Bitcoin has been added to the recent rebound series after seeing yet another bounce in the past day. Here’s what On-Chain Data says regarding whether BTC goes anywhere with them:

Bitcoin Realised Profit/Loss Rate Shedding Light on the Wide Dynamics

In its latest weekly report, on-chain analytics firm GlassNode discusses recent trends in Bitcoin’s realized profit/loss ratio.

The metric measures the ratio of profit to losses realized by the owner or the entire address, as the name already suggests.

This indicator works by looking at the transaction history of each coin sold on the network and finding the price transferred prior to this sale. If this previous sales value is lower than the latest spot price for the token, then the metric includes it under profit volume.

The total profit realized through the sale of coins is assumed to be equal to the difference between the two prices. The indicator calculates this value for all coins belonging to profit volume and takes the total sum to determine the size of profit realizations that occur across the blockchain.

Similarly, the realized profit/loss rate finds the total amount of loss realized by referring to the sales of the opposite type of coin (i.e., tokens where the last transaction value is higher than the current spot price). Next, a ratio between the two totals is required to estimate the net situation of the sector.

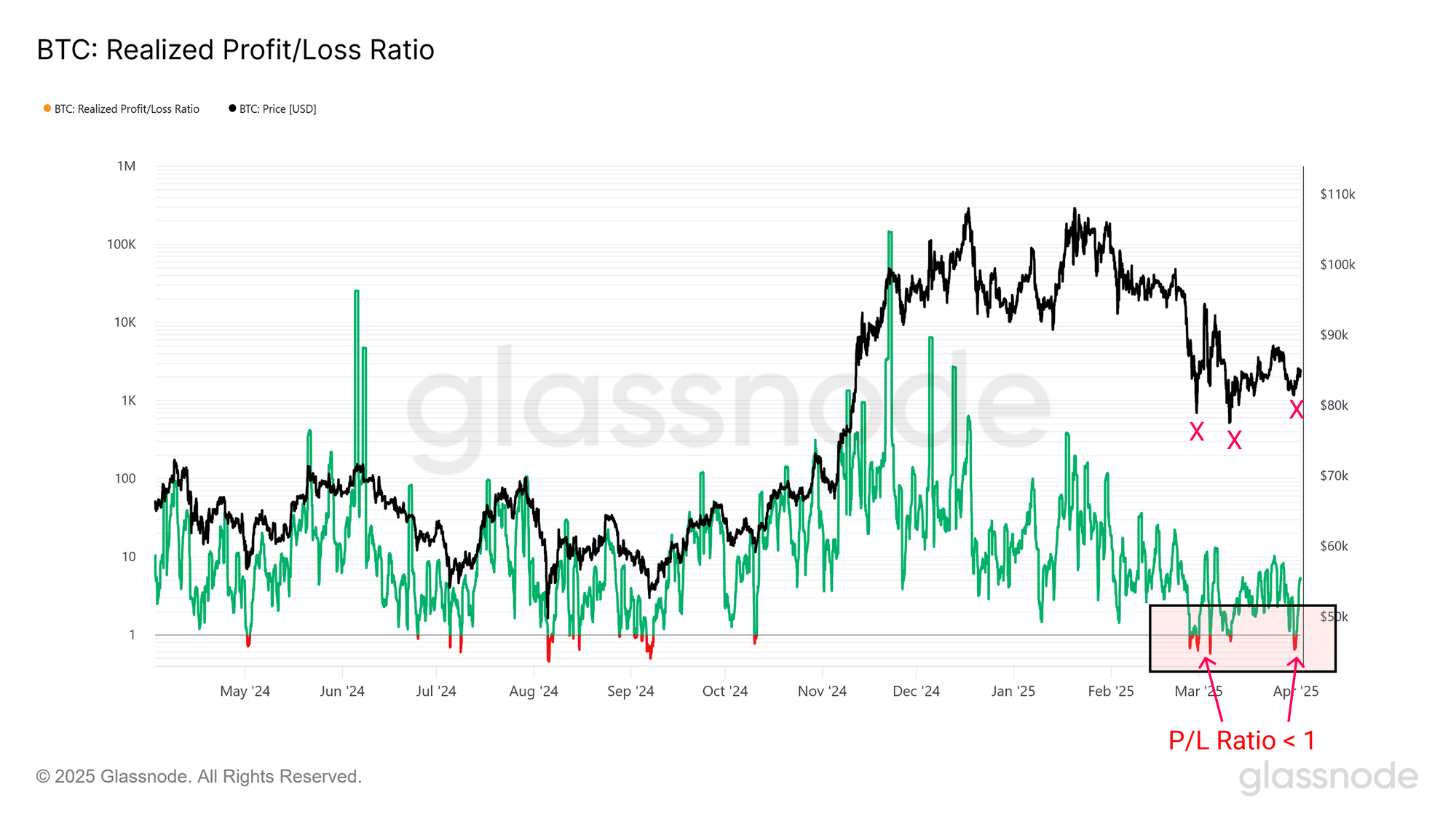

Over the past few months, Bitcoin has gone through a bearish price action phase. Following the realised profit/loss ratio, what the investor’s trading behavior was during this period is as follows:

As the analytics company highlights in the charts, the indicator saw a dip under one mark during each recent recent of BTC. The values for this region correspond to that reducing losses is more dominant than gaining profits.

