Ethereum is under pressure as broader market sentiments struggle to change bullishness. Prices continue to float around the main demand zones, with few indications of immediate strength from the bull, while derivatives and chain activities show signs of attention.

Technical Analysis

By Edris Dalakshi

Daily Charts

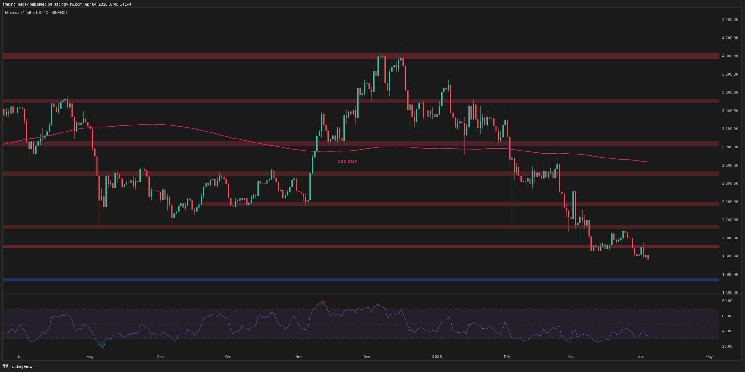

In the daily time frame, ETH has failed to recover previous support nearly $2,000 in resistance. The daily structure remains bearish, with refusal from the $2,200-$2,000 supply zone strengthening sales pressure.

The 200-day moving average, now above $2,800, highlights a broader bearish bias, but it suggests that RSI is oversold, suggesting that downside momentum is still present but potentially weakened. The next strong support is near the $1,550 area and could be touched quickly.

4-hour chart

Zooming into the 4-hour chart, ETH forms a horizontal integration pattern, compressing a low high for horizontal support of nearly $1,750. The asset recently retested the $1,900 zone, but was quickly rejected and failed to create a bullish breakout.

The RSI also shows that it will be pulled back from previous bounces and lose momentum. A confirmed breakdown below $1,750 support would be the first indication of short-term strength to surpass the pattern.

Emotional analysis

By Edris Dalakshi

Replacement Reserve

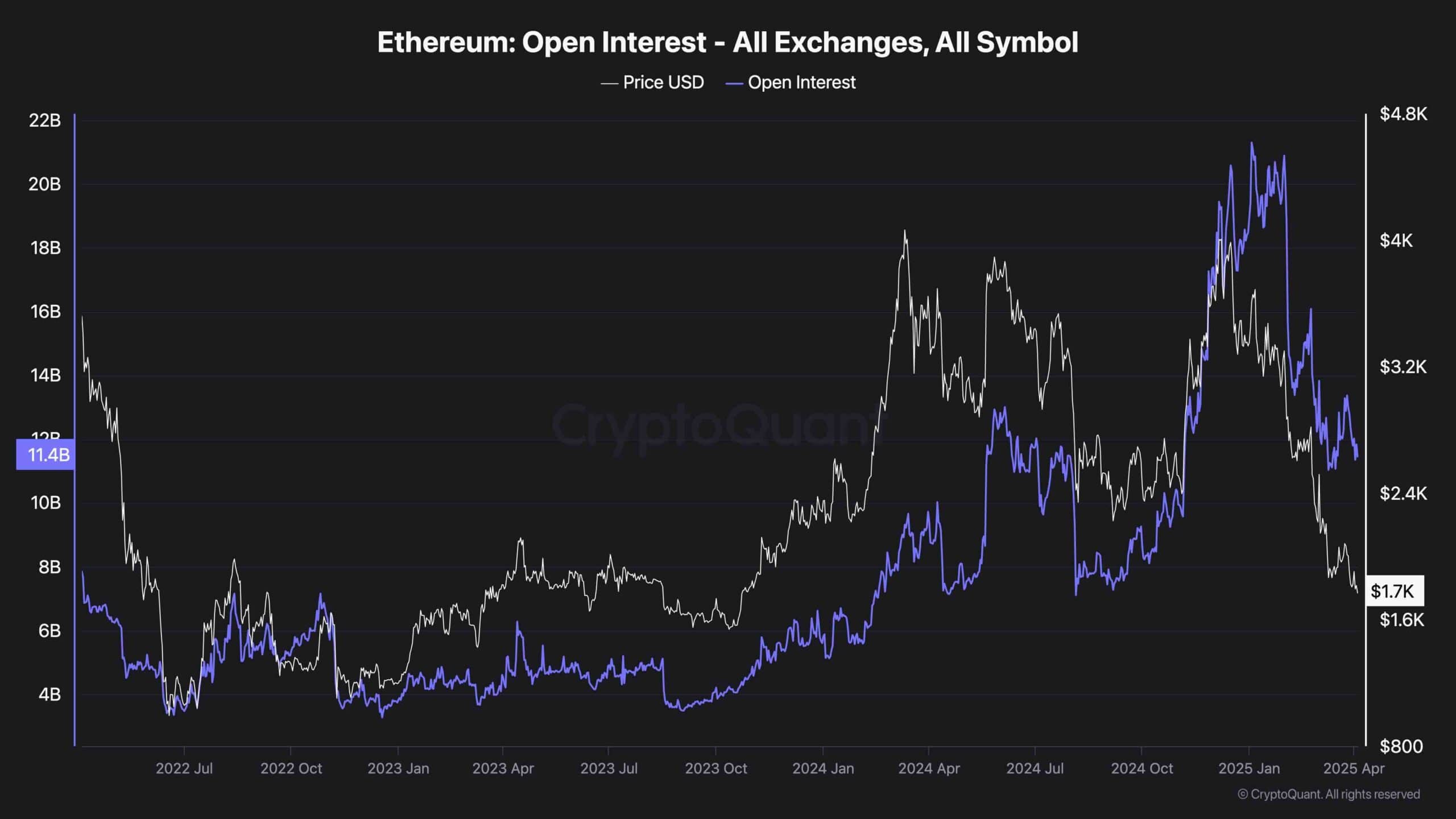

In terms of sentiment and open interest, Ethereum’s open interest continues to rise compared to historic value in recent years, despite the continued slide in prices.

This suggests an influx of offensive short positioning or slow leverage entering the market. If this open interest is rapidly rewinded, it can cause a short pressure on any reverse volatility. However, as long as prices remain high while they are lowered, the pressure and risk of continuing liquidation, especially close to the main support zones, will be added.