Bitcoin prices fell to lows in April as financial markets got caught up in a surprising tariff announcement by US President Donald Trump.

Cryptocurrency fell 8% to $83,162 on April 3, with US stocks recording the worst day session in years.

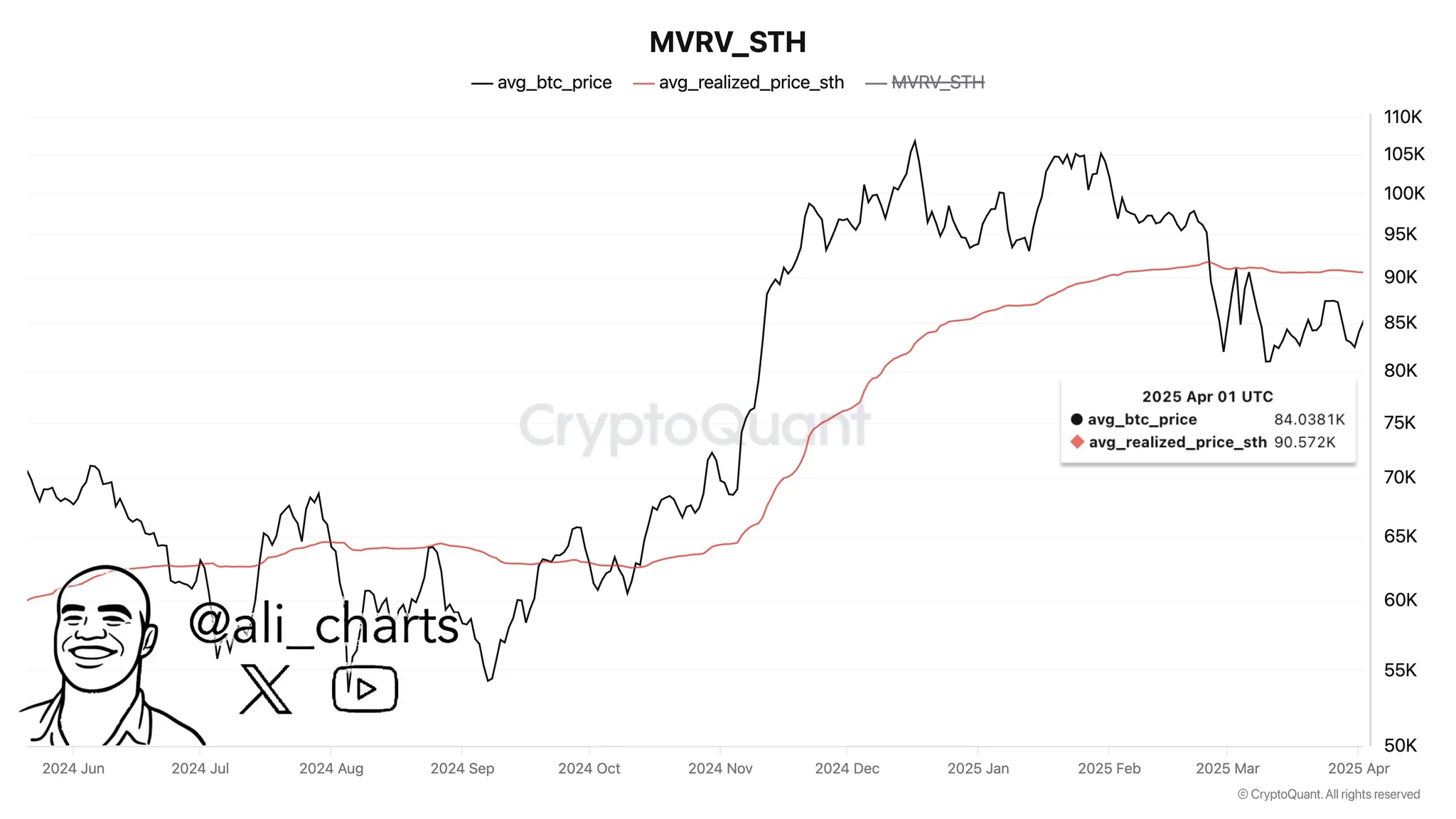

Traders and analysts are currently aiming for $90,570 as a key price to collect if Bitcoin wants to resume its upward trend.

