Today, April 16th, several spot ETFs from Solana make their first debut in Canada. Bloomberg analyst Eric Balknas said this, adding that dyeing some of the SOL reserves could also provide additional yields.

Canada and Spot Solana ETF debut

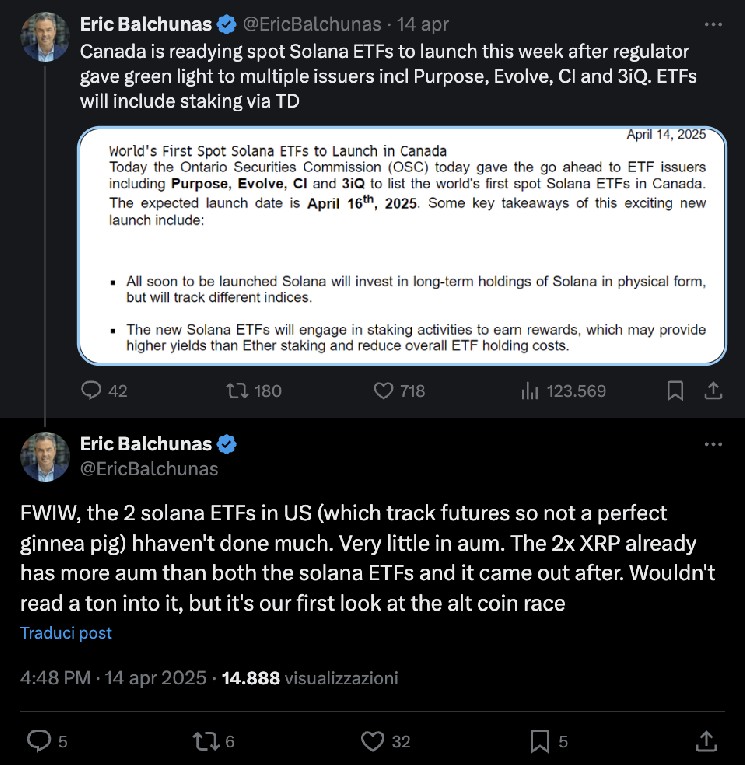

Bloomberg Analyst, Eric Balkunasrevealed in today’s X post, Several spot ETFs from Solana’s debut in Canada on April 16th.

A confidential memo from TD Bank’s client states that the Ontario Securities Commission (OSC) has approved the asset manager Purpose, evolution, CI, and 3IQ Issues an ETF based on the SOL.

Not only that, the document says it is permitted You can wager a portion of the SOL reserves to get additional yields.

sauce

“Canada is preparing a Solana Spot ETF for launch this week after regulators gave green light to several publishers including purpose, Evolve, CI and 3iq. The ETF includes staking via TD.

FWIW, the US two Solana ETFs (not perfect guinea pigs because they track futures). Mostly at AUM. The XRP 2X already has more AUM than both Solana ETFs and came out later. I haven’t read it much, but that’s the first way to look at alternative coin bull runs. ”

Balchunas downplayed the potential performance of its products By comparing it to what happens in the US: Sol’s ETFs did not function due to their strong interest in Tecrium XRP ETFs.

Multiple ETF launches in Canada and Solana: Sol price

News of the ETF’s launch in Solana, Canada, was given two days ago by a Bloomberg analysts.

However, looking at the performance of Sol’s price, it doesn’t seem like investors are valuing it.

At the time of writing, The SOL is worth $125 at a 19% pump in the last 7 days, but is a -5% dump in the last 24 hours. that’s right Sol follows the general trends in the crypto market.

In any case, the current price is half that ATH – Sol reached an all-time high at the end of January when it was worth $257.

US: SEC is delayed with crypto ETF fixes

Looking at the status of US crypto ETFs, the Securities and Exchange Commission (or SEC) has recently commented on several timelines.

in fact, Sec You’ll have it It’s postponed Some of that decisions are made according to requests for a change to a particular cryptographic ETF.

For example, in the case of Vanek, the SEC decided to take 45 more days For proposals for amendments by CBOE BZX Vaneck Bitcoin Trust and Vaneck Ethereum Trust. Here the idea is to allow These ETFs “reed with actual works.”

Same timing He was then chosen for the final decision The same change was requested for the WisdomTree Bitcoin Fund.

Request from NYSE ARCA for rules change Grayscale Ethereum Trust ETF and Grayscale Ethereum Mini TrustETF I’m also looking at that decision It has been postponed to June. In this case, the proposal Two trusts can hold ETH and activate staking.