As April approaches, traders are closely watching whether Bitcoin can maintain its current momentum or face another round of volatility. Major cryptocurrencies are trading at $87,208, and have been focusing on a 10% increase over the past two weeks.

With a wider market recovery underway, demand for BTC could be strengthened in April, with its prices steadily recovering and retesting the $90,000-95,000 range.

Bitcoin market bottom? According to analysts, the current level indicates bounce

Bitcoin (BTC) kicked off in March with a strong bullish momentum and had surged to a high of $96,484 by March 2nd. However, market sentiment became bearish and profits were strengthened, dragging the main coin to a four-month minimum of $76,642 on March 11th.

Since then, Bitcoin has staged a recovery driven by wider market rebounds and updated demand. Coins are currently traded within ascending parallel channels. This is a pattern that shows a gradual surge in BTC prices as momentum increases.

BTC rising parallel channel. Source: TradingView

We confirmed this bullish outlook in an exclusive interview with Beincrypto with Julio Moreno, the head of research at Cryptoquant.

“The price of Bitcoin could bounce back in April as sales pressures eased from traders,” Moreno said.

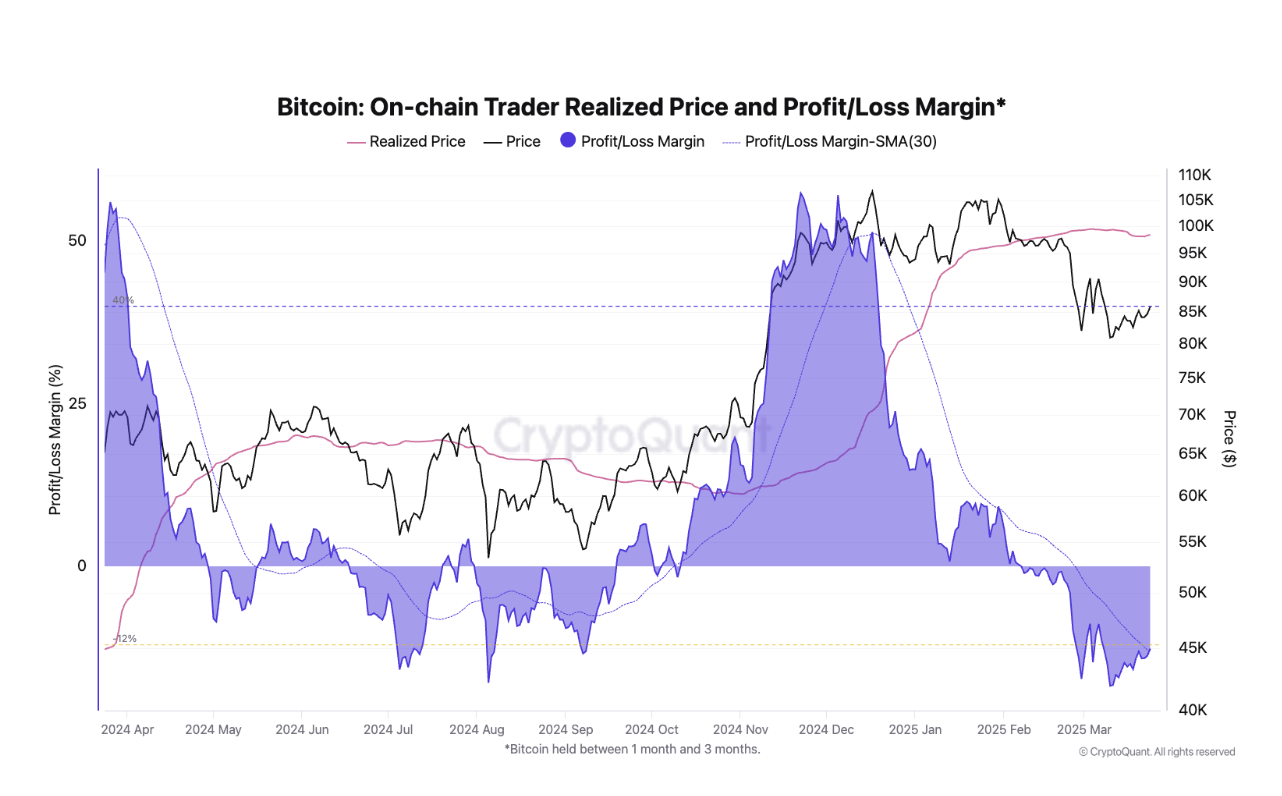

Moreno assessed the realised profit/loss margins of BTC and found that it had been steadily decreasing since the beginning of the year. As this metric drops, the overall profitability of BTC coins spent on the chain is decreasing.

BTC has achieved profit/loss margins. Source: Cryptoquant

This means investors will recognize less profits or suffer losses, reducing their incentives to sell. Over time, this trend will gradually ease sales pressure in the BTC market and raise prices in the coming weeks.

