Bitcoin is trading at $84,583 with a market capitalization of $1.67 trillion, but its 24-hour trading volume remains extremely low at $127.9 billion, reflecting a careful market sentiment of between $84,262 and $86,546.

Bitcoin

Bitcoin’s one-hour chart reveals an immediate downtrend, with BTC struggling below the important resistance at $86,800. Sales pressure dominates, as reflected by the momentum indicator at -75 and the moving average convergence divergence (MACD) level of -2,720, both signals bearish momentum. The 39 relative strength index (RSI) remains neutral, suggesting that Bitcoin has not yet been sold. A potential support level of $84,200 has been tested, and a confirmed double bottom layer with an increased volume could provide a short-term inversion opportunity. However, failing to retain this support can lead to further negative side pressure.

BTC/USD 1H chart via BitStamp on March 9th, 2025.

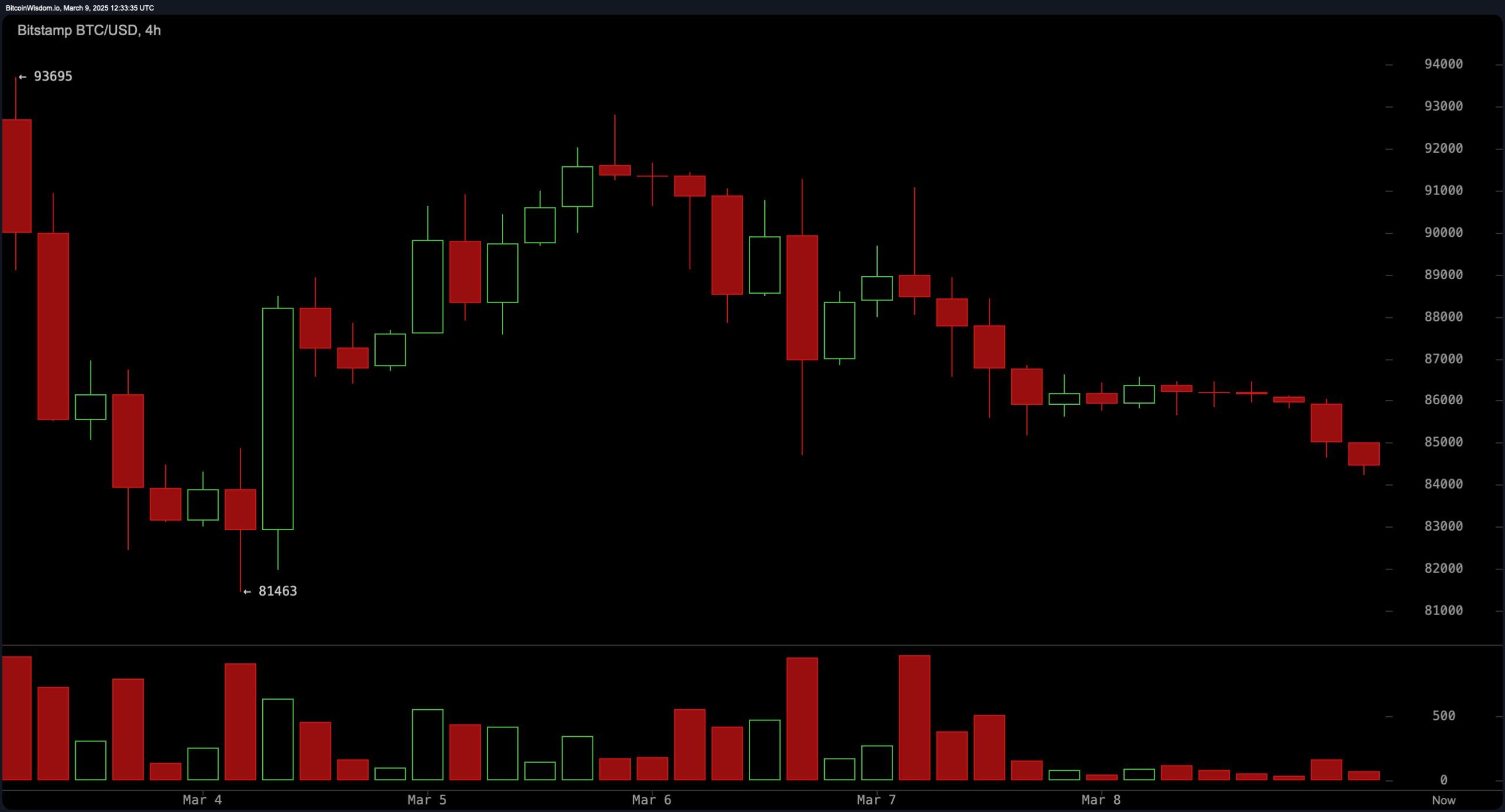

The 4-hour chart shows a wider integration within the bearish framework. Bitcoin faces resistance of nearly $88,000, with support levels of around $81,000. The large red candles indicate a sustained sale, while the occasional green volume spikes suggest short-lived purchase attempts. The 34 mean directional index (ADX) reflects the strength of the weaker trend, meaning that the bearish bias is intact, but the volatility remains high. Traders can look for short entries close to resistance if Bitcoin is high and unable to infiltrate, but if the $81,000-82,000 zone attracts a significant amount of purchases, potential long positions can emerge.

BTC/USD 4H chart via BitStamp on March 9th, 2025.

