The major Altcoin Ethereum has been riding a wave of broader market recovery with prices rising 5% over the past week. This price growth has rekindled demand for Altcoin, particularly among US-based ETH retailers, as shown in current chain data.

However, institutional investors appear to remain skeptical. They continue to draw capital from Ester-backed funds, demonstrating a lack of confidence in short-term price rebounds.

Retail interest in Ethereum will increase to buy Coinbase premium signals

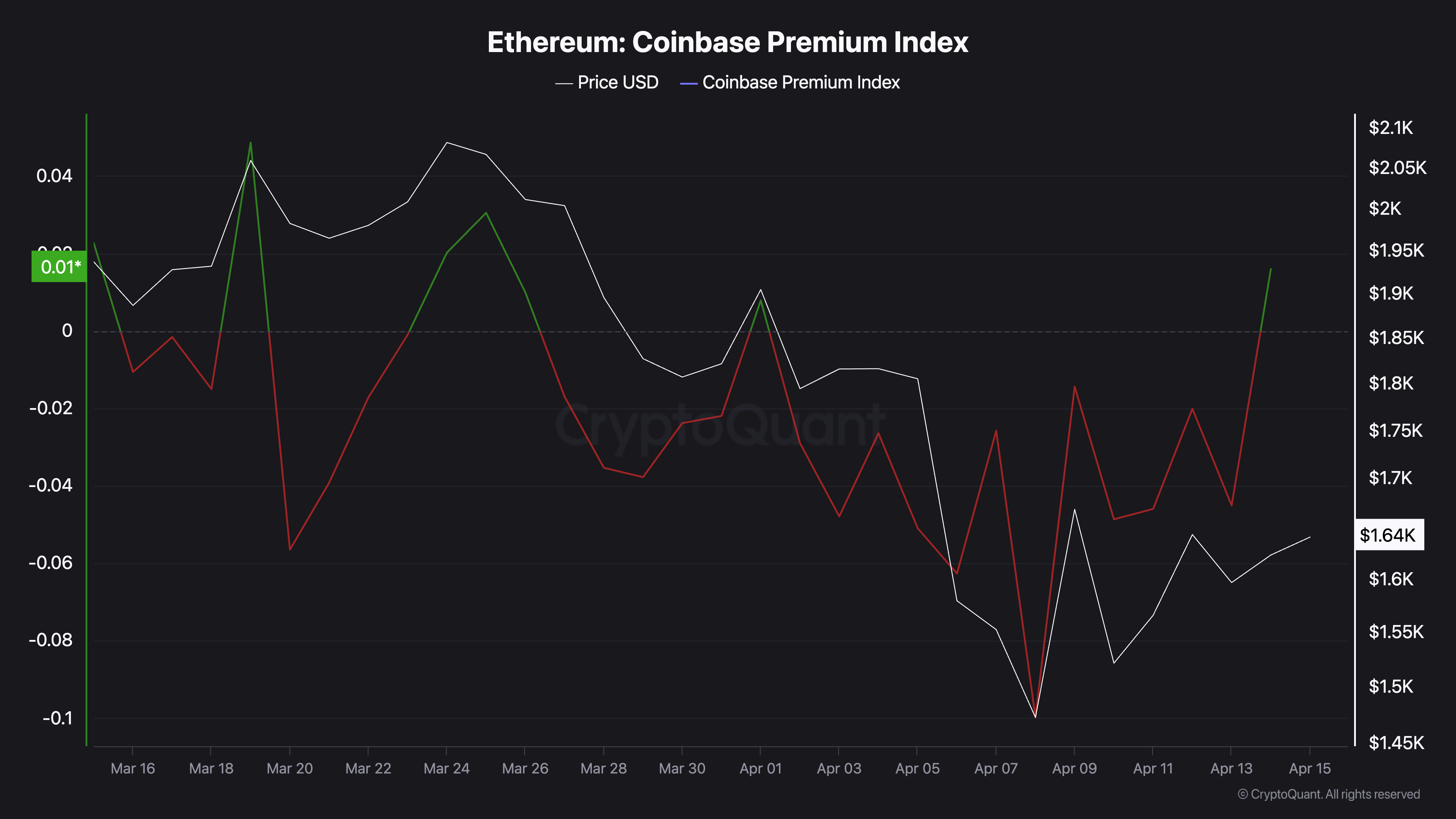

The growing interest in retail is evident at ETH’s Coinbase Premium. It has returned above zero, indicating a growing buying activity from US investors. At press, this is 0.016.