“This imbalance usually indicates seller fatigue to the extent that the negative momentum fades away as seller pressure is absorbed,” explains GlassNode. Because of this, surrender tends to help the BTC arrive at the local bottom.

From the graph, we can see that cryptocurrencies benefited from this effect during the recent burst of loss realizations.

However, these Bitcoin rebounds have not been maintained so far. Will they ultimately culminate in the return of proper bullish momentum, or are they only cat bounces dead along the way? To address the question, the analytics company mentions the long-term view of the profit/loss ratio realized.

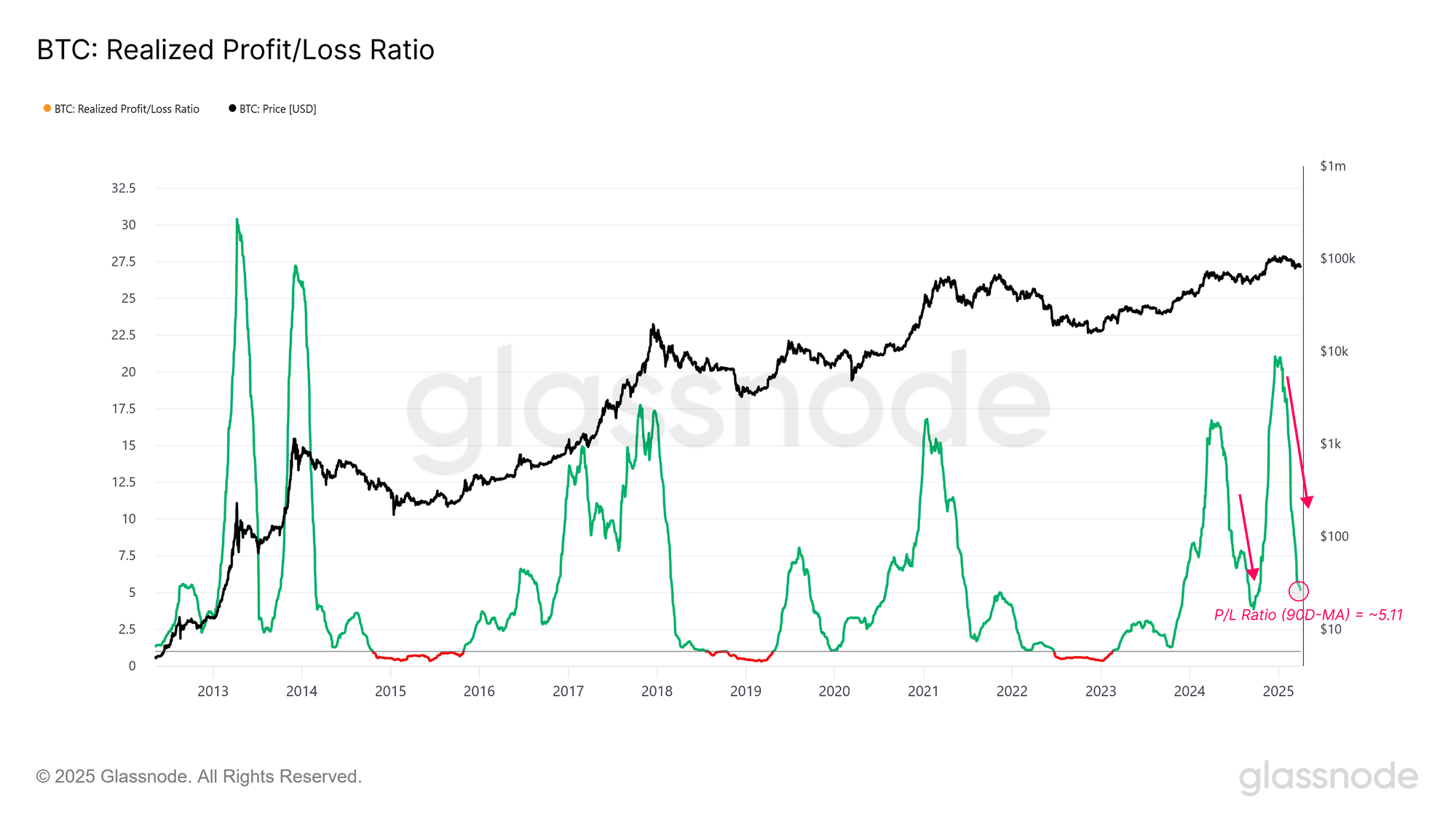

As shown in the chart above, the 90-day simple moving average (SMA) of Bitcoin realised profit/loss rate has been declining sharply recently despite a jump in profit realisation in the short-term view.

“These short, profit-driven spikes cannot reverse the broader decline, and macro images generally suggest that liquidity is decreasing and investors’ profitability is deteriorating,” GlassNode said.

So, whether Bitcoin has witnessed a shift to bullish momentum with its recent rebounds, the answer is at first glance no, at least in terms of realised profit/loss rates.

BTC price

At the time of writing, Bitcoin has traded around $83,600 in the last seven days, a nearly 2% drop.

Dall-E, Glassnode.com featured images, tradingView.com charts