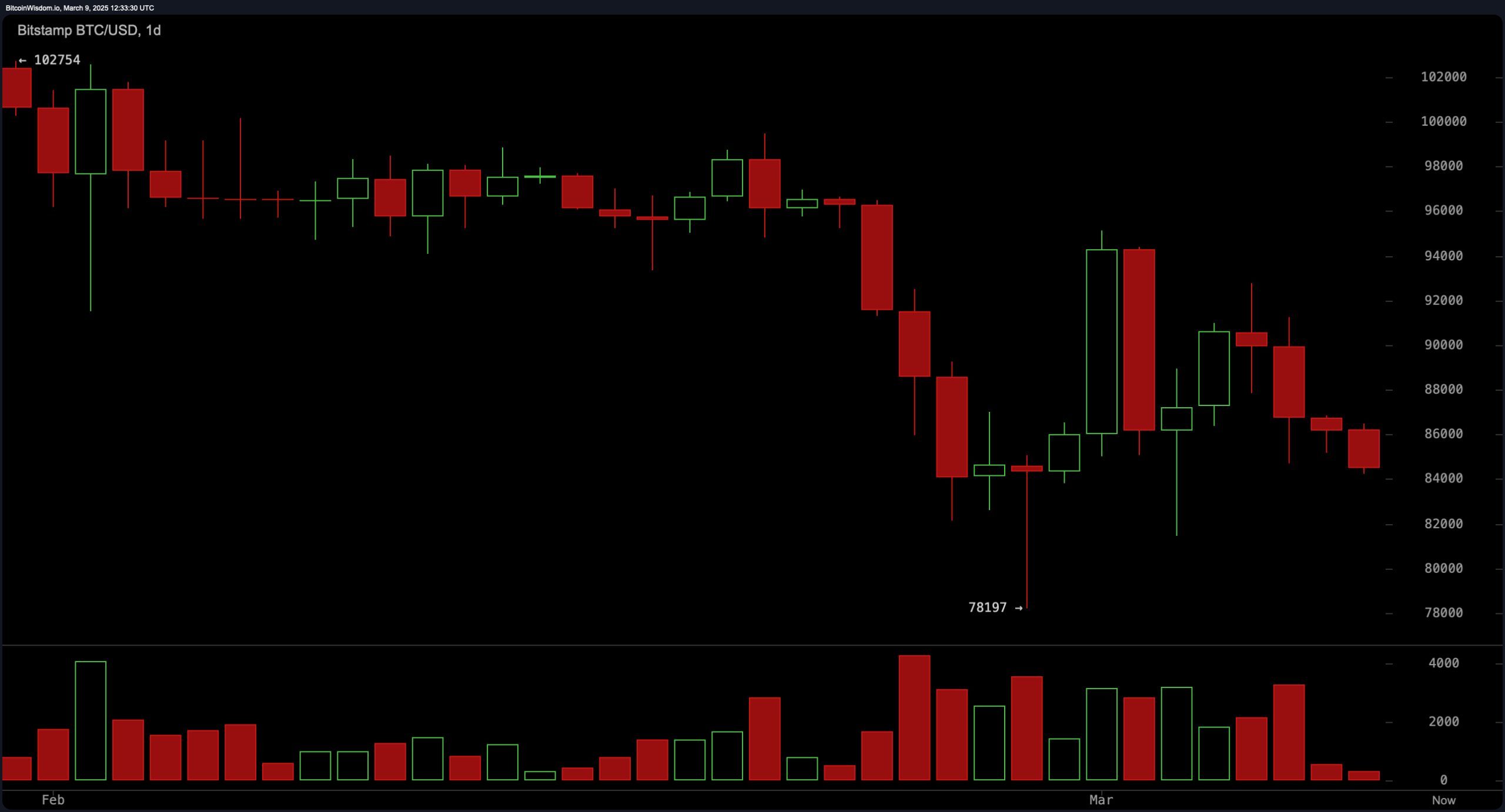

On the daily charts, Bitcoin remains a solidly weakened structure, with key resistance nearly $94,000 and $78,000 in support. The presence of bearish-enveloped candles reinforce the downtrend, and the formation of lower peaks and lower lows suggests continuous debilitation. The Moving Average (MAS) confirms this trend, with the Exponential Moving Average (EMA) 10 at $87,729, the EMA 20 at $89,813 and the EMA 50 at $93,298, all putting pressure on signaling sales. The $83,290 Simple Moving Average (SMA) 200 offers long-term support and is in contrast to the $85,822 EMA 200, which remains a bearish indicator.

BTC/USD 1D chart via BitStamp on March 9, 2025.

The oscillator measurements further support the bearish outlook, as the commodity channel index (CCI) of -80 remains neutral. If Bitcoin finds support in a lower range, most moving averages suggest sales signals, allowing traders to look for potential short-term bounces. However, failing to hold important levels could result in deeper fixes to the $78,000 support zone.

Overall, Bitcoin’s price action is under downward pressure, with the short-term outlook relying on whether the $84,200 level is retained. A sustained break above $87,000 can change momentum, but if resistance fails to regain, Bitcoin may retest its lower support zone. Low trading volumes and sustained bearish technical signals will require caution soon.

Bull Verdict:

Despite the short-term bearish momentum, Bitcoin surpasses major support levels, potential bounces could emerge when purchases increase. A break above $87,000 could trigger new bullish feelings by recovering to over $90,000. Once the market stabilizes and buyers regain control, the long-term uptrend remains intact.

Bear Verdict:

Bitcoin remains on a solid downtrend across multiple timeframes, with all important moving averages signaling strong selling pressure. Failing to hold $84,200 could lead to a retest of the support range of $81,000-$78,000. With low trading volumes and persistent bearish technical indicators, the further downside remains the dominant scenario, unless the buyer is convicted.