Ethereum prices have fallen free this year, making them one of the worst major cryptocurrencies.

Ethereum (ETH) has fallen for three consecutive weeks, falling to its lowest level since March 2023. More than half of its value has been lost since its peak in November, bringing investors to billions of dollars. In this article, we will use key charts to classify ongoing Ethereum price crashes.

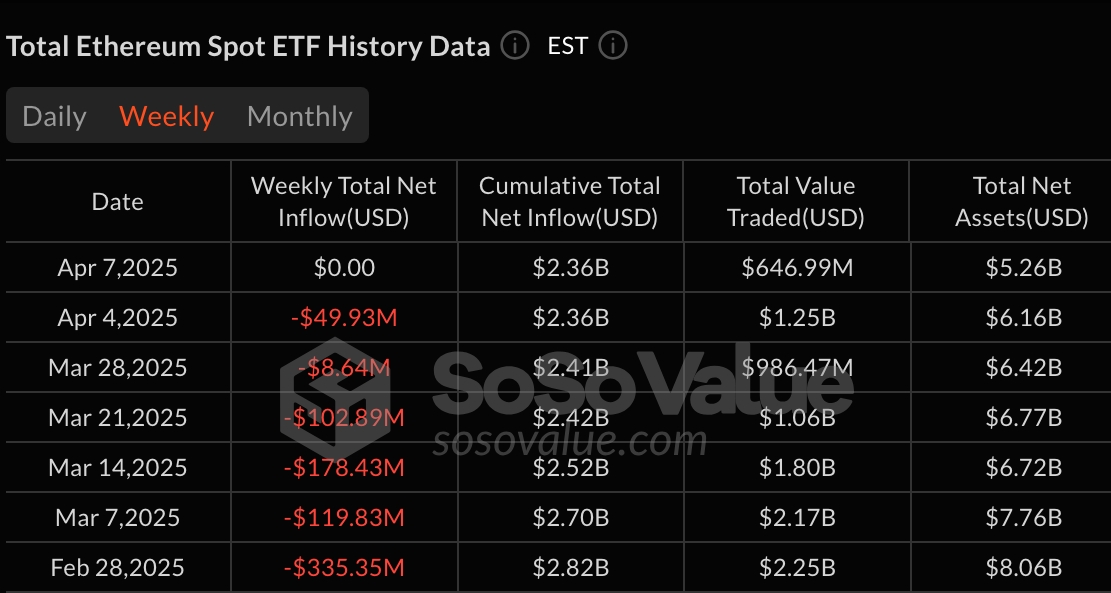

There was a considerable leak in the Spot Ethereum ETF

One reason for the sharp drop in ETH prices is the huge spill of Spot ETFs this year, with weak demand in the US. The chart below shows that these funds have had net outflows for the past six consecutive weeks. These funds currently have only $2.3 billion in net inflows compared to $35 billion in Bitcoin. That’s a sign that investors prefer Bitcoin with a larger margin than ETH.

