Disclaimer: The analyst who wrote this work owns Strategic Stock (MSTR).

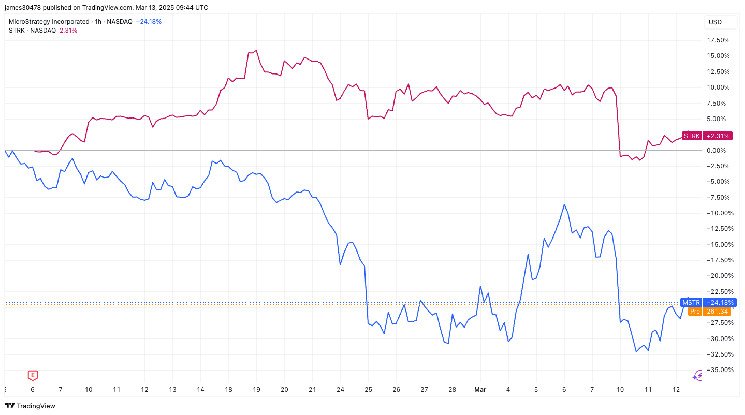

The preferred stock issued by Strike (STRK) and Bitcoin Buyer Strategy (MSTR) have been listed for just a month, and is now 3% higher than the February 5th introduction. Meanwhile, common stocks in the strategy are 20% lower over the same period.

Preferred stocks like STRK can be considered a hybrid of fairness and debt. Holders have a greater right to pay dividends than the owner of common stock on the company’s assets if liquidation occurs. STRK is a permanent issue, with no maturity date (such as stocks) and paying fixed dividends (such as debt).

These functions mean that preferred stocks tend to be less volatile than common stocks. It certainly seems to be the case with STRK. According to Strategy’s dashboard, STRK is 26% correlated with MSTR and slightly negative -7% correlated with Bitcoin (BTC). It also has a low volatility of 49%, compared to approximately 60% of Bitcoin and MSTR volatility of over 100%.

Last week, Strategy announced its $21 billion offering in STRK’s market. This means that you are ready to sell that amount of shares at current market prices over a period of time. If all STRs are on sale, the company faces an annual dividend bill of approximately $1.688 billion.

Generating that amount of cash means that the company will sell its common stock through the provision of an ATM – given the recent stock price has fallen – or will not use cash generated from operations or revenues from raised convertible obligations.

STRK offers an annual dividend yield of 8% based on a liquidation appetite of $100, and currently offers an effective yield of around 9% at a price of $87.45. Like debt, the higher the price of STRK, the lower the yield and vice versa.

STRK also includes the ability to convert each share into 0.1 common shares, with MSTR prices reaching $1,000, or equivalent to a 10:1 ratio. Strategic stock closed at $262.55 on Wednesday. This should be highly evaluated for durability to provide a potential inverse beyond the fixed dividend of STRK.

As a revenue generation product with low volatility, STRK offers a more stable option. However, just as how ATM stock sales have affected the performance of common stock, large ATM offerings could impact this potential.