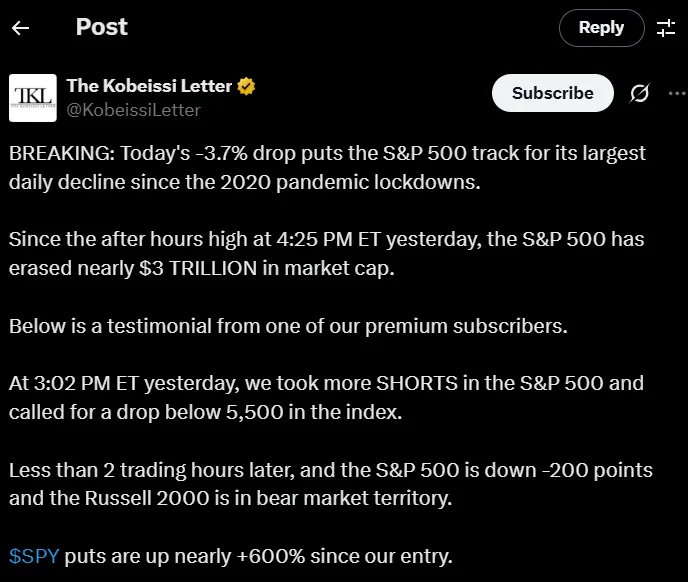

1.6T wipeout of stocks will overturn the price of bitcoin

On April 3, the S&P 500 opened and fell 4.2%. This is the biggest daily decline since June 2020.

The NASDAQ Composite fell 5.23%, while the Dow Jones industrial average fell 3.41%, closing at 40,785.41.

Bitcoin prices surged temporarily to $88,580 following tariff news, but quickly reversed the course, according to TradingView.

Investor sentiment has worsened as Trump’s actions against several trading partners hit headlines.

Source: Kobeissi Letter/x

Follow x’s pos by Cobessy’s letter,

“The S&P 500 erased its market capitalization of nearly $3 trillion from its yesterday’s high.”

Coingecko’s data showed that the total crypto market lost 6.8% in 24 hours. Coinglass said more than 200,000 traders have been liquidated, totaling $573.4 million.

The largest single liquidation was Binance’s $11.97 million ETH/USDT position.

Bitcoin prices will need to regain $90,570 to resume bullish structure

According to Ali Martinez, Bitcoin’s first bull signal would regain the realized price of short-term holders at $90,570.

