According to a new study from Grayscale, 26% of US investors have investable assets of over $1 million in their own encryption, while 38% plan to invest. Though economic concerns among older participants have increased interest, young people have cited the normalization of crypto as an asset class.

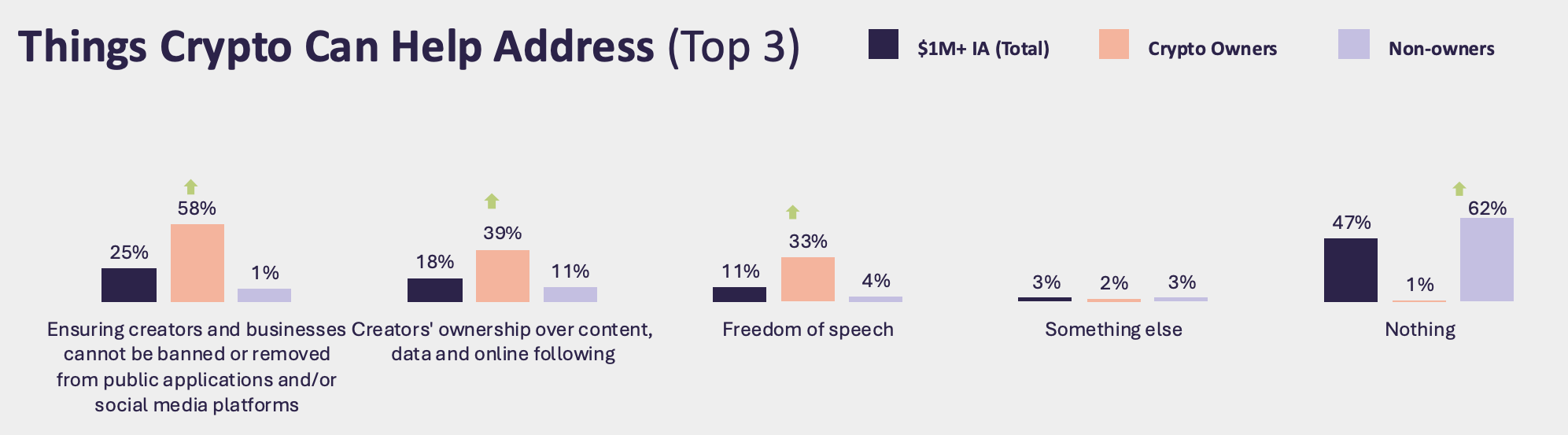

However, almost half of these wealthy respondents do not believe that Crypto has any non-invest use cases. This highlights the growing disparity in the community as they fear the loss of innovation.

Wealthy investors want to buy crypto

Today, asset management company Grayscale has published a report claiming that high-end investors are interested in Crypto.

“It’s exciting to witness a shift in crypto momentum as more investors begin to recognize the value of their digital assets. Surprisingly, 38% of high-end investors think they’ll include future crypto in their investment portfolios,” claimed Grayscale CEO Peter Mintzberg on social media.

Grayscale conducted extensive research on wealthy Americans to assess crypto attitudes and purchasing habits. We have revealed increased affinity for several important metrics.

For example, 26% of investors with over $1 million in investable assets claim to own crypto more than the average population.

These investors are interested in crypto for a variety of reasons that have diverged by age group. Because of the economic situation, almost 78% of respondents over the age of 50 who own a wealthy code. This reflects the old argument that Bitcoin is an inflation hedge.

Meanwhile, their younger counterparts see it as a normal investment option that has nothing to do with these concerns.

“More than a third of these high-value investors are paying close attention to Bitcoin and other crypto assets due to geopolitical tensions, inflation and weakening of the US dollar,” Grayscale Study argues.

However, this study also exposed several holes in traditional code stories. For example, President Trump’s recent backlash against the Crypto Summit highlights growing community disparities.

Can cryptos build a new economic future, or is it just a way to get more Fiat currency? These investors strongly prefer crypto for the latter purposes.

Wealthy investors believe that crypto can’t handle anything. Source: Grayscale

Certainly, this sample may not be entirely representative. A Grayscale survey found 5,368 adults voted, all of whom were scheduled to vote in the last US presidential election.

In short, this study reflects the industry’s positive and negative outlook, depending on the perspective. On the one hand, wealthy investors can pour huge sums into crypto in the near future, especially in the event of economic disruption.

However, this inflow of capital may not be of much help to build new technologies. Most investors have yet to see crypto use cases beyond their investment objectives.

Ultimately, future projects need to balance both concerns.