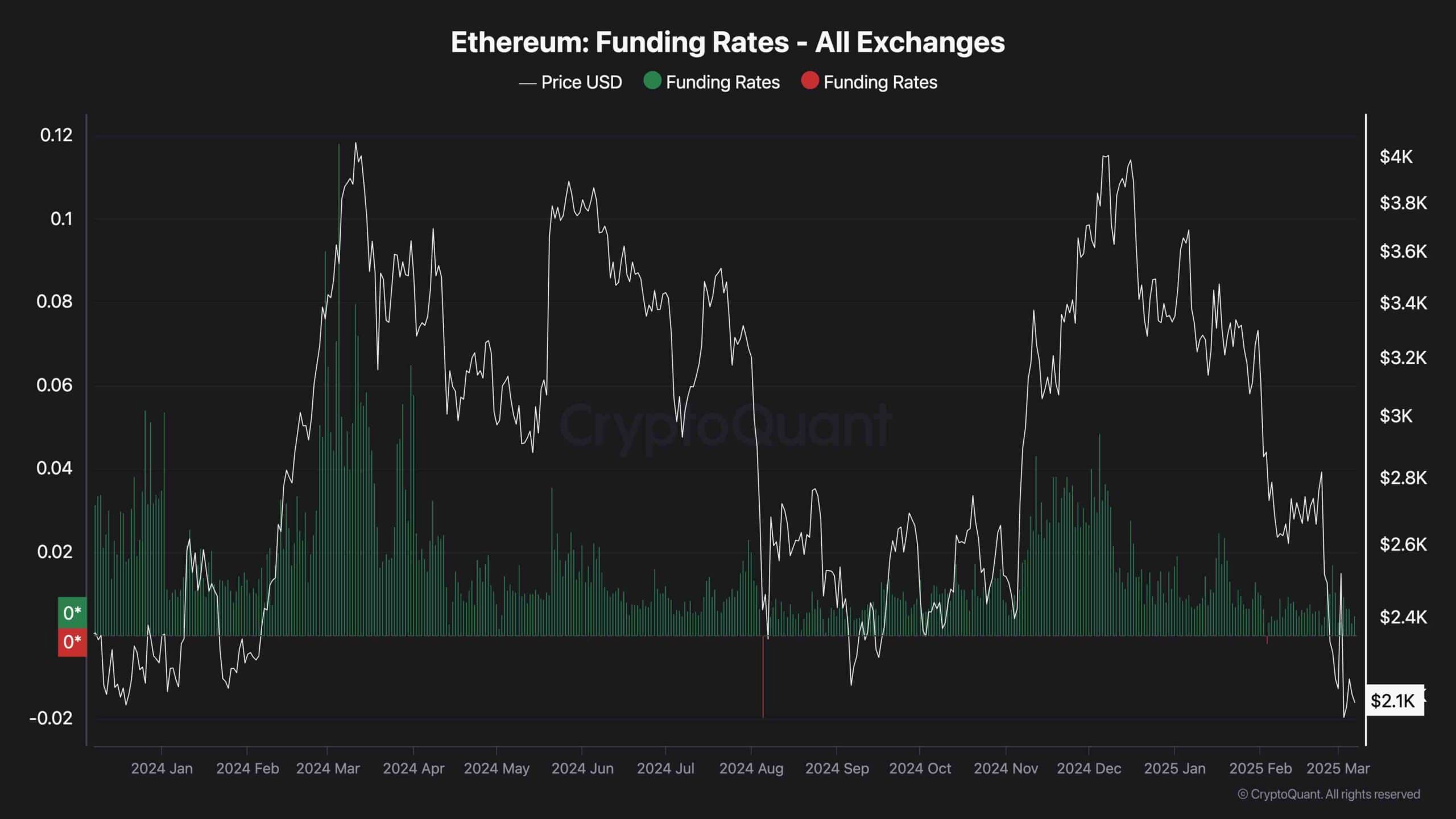

Funding rate indicators are key indicators of buyers and sellers’ control in the Ethereum futures market. Since peaking at 4K at the recent peak of ETH, funding rates have declined, indicating an increase in short positions and overall bearish sentiment. This increases the chances of continuous market corrections in the short term.

Negative funding rates usually indicate seller control, but they also increase the likelihood of a Shorts event. If Ethereum experiences even a modest bullish rebound, a wave of short position liquidation could lead to a rapid price surge, pushing the market higher.

Ethereum’s ability to hold beyond $2K support zone is important in determining your next major move: Once the ETH is stable, $2.5K and 3K$3K could pave the way for bullish inversion as the main resistance levels. However, continuing sales pressures show a deeper downward trend when prices are driven below $2,000. The next few days will be important in determining Ethereum’s short-to-medium trajectory.