Circle wants an IPO, and S1 Filing details the incredible differences between a regulated US-based Stablecoin publisher and its offshore competitor Tether.

Despite their relatively similar size, the two largest stubcoin issuers in the world are miles apart in finance.

As of December 31, 2024, there were USDT of USD137.4 billion and USDC of 43.9 billion in circulation. Despite USDC’s market capitalization being about one-third of USDT, profitability is very different.

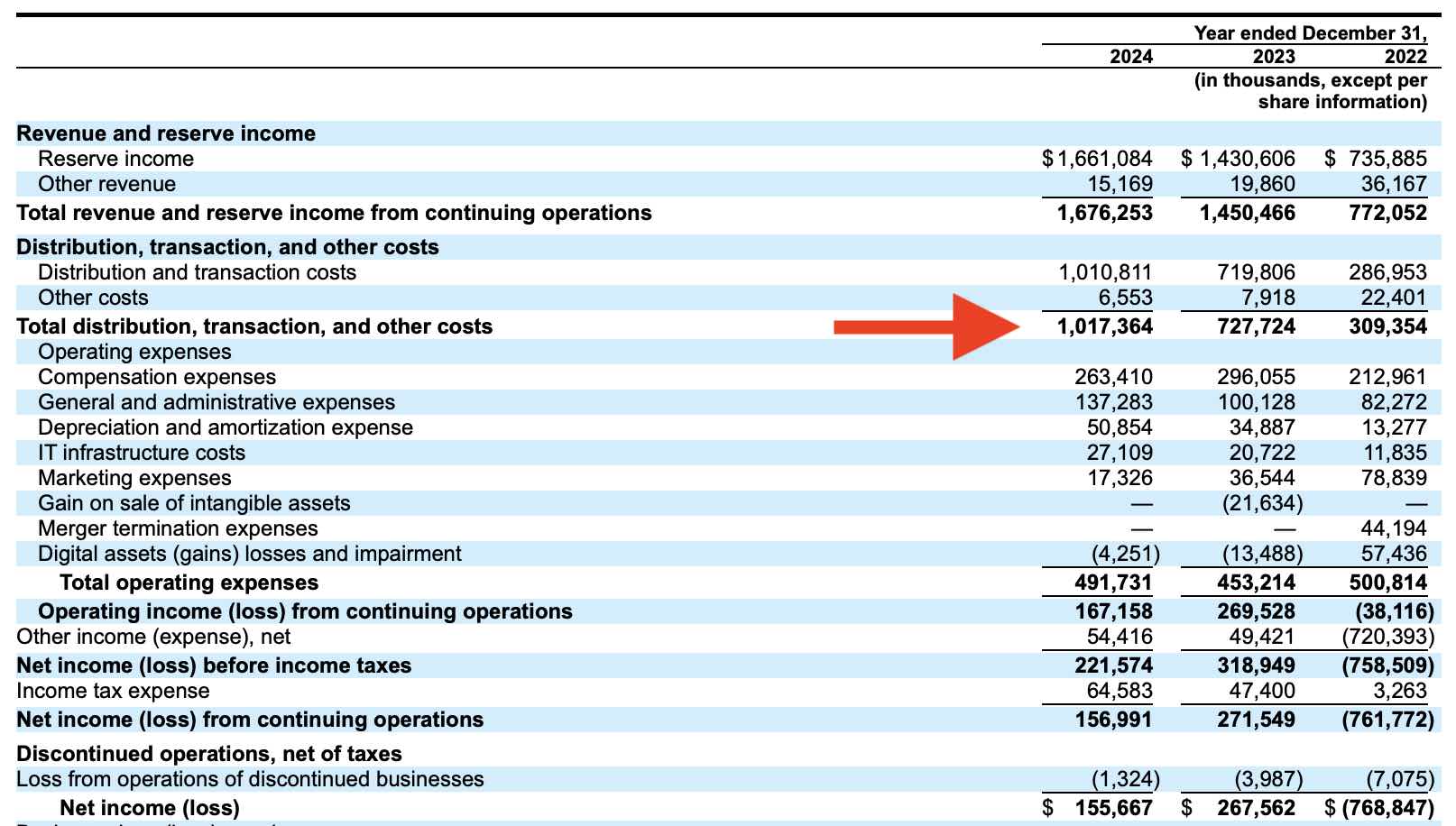

Specifically, Tether reported gross profits $13 billion that yearMeanwhile, the circle reported only $156 million in net profit.

Specifically, Tether reported gross profit of $13 billion that year, while Circle reported just $156 million in net profit.

In terms of percentage, USDT’s market capitalization was only 213% greater than USDC. However, the profit was about 8,000% higher.. That certainly brings to the question of how Tether achieved its extraordinary profits.

Cheap books offshore, expensive books on land

Like Tether, the Circle supports USDC with US Treasury bonds, which have a lot of interest. However, unlike Tether, it costs a substantial fee for partners like Coinbase.

And unlike circles, it claims that Tether ranks it as the most profitable company in the world. Nearly 200 Employees apparently generated gross profits of more than $65 million per person last year.

In contrast, the circle, Paying more than half of your revenue, Or it will be ranked for “distribution fees” to Coinbase’s Coinbase customers last year, which cost around $900 million, and as a preferred stubcoin on the exchange. Tethers are rare with similar incentive payments.

“We happened in the year ended December 31, 2024 Distribution costs of $907.9 million In relation to the contract with Coinbase. Future distribution costs are expected to increase as distributors and approved participants are added. Our distribution costs also increase to the extent that our reserve income increases over time. ”

-circle s-1 filing

Circle paid about $900 million last year in Coinbase’s “distribution fee.”

Worse, Tether has never filed an application for the Securities and Exchange Commission, nor has he ever filed a public document that would subjugate it to the definition of a committee of financial accounting standards or record-keeping.

Instead, avoid auditing and use non-standard terminology to make it difficult to perform apple and april comparisons.

Read more: Howard Lutnick hopes Tether gets audited

In fact, Tether does not specify 2024 net profit. This is a regulated term. Instead, they simply reported “gross profit” of $13 billion without acknowledging the generally accepted accounting principles.

Definition of Arrival Profit and Minority

Worse, Tether did not specify the profits it specifically acquired with assets supporting USDT against other assets such as Xaut, CNHT, and MXNT. So, we know that the overwhelming majority of $13 billion comes from assets supporting USDT, but no one except Tether knows the exact amount.

Tether Holding Group’s activities also include a much larger set of assets than Circle, investing in a variety of companies to find additional yields.

No matter what, Tether claims to sit in the world from its closest competitors in terms of profitability. Despite the low difference in triple girders size, the difference in profitability between the tether and circle is the high isolation girders.

Maybe Tethers are better in business than circles. Perhaps it benefits from historical lies and alliances with Donald Trump’s administration. Perhaps something else explains the contradictions of the wild.