- Capmoney has adopted the ChainLink price feed to stabilize COSD and provide live pricing data on the Defi platform.

- Chainlink Oracle for distributed verification in maintaining COSD dollar stability and automated smart contract capabilities.

- Linked tokens continue to decline as whales offload the token, but become less active addresses and damaging the market.

Capmoney has revealed that it will use Ethereum’s ChainLink Price Feeds to achieve Stablecoin Peg into US dollars. Adjusted for cross-border payments and remittances, Stablecoin aims to provide consistent pricing data and improved security in a distributed financial (DEFI) environment.

. @capmoney_ is consolidating the integrated chain link price feed into @ethereum to power its distributed interest CUSD stablecoin.https://t.co/w1qnpktgzw

CUSD is fully secured and backed by breaking assets, so we use ChainLink to offer a stronger guarantee: Stablecoin Minting and…pic.twitter.com/z7qagsrivt.

– ChainLink (@ChainLink) April 17, 2025

Currently, ChainLink’s price supply is popular because it is not decentralized and therefore the game is not possible. Extract data from over 20 CEXS and DEXS aggregators and merge data using volume weighted averages. These prices are further verified through consensus by other parties known as security audit nodes.

In fact, CUSD smart contracts will require a new price renewal period when the market changes or it is due. The Oracle node collects and processes pricing information from the external environment, excludes outliers, and reports the results. With chain link data pooled and the averages exposed on-chain, CUSD remains safely glued and reachable even in the event of volatility or extreme loads.

The Defi utility expands as CUSD acquires new features

By using the ChainLink infrastructure, CUSD introduces itself to integrate across numerous Defi platforms. Agricultural systems that rely on automated market makers, lending platforms, and reliable pricing data can now be integrated with CUSD.

ChainLink’s programmable Oracle allows real events to generate smart contract transactions. Capmoney plans to optimize the settlement and change collateral requirements, further expanding the potential use cases for CUSD.

Integration not only provides operational stability, but also benefits CUSD by setting benchmarks that other Stablecoin publishers on Ethereum should follow.

