Ethereum prices face risk amid recent price declines affecting the market. As large markets experienced a recession, ETH prices saw extreme lows, just like other cryptos. Most cryptocurrencies increase their lows each year, following BTC prices.

Ethereum price is $1,542.74, a significant drop under the average purchase price of $2,200 for Ethereum holders.

Many Ethereum investors face net losses as their assets fall below the purchase price, indicating significant capital losses across the Ethereum network.

Large Ethereum holders with over 100,000 tokens offer an average cost base of $1,290.

This particular price number is strong as it defines important support boundaries. This is where Ethereum could reach in case the price slides.

The market showed signs of recovery during the June 18th, 2022 Luna crisis, causing other previous market declines in which Ethereum prices fell to $870.

Previous market recovery offers hope for stabilization and recovery once Ethereum prices reach these historic levels.

According to Coinmarketcap, Ethereum’s value fell 10.84% within a day to settle at $1,542.74.

Trading volume rose 552.31%, and market capitalization was $1861.3 billion due to significant sales pressure.

Market value appears to be very unstable, but suggests that short-term price drops could occur.

Technical Analysis of Ethereum Price Charts

According to the graphical data provided, the Ethereum market showed considerable price instability during the observed period.

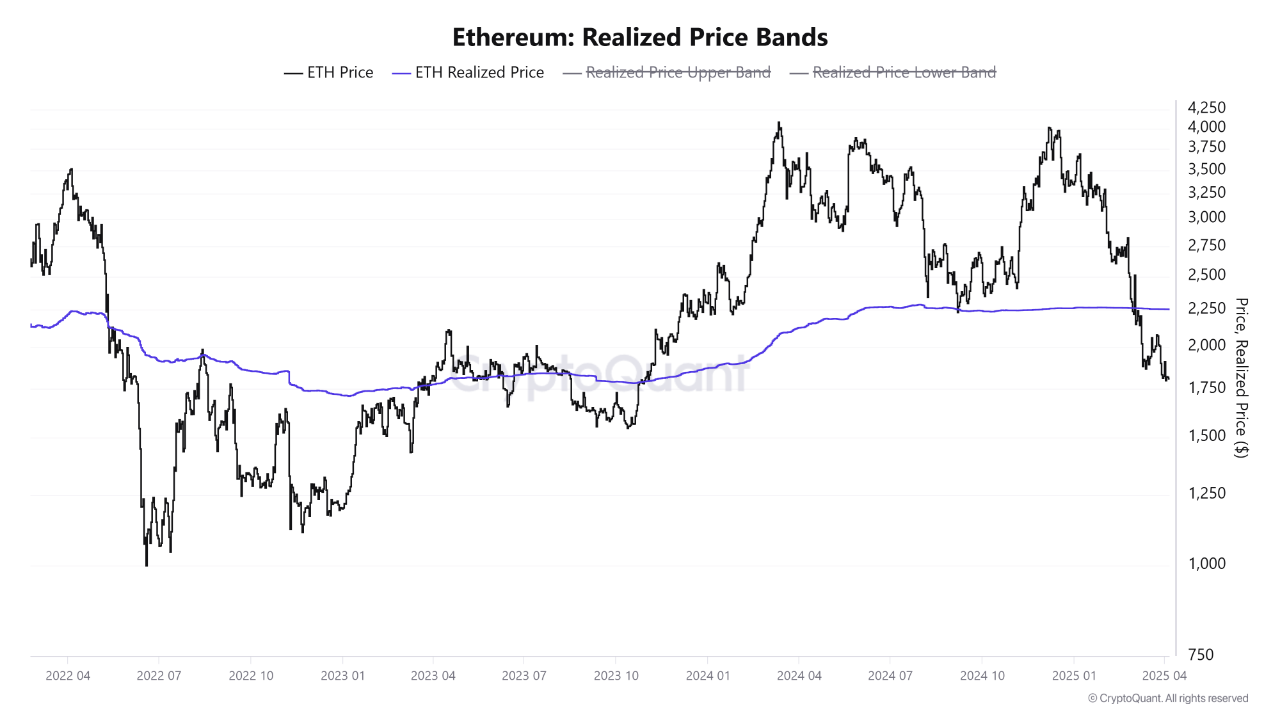

Ethereum Data Chart | Source: Cryptoquant

According to the chart, the average price at which all Ethereum tokens are traded during market trading is an important indicator known as realised price.

The Black Line depicts Ethereum market prices from the current exchange while remaining under realized price values.

The realized price line is the main criterion for many holders determining the maximum loss level.