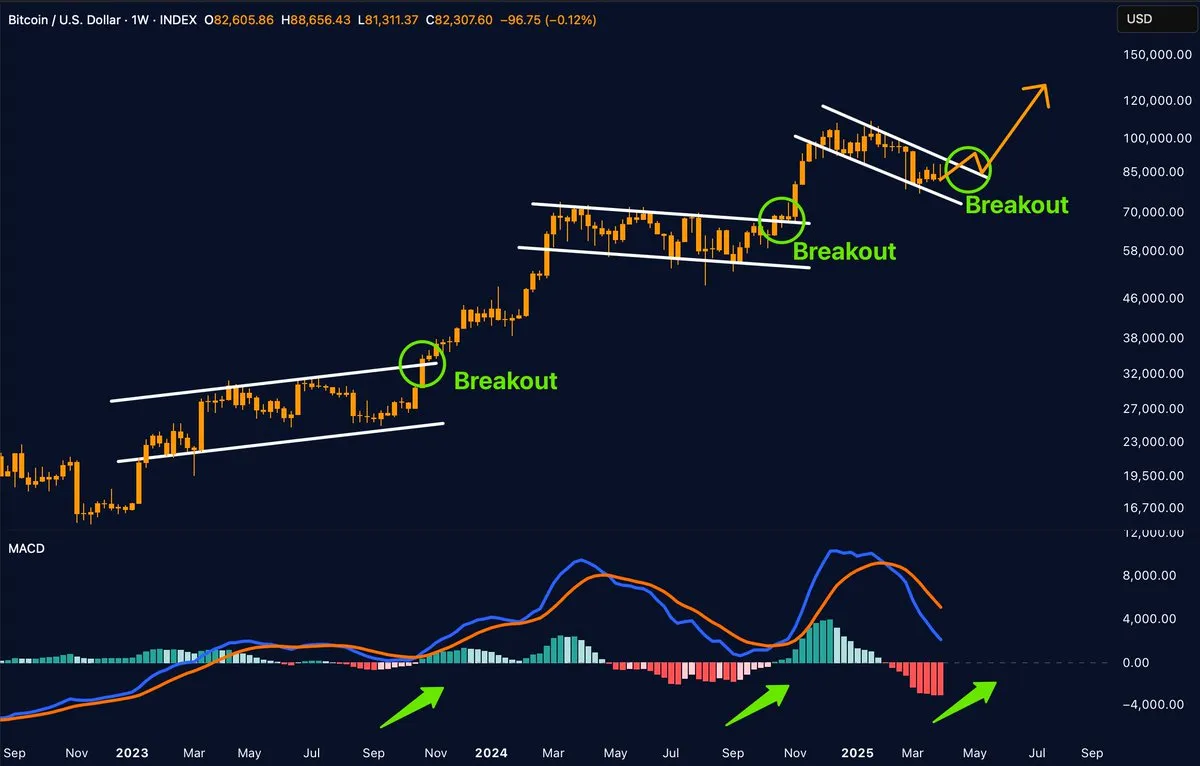

Until that happens, the technological structure will appear fragile. Rekt Capital said the price of Bitcoin has been rejected from a recent price downtrend, but the successful retest of the RSI downtrend suggests potential strength.

A more cautious tone came from Postyxbt, which described the latest fix as “up the stairs and then down the elevator.”

Source: Merlin the Trader/X

Meanwhile, trader Merlijn compared his current setup to his previous momentum reset, bringing together a +50-70% rally in a few weeks. However, traders remained divided over whether such repetitions could occur soon.

Heavy liquidation suggests that deeper falls are possible

Bitcoin’s open interest fell below $50 billion, reducing leverage, but exposing the market to a bigger swing.