Ethereum Coinbase Premium Index. Source: Cryptoquant

Eth’s Coinbase Premium Index measures the difference between Coinbase’s Coin price and Binance. When its value exceeds zero, it suggests Coinbase’s important purchasing activities by US-based investors.

Conversely, if it drops and immerses in negative territory, it indicates less trading activity on US-based exchanges.

Eth’s Coinbase Premium Index reflects the bullish sentiment of the market as traders are willing to pay premiums to buy coins at Coinbase. In the short term, this shows advanced investor interest, which can increase the value of Altcoin.

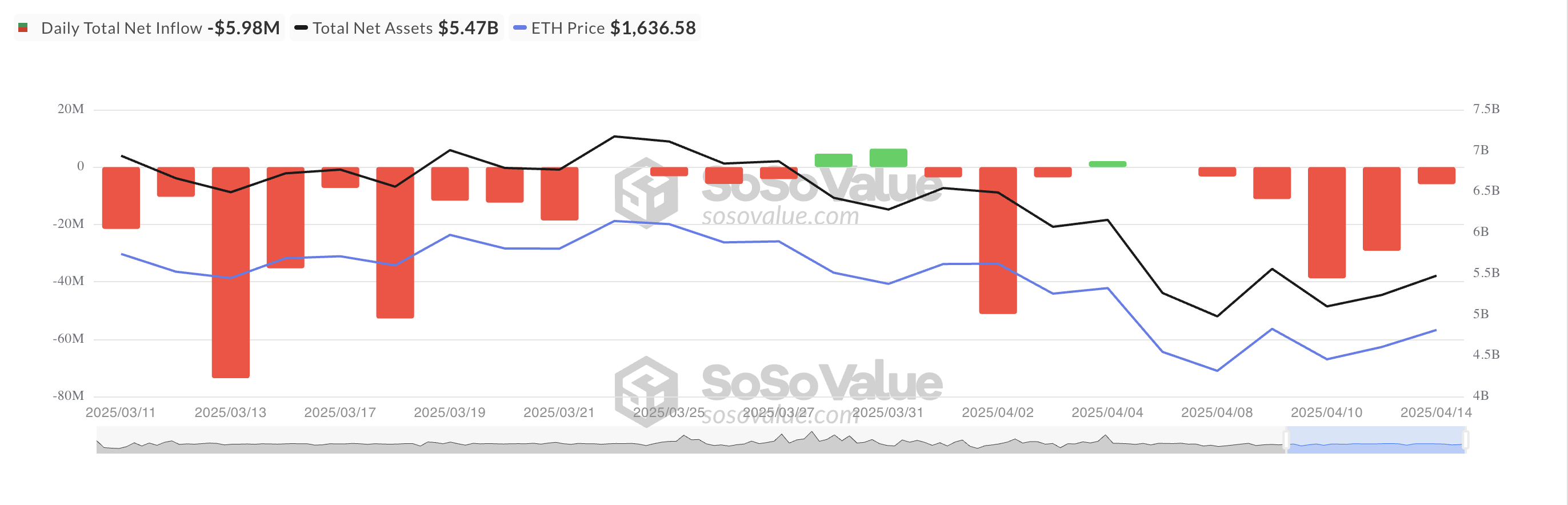

However, US institutional investors are cautious. This is evident in an ongoing spill from the US-based Spot ETH Exchange Trade Fund (ETF), marking Altcoin’s seventh consecutive day of withdrawal.

All Ethereum spot ETF net flow. Source: SosoValue

The ongoing exit of the facility’s capital is in stark contrast to the growing enthusiasm of retailers. This difference suggests that US retail investors are becoming increasingly optimistic about ETH’s short-term outlook, but institutional players are more cautious, perhaps due to macroeconomic uncertainty.

ETH shows strong capital inflows, but bearish sentiment can see prices fall

ETH’s Balance of Power (BOP) is a positive during press time, reflecting today’s market recovery. This indicator, which measures trading pressure, is on an upward trend at 0.57.

Such positive BOPs show a more capital inflow into ETH than outflow, indicating accumulation trend. If this continues, it could push the Altcoin price to $2,114.

ETH price analysis. Source: TradingView

However, if market sentiment becomes bearish and esthetic traders reduce demand for Altcoin, they could lose recent profits and drop to $1,395.