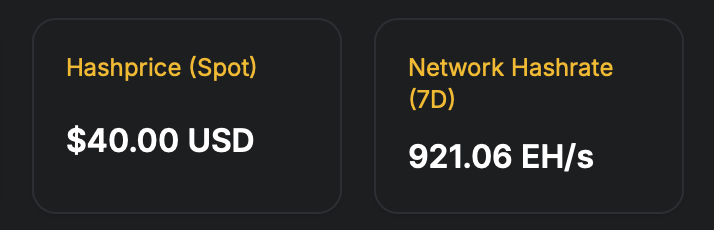

As Bitcoin’s valuation approaches its weakest point since last year, with Hashpris, daily revenues of petahash (pH/s) per second (pH/s) have retreated to $40, which has caused the network’s computational muscle to paradoxically swell to a historic peak.

Bitcoin hashrate hits historic high amid prices plummeting

This stretch has proven difficult for Bitcoin miners, with revenues being signed rapidly. On April 2, in line with former President Donald Trump’s announcement of vast trade tariffs, Hashpris hovered at $48.45 before cascaded to $40 per PH/s.

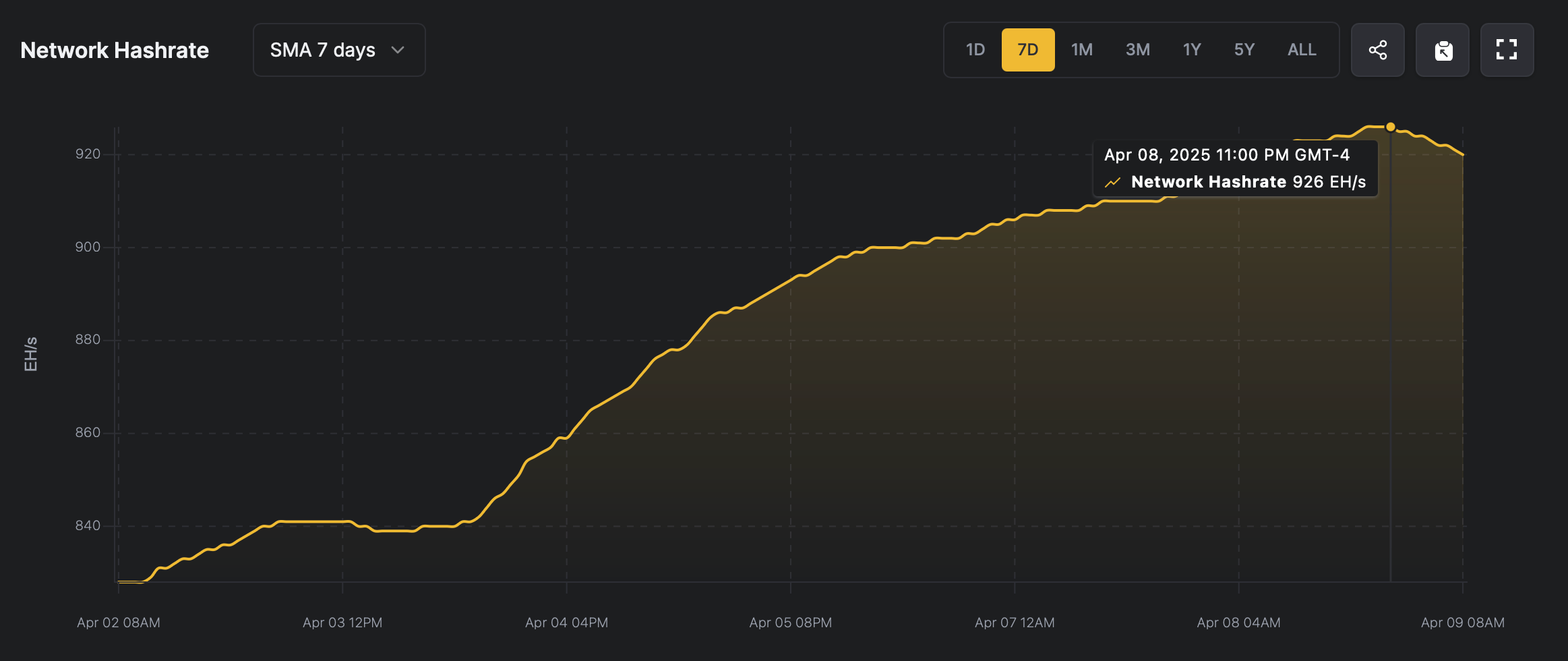

With the strain worsening, mining complexity metrics pushed 6.81% just four days ago at block 891,072, at an unparalleled difficulty of 121.51 trillion. Traditional logic suggests that such a triple (depreciation value of BTC, reduced miners’ income, and increased operational demand) erodes global computational output.

But reverse expansion: Bitcoin hashrate ignored gravity and scaled to an unparalleled peak on Tuesday, April 8, 2025. Metrics temporarily cheate at 926 Ekhash (EH/s) per second, inching within 74 EH/s of the elusive 1 Zetahash (Zh/s) threshold.

By 9:30am on Wednesday, April 9th, it had eased slightly to 921.06 EH/s and remained near the stratospheric peak. The block interval reflects the expected 10-minute standard, and although the readjustment of the impending difficulty on April 19 appears to be slight, the volatility remains very reasonable.

Meanwhile, the lethargy of transactions beyond the Bitcoin blockchain has caused strange stretches of underutilized blocks and lower fee pressure. Currently, premium transactions command a modest 2 Satoshis per virtual byte (SAT/VB).

In the past day, fee-derived revenues accounted for just 1.32% of miners’ total compensation, exposing ecosystem thinning profit margins. However, in the representation of the algorithm’s rebellion, network calculations can persist in stratospheric height scaling.