Spot ETH ETF leak | Source: SosoValue

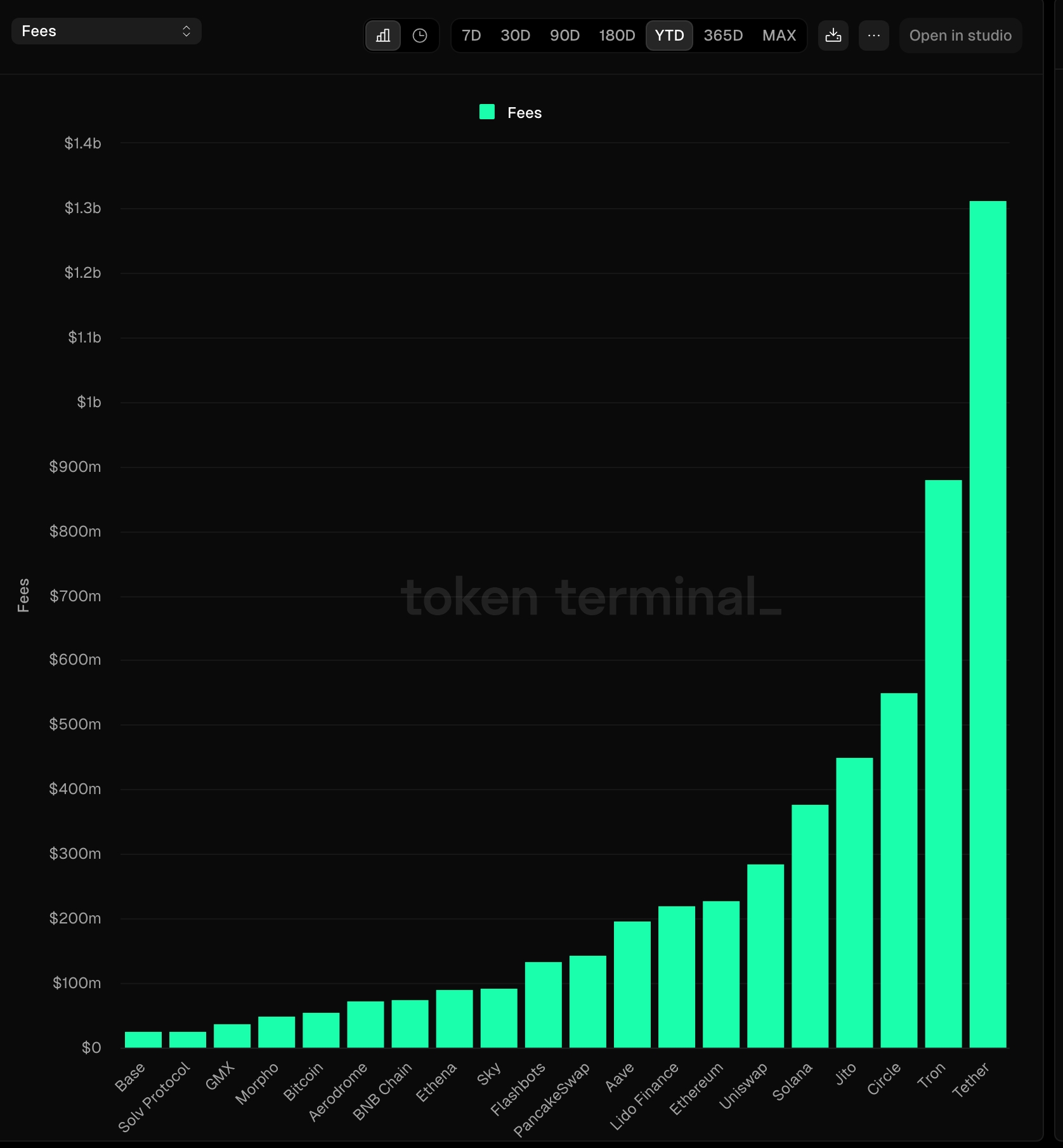

Ethereum is no longer leading in fees

For a long time, Ethereum was the most profitable chain in the crypto industry, as it dominated industries like defi., Games, inappropriate tokens, stubcoins, real-world asset tokenization. This performance has changed this year, with the network being overtaken by other popular chains.

The chart below shows that Ethereum generated $227 million in fees this year. In comparison, Tether was raked for $1.3 billion, Solana $376 million, and Tron was raked for $880 million, primarily from Stablecoin-related activities. Platforms like Jito and Uniswap are also outpacing Ethereum in total costs.

ETH Network Prices | Source: Tokenterminal

You might like it too: XRP prices will be short-lived, forming doji after bullish Ripple news

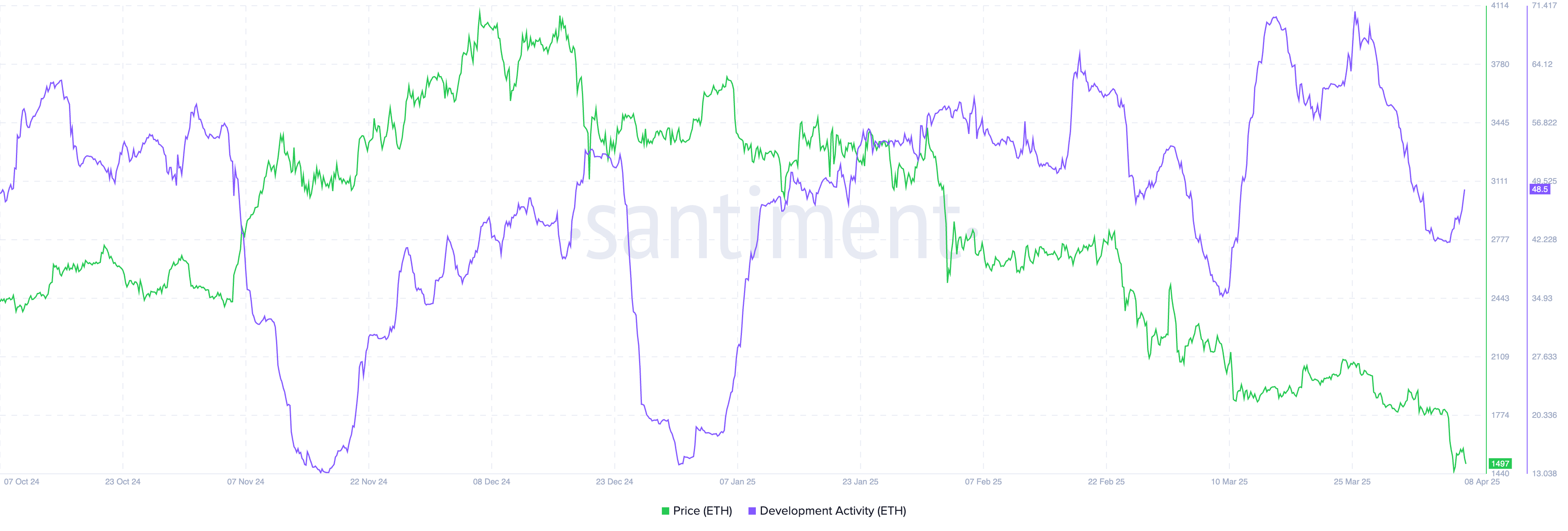

Development activity has declined

On-chain data also shows that Ethereum developer activity has declined in recent months. This drop comes from developers moving to other rapidly growing chains such as Solana, Sonic and Bellachin. Many also shift their focus to Ethereum layer 2 solutions such as Base, Kinkai, and Optimism, offering faster speeds and reduced transaction costs.

Ethereum Development Activities | Source: Santiment

Ethereum prices formed triple top patterns

From a technical standpoint, Ethereum fell sharply after forming a bearish triple-top pattern on its weekly charts. The formation consists of three peaks of approximately $4,062 and a neckline of $2,132. This is the major support level last tested on August 5th.

The ETH is broken under this neckline, checking for a bearish signal. It also falls below both the 50-week and 100-week moving averages. As a result, your next downside target could be $1,000.

ETH Price Chart | Source: crypto.news

summary

Ethereum fell sharply in 2025, bringing its $10,000 investment in November to just $3,650. Weak foundations and negative technical indicators suggest that further shortcomings could possibly occur in the coming months.

You might like it too: Ethereum to achieve immediate finality? Vitalik Buterin’s roadmap aims to silence critics