Data on the chain shows that the Ethereum MVRV ratio has been showing a significant decrease in recent years. History says this is what it means for the price.

Ethereum MVRV ratio has recently dropped to a relatively low level

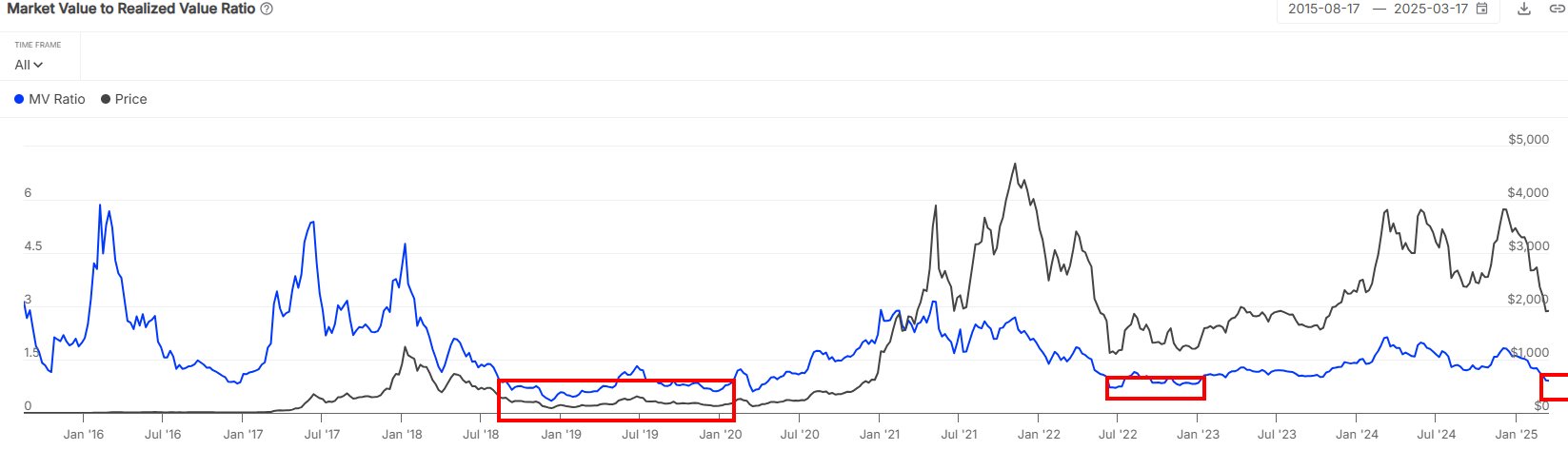

In a new post from X, Market Intelligence Platform IntotheBlock discusses the latest trends (MVRV) ratio of Ethereum’s market value. The MVRV ratio refers to an on-chain metric that measures the ratio between the market capitalization and the ETH realization cap.

In short, what this indicator tells us is how the value held by the entire investor compares the investment they made to buy coins first.

If the MVRV ratio is greater than 1, it means that the average holder can be assumed to bear a net unrealized profit. Meanwhile, metrics below the cutoff suggest that the entire market is underwater.

Now, here is a chart of indicators shared by analytics companies. This shows the trends in value of Ethereum over the past decade.

The value of the metric appears to have been sliding down in recent days | Source: IntoTheBlock on X

As can be seen in the graph above, the Ethereum MVRV ratio has recently declined, crossing under the 1 mark, meaning ETH investors are currently at net loss. The reason behind this change in the market is, of course, the price crash that cryptocurrency faced as part of a sector-wide slump.

Currently, the ETH MVRV ratio is 0.9. IntotheBlock notes that indicators do not frequently achieve this level, and generally only the bear market can force this.

Looking at the past price trajectories that followed such a low-sitting indicator period, an interesting pattern emerges. “Historically, an MVRV ratio below 1 is consistent with the preferred entry point for ETH,” the analytics company says.

However, what should be noted is that while the MVRV ratio falling into this zone has actually proven bullish for Ethereum, it tends to not be immediate, and cryptocurrencies usually need to stay in the region for a long period of time before a rebound occurs.

In other news, IntotheBlock points out how ETH’s main on-chain support block exists between the $1,843 and $1,900 levels in another X-Post.

The cost basis distribution across the various price levels | Source: IntoTheBlock on X

In chain analysis, the strength of the support level is measured based on the supply the investor has last purchased. The price range mentioned above is particularly dense in terms of supply. This is because 3.56 million tokens of assets were purchased within them by addresses of 4.64 million.

“This accumulation suggests robust support, but when ETH drops below this range, demand appears to be pronounced above this level, increasing the risk of capitulation,” the analytics firm says.

ETH Price

Ethereum is currently retesting its on-chain support zone as it currently trades at around $1,877.

Looks like the price of the coin has gone stale recently | Source: ETHUSDT on TradingView

Dall-E featured images, charts on IntotheBlock.com and tradingView.com

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.