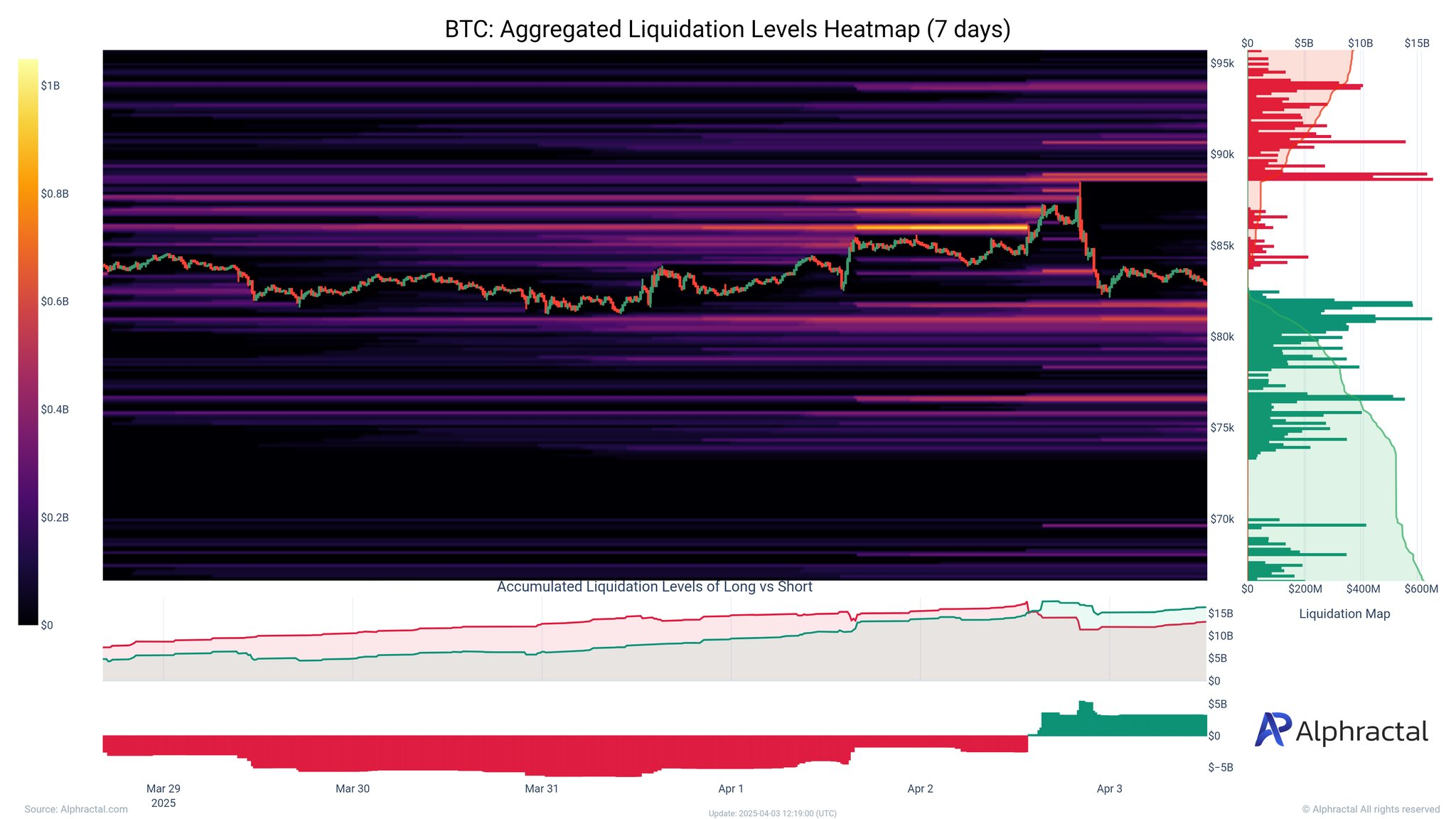

Alphractal CEO Joao Wedson warned that HeatMaps would show heavy leverage of around $80,000. If the volume breaks, it may continue to drop between $64,000 and $65,000.

Bitcoin liquidation map. Source: x

The GlassNode team also raised concerns about the new “Death Cross.” The 30-day volume weighted Bitcoin price is above 180 days, marking historically a bearish trend for months.

Bitcoin has influenced the “death mutual” of prices. Source: GlassNode/X

According to analytical companies’ reports,

“On-chain analogues of the Death Cross appeared. This pattern preceded a bearish trend of three to six months.”

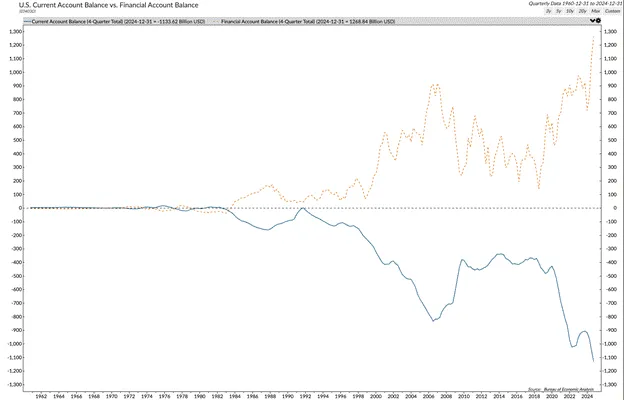

Fear of recession in tariffs and job data

The broader macro background remains unsettling. Following the announcement of tariffs, US unemployment claims were lower than expected at 219,000, below the projected 228,000. Cobessy’s Letter Be careful,

“The market believes the Fed will be forced to cut fees soon next month.”

However, a resilient labor market could justify a tougher situation for longer. This risks further damage to risk assets, including cryptocurrencies.

Arthur Hayes repeated the macro concerns, but with a bullish twist, he wrote, “The global imbalances will be fixed and papered with printed money.”

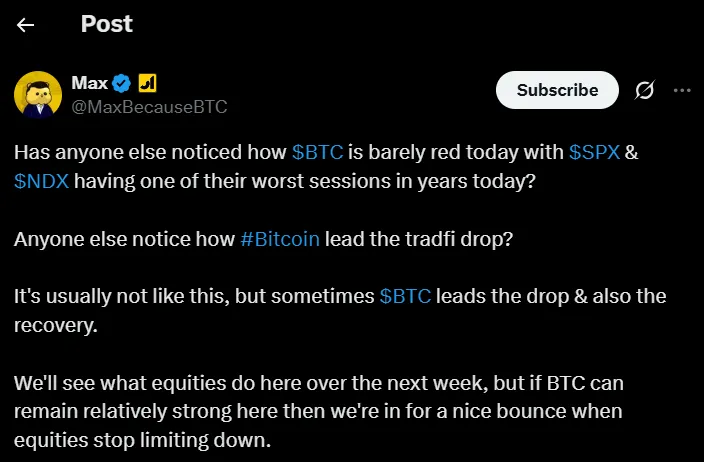

Some traders have focused on the rare reversal of trends. @maxbecasebtc observed that Bitcoin is leading the latest decline rather than slowing down traditional markets.

Source: Max/X

The analyst wrote,

“It’s not usually like this. Bitcoin can lead to drops and recovery.”

Such behavior suggests that Bitcoin may be sculpting more independent pathways in risk-off environments, but that theory remains untested among ongoing volatility.

