Swiss francs and gold have become part of the best safe inventory assets as stock and bond market turmoil continues.

The USD/CHF exchange rate fell to 0.8100 on Friday, 12% below its 2024 high. This performance has made the Swiss franc one of the best performing currencies this year.

The Swiss Franc’s performance was that of the US dollar, which fell to its 2018 low. Its performance is largely due to Swiss neutrality and bank secret laws, and has always been a shelter.

The Swiss National Bank (SNB) is a leading investor in the US market and holds considerable positions in many American companies, including common names such as Apple, Microsoft, Amazon, and Alphabet. He is also the 10th largest owner of the US Treasury Department.

Gold has also become a top heaven, with its price rising to a record high of $3,240. This year alone, there has been a 24% increase from the pandemic low of 125%, and 24%. In contrast, the S&P 500 and Nasdaq 100 indexes are retreating in two digits.

You might like it too: This Week’s Chart: Buy Now or Wait? High lipids, curved dao, fartcoin are the hottest picks

Gold and Swiss franc outweigh Bitcoin

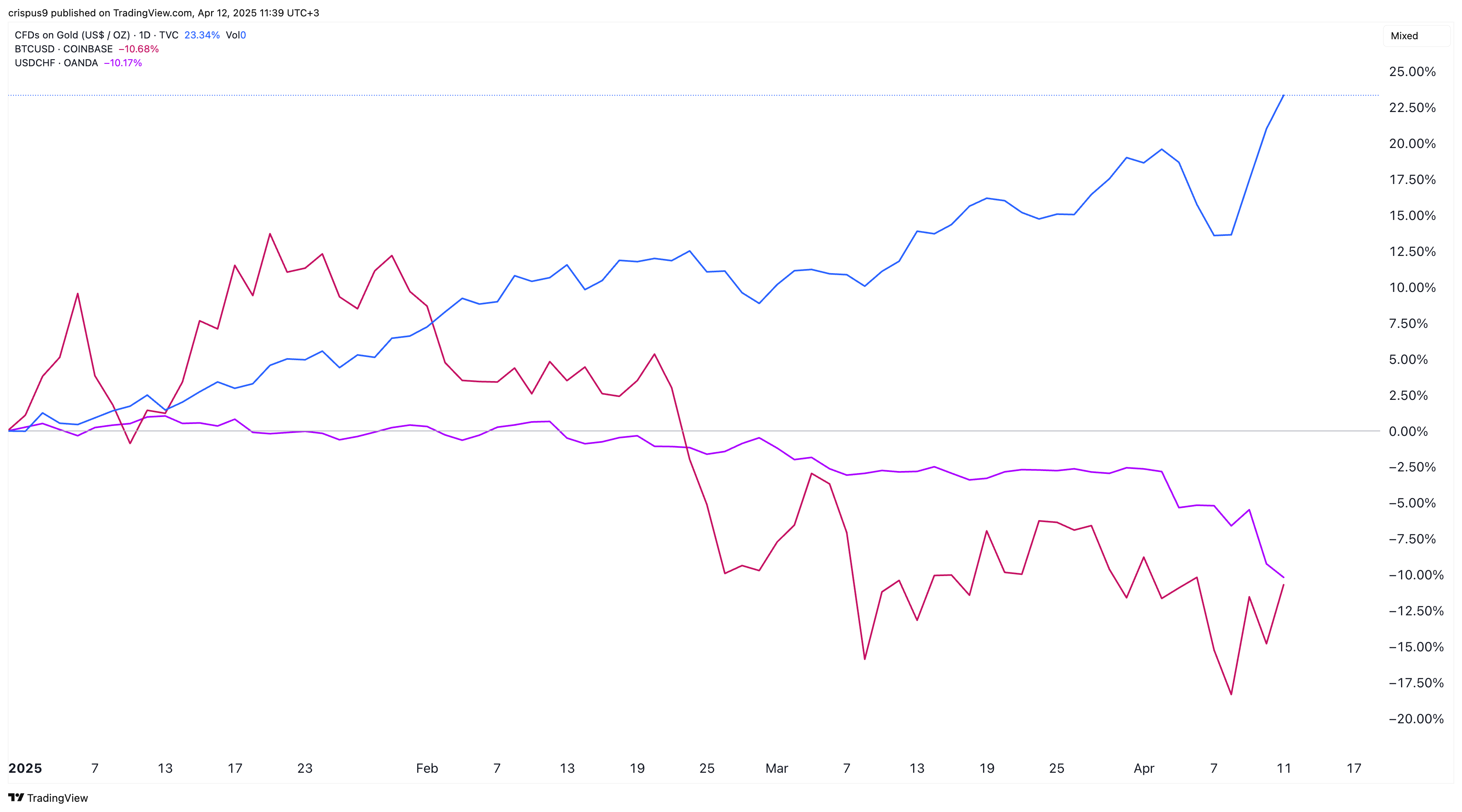

Gold and the Swiss franc have defeated Bitcoin (BTC) safe shelters as the trade war escalated. Bitcoin, often considered a digital version of gold, has slid from its annual high of $109,300 to $83,000.

Gold vs USD/CHF vs Bitcoin | Charts by TradingView

Bitcoin is often considered a shelter due to growing demand from Wall Street investors, as it has a limited supply of 21 million coins.

They have also done better than US bonds that have been under pressure over the past few weeks. On Friday, the benchmark 10-year yield rose to 4.50%, while the 30- and 2-year yields rose to 4.85% and 3.97%, respectively.

Global risks continue to rise this week, and analysts predict that a recession will occur this year. Polymarket Data has placed a 60% chance of a recession this year, but BlackRock’s Larry Fink believes the US is already one.

Moody’s chief economist Mark Zandy has raised the odds of the recession to 60%, citing heavy tariffs between the US and China. He also noted the 10% US basic tariff on all imports and the 25% collection on steel, aluminum and vehicles.

Similarly, economists at companies such as Morgan Stanley, BNP Paribas and UBS have warned that US GDP will fall this year and unemployment will rise to 5%.

You might like it too: Rebound, Bitcoin cheats for $84,000 as trade concerns ease