Trade activities below realised prices indicate the current market situation of negative dynamics. This leads to losses for most Ethereum holders.

The current value position at the lowest end of Ethereum suggests an additional downward price movement, unless it begins to change prices.

The current price movement in this analysis reflects the current market stabilization for Ethereum.

However, they also suggest substantial changes going forward based on trends across the market.

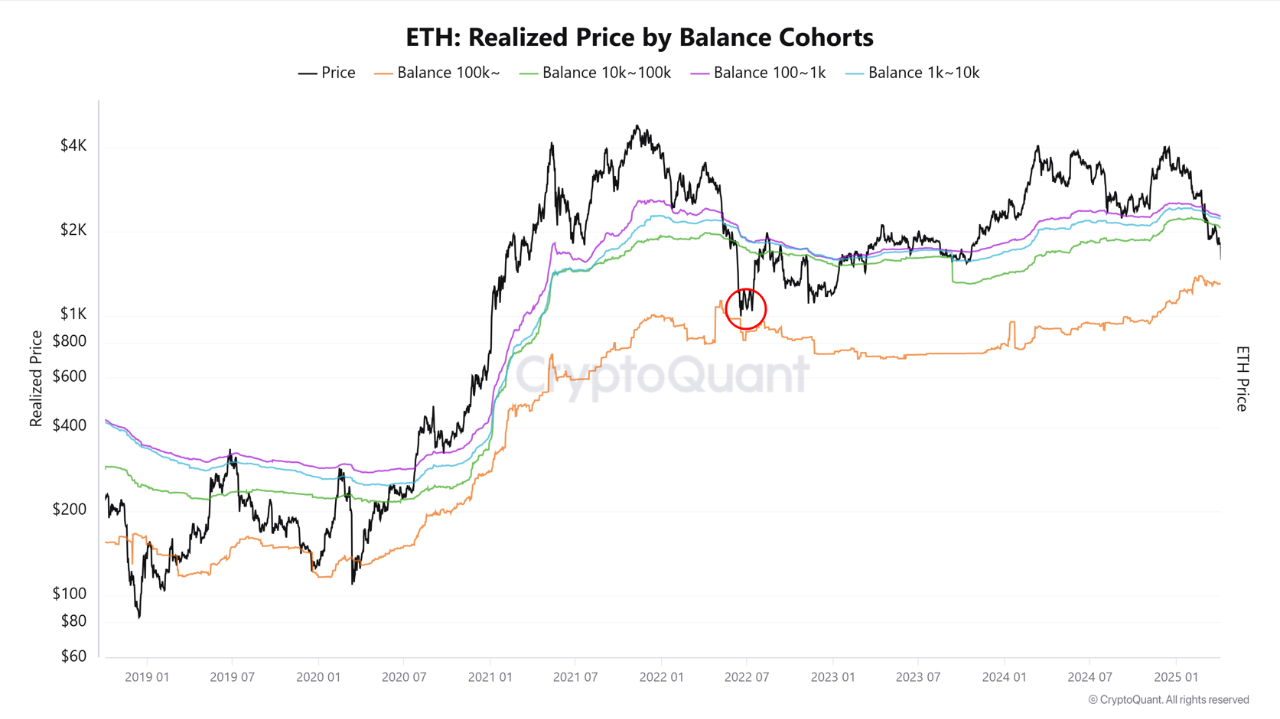

ETH: Realized price cohort analysis by balance

Other charts show Ethereum holders in different groups based on the balance size. This is the price achieved by the balance cohort.

The recognized prices reached a higher level among holders, as indicated by the green and purple lines, compared to other lines.

Ethereum Data Chart | Source: Cryptoquant

Groups with 1,000-100,000 Ethereum holdings are paying for an asset price increase based on the amount of ownership.

Holders at these levels are currently facing losses in their asset positions as the market value of Ethereum has fallen to a defined extent.

Small Ethereum holders provide evidence that they hold assets at a more expensive price.

This indicates that there is a tendency to sell in response to additional market declines.

Therefore, this could further degrade the market.

But not everyone is afraid of dipping. The sudden, high-liquid 50x whale look may mean that some, if not all, investors are targeting bounce.

Thus, whales have been open for a long time with a massive leverage of $47 million from whales. This means that ETH will inevitably recover or stay at the price level they are currently trading.

The entry of major market players tends to precede major price movements, and such large transactions often precede major price reversals.

If whales raise prices for Ethereum, this will change sentiment in the broader market and encourage other investors to follow the whales’ behavior.