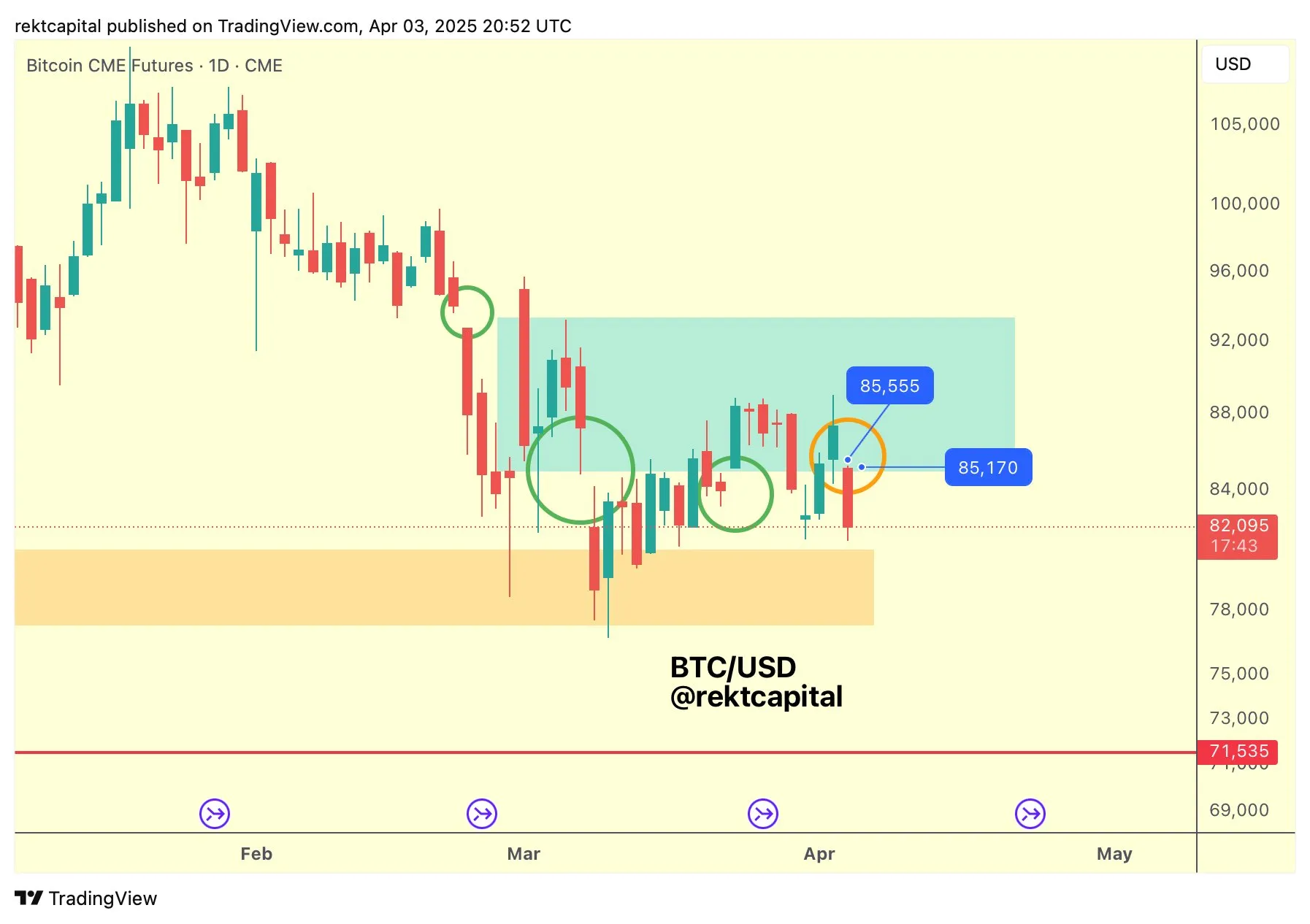

The $85,000 gap adds technical pressure

In addition to the technical mix, Rekt Capital has identified a new daily CME gap of nearly $85,000. Most gaps are historically fulfilled, so the chances of revisiting remain high.

ADA/USD 1D price chart. Source: Rekt Capital/X

With Bitcoin price trading below $84,000, the Bulls are facing pressure from multiple fronts. Macroeconomic headwinds, technical breakdowns, and increased liquidation.

Unless the Bulls can regain $90,570, short-term optimism could replace expanded integration or even further downsides.