The cryptocurrency market has remained fairly stable despite the global macroeconomic headwinds that have shook the traditional market over the past week. Ethereum prices did not enjoy the same relief as other large assets. This began in April, which almost ended in the first quarter of 2025.

The second-largest cryptocurrency is on the verge of losing the $1,800 level, falling almost 5% over the past week. However, the latest on-chain data suggests that Ethereum prices may be nearing the bottom and may be ready for rebound in the coming weeks.

Metric rise says Ethereum prices may be ready for a comeback

In a recent post on the X platform, on-chain analyst Maartunn shared new insights into Ethereum investors’ activities regarding centralized exchange. According to Crypto Pundit, this latest on-chain shift suggests that new bottoms could be brewed at Ethereum prices.

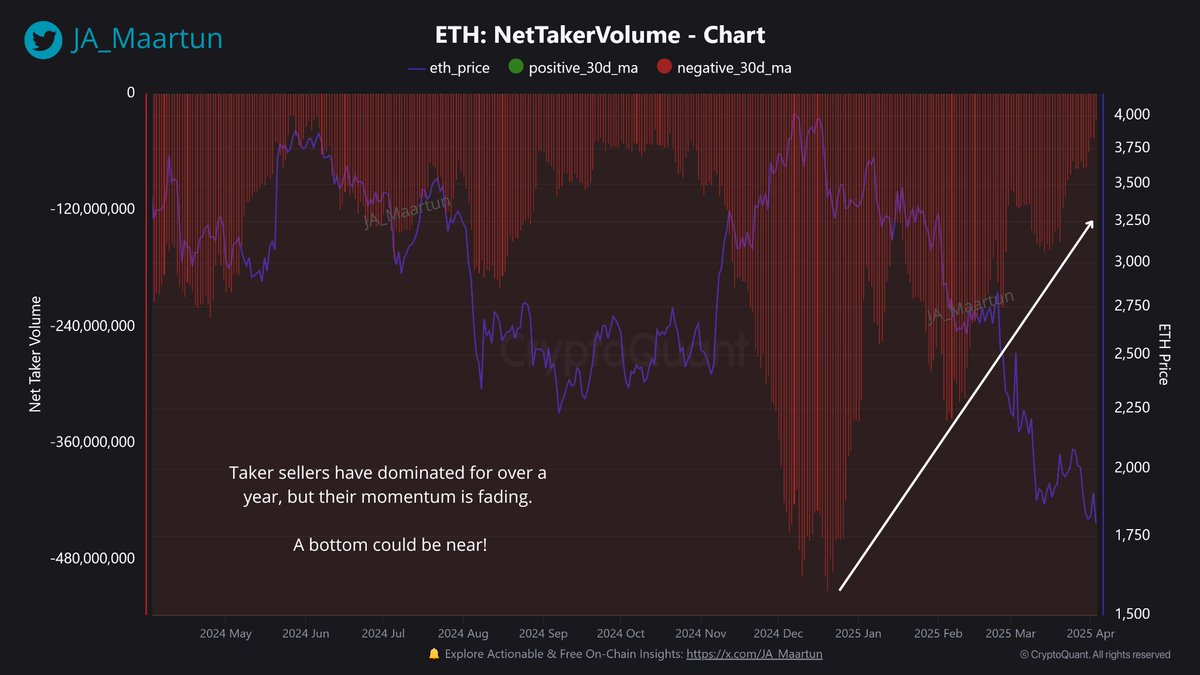

The relevant metric here is the Nettaker Volume metric, which tracks taker buy volume and taker sales volume in a given asset market (in this case Ethereum). This on-chain indicator can be used to assess the strength of your sales or purchase pressure in the market.

When nettaker volume is positive, it shows that offensive buying activities (Taker Buys) are overwhelming sales activities (Taker Sells), suggesting enhanced bullish sentiment. Negative metrics mean that Taker sells higher than Taker buy volume. This is usually a bear signal.

In his post, Maartunn pointed out that aggressive sales activities have outperformed purchasing activities in the Ethereum market for more than a year. However, on-chain analysts emphasized that Taker’s sales volume has declined over the past few weeks and appears to have lost steam.

Source: @JA_Maartun on XAs shown in the chart above, despite the price of Ethereum creating new lows, nettaker volumes are forming higher lows. This classic bullish emancipation Altcoin suggests that it may be cutting the bottom and preparing to experience a bullish reversal.

At the time of writing, the ETH token is valued at around $1,806, reflecting a price increase of around 1% over the past 24 hours.

ETH Whales are trimming their holdings

Interestingly, competing on-chain data has also emerged, indicating that a key class of investors known as whales are offloading their assets. This cohort of investors influences market dynamics due to their significant holdings and is usually monitored by other investors.

Source: @ali_charts on X

In a post on April 4th on X, Crypto analyst Ali Martinez revealed that whales (holding 10,000-100,000 coins) have sold over 500,000 ETH tokens in the last 48 hours. Given the size of this sale and the impact of investors, this activity could be a bearish obstacle to the possibility of Ethereum price recovery.

The price of ETH on the daily timeframe | Source: ETHUSDT chart on TradingView

ISTOCK featured images, TradingView chart

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.