ChainLink faces pressure despite strategic adoption

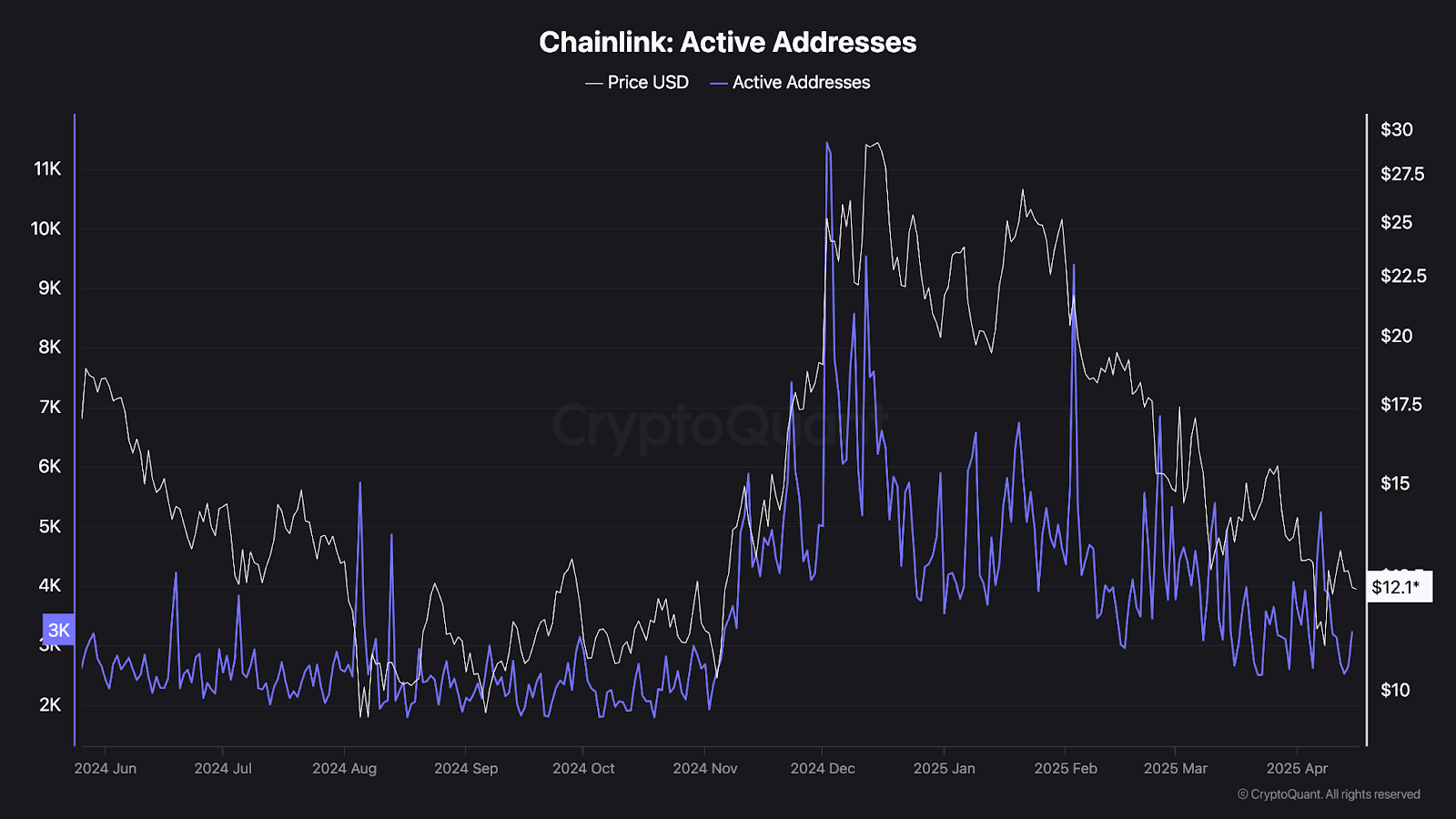

However, Link, a native token for ChainLink, was unable to maintain an upward trajectory even in collaboration with Capmoney. The link is currently at $12.15, showing a daily drop and relatively bearish from the peak of around $30.86 recorded in December.

However, the Onchain indicator shows a negative trend in the foundation. Cryptoquant shows that ChainLink’s active addresses have dropped to around 3,200 this week, 72% less than the 11,400 recorded in December.

Source: Cryptoquant

Active address metrics that track the number of different wallets involved in linked tokens can also increase when prices are made. A further decline means reducing user interest and reducing trust in prospects.

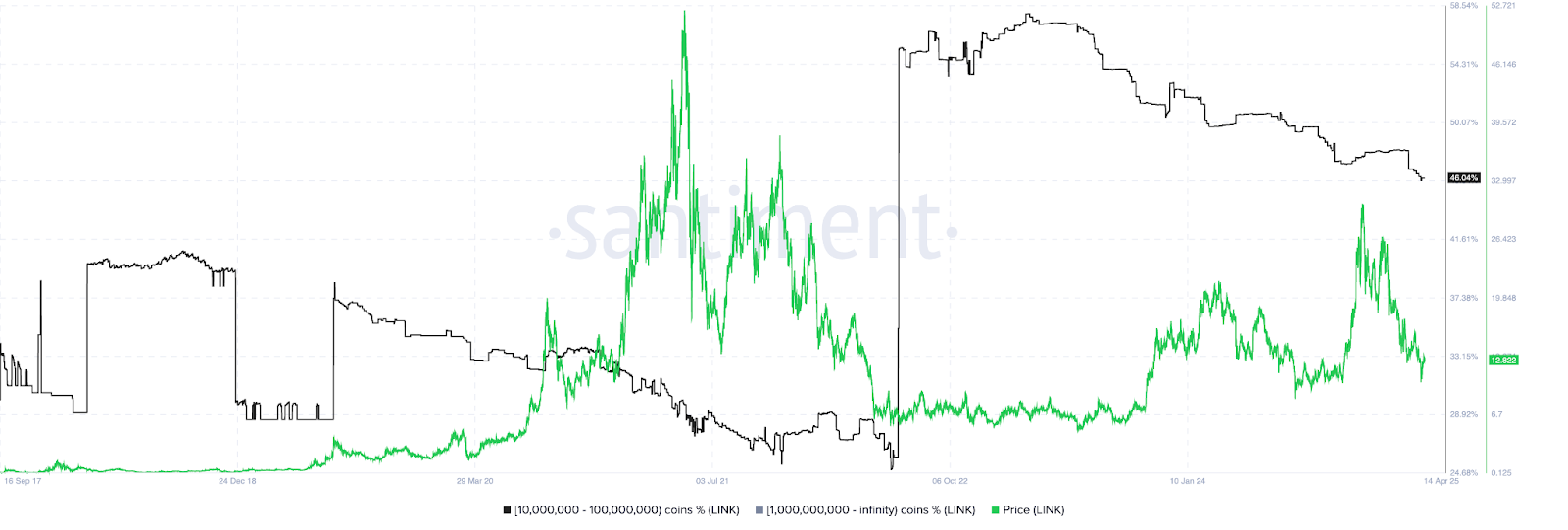

Santiment also shows that larger holders are also starting to sell more. Many large addresses, ranging from 10 million to 100 million links, are on sale from February to mid-April. These wallets currently have 46% of all linked tokens circulating. This puts the lower pressure on becoming common in this whale group due to exit activity.

The link is close to the $10 support level. It is expected to fall below this level, which will result in more losses if the bearish momentum persists. Traders are currently awaiting positive signals that could stimulate the desire for users and large whales to interact with the platform.