“Bitcoin prices have experienced a 23% drawdown from previous record highs, so traders only experience losses when sold. This situation usually indicates that there is less sales pressure for Bitcoin.

Sales pressure can surge as emotions get worse

Bearish sentiment remains important among traders, especially as the markets try to recover.

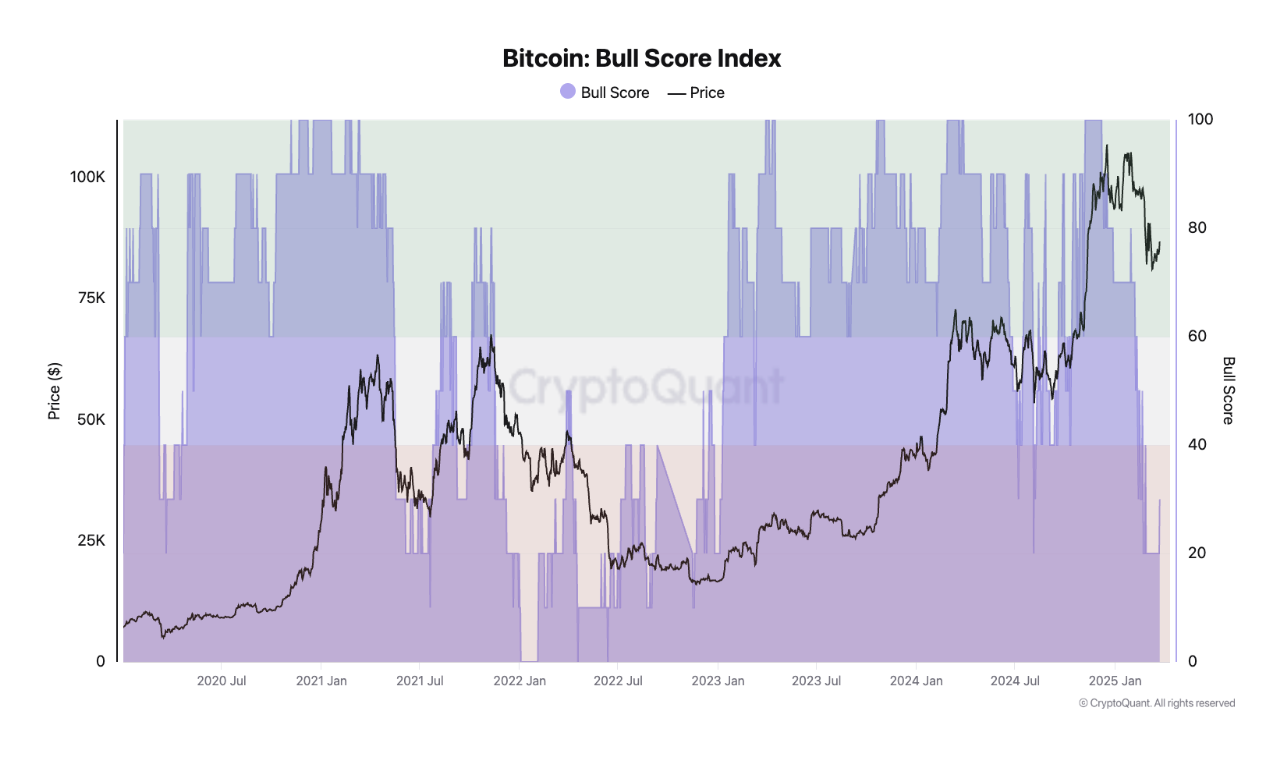

“As you can see in Cryptoquant’s Bullscore Index, overall market sentiment remains bearish. We touched on 20 a few days ago – showing the lowest market situation since January 2023.

He also added that historically, Bitcoin has only experienced a sustained price rise when its bull score is above 60, with consistent measurements below 40 being linked to the bear market.

BTC Bull Score Index. Source: Cryptoquant

The reading from the code’s fear and greedy index reflects this outlook. At the time of press, the index was 40 years old, suggesting that the market is currently afraid.

Code fear and greed index. Source: Alternative.me

If traders fear this way, they cause an increase in sales pressure, a decrease in BTC trading volume, and price triggers.

Will Bitcoin hold above $87,000 or will it drop to $77,000?

BTC traded at $87,208 at press time, up 2% last week. On the BTC/USD one-day chart, the Coin’s relative strength index (RSI) remains slightly above the neutral line of 51.48, indicating a gradual revival of new demand for King Coin.

The RSI indicator measures the market conditions for asset acquisitions and overselling. It ranges from 0 to 100. Values above 70 suggest that the asset is over-acquired and paid for a price drop, while values below 30 indicate that the asset is over-sold and may witness a rebound.

At 51.48, with a slight uptrend, BTC’s RSI suggests a growing bullish momentum in the market. If demand is strengthened, the coin could be pushed to $89,434. A successful violation of this resistance could lead to a rally to $93,478.

BTC price analysis. Source: TradingView

However, once Selloffs resumes, BTC prices could drop to $77,114.