Ethereum suffers from very low market activity, and its prices show minimal volatility.

This stagnant behaviour increases the likelihood that sellers will push cryptocurrency below its key support level of $1.5,000 over the next few weeks.

By Shayan

Daily Charts

Ethereum continues to surpass the long-standing psychological and structural level of important $1.5K support regions that have been held since January 2023. However, the market is currently showing very low activity, with prices consolidating in a calm, lateral direction. This volatility and lack of momentum suggests a state of uncertainty in which neither buyers nor sellers exhibit advantages.

These conditions often precede important moves as the market builds energy waiting for new supply or demand. From a technical standpoint, bearish sentiment dominates current price action. If updated sales pressure occurs, a critical break below the $1.5,000 mark could trigger the cascade towards the $1.1K level.

Still, a short-term corrective retracement into a $1.8,000 resistance zone remains possible before the seller acquires another attempt to violate the $1.5,000 support. The upcoming days are very important as price action at this level are likely to determine the direction of Ethereum’s next major trend.

4-hour chart

The rigorous integration of Ethereum is clearly visible in the four-hour time frame. Currently, the price is locked at $1.6k between $1.5,000 support and the upper boundary of descending channels, reflecting the equilibrium market. This balance suggests hesitation from both buyers and sellers.

Breakouts from this narrow range are crucial. If Ethereum violates the $1.6K limit, a short-term rebound to $1.8k could be achieved.

Conversely, breakdowns below the $1.5,000 level are likely to cause a significant downward movement, potentially driving prices to the mid-term $1.1,000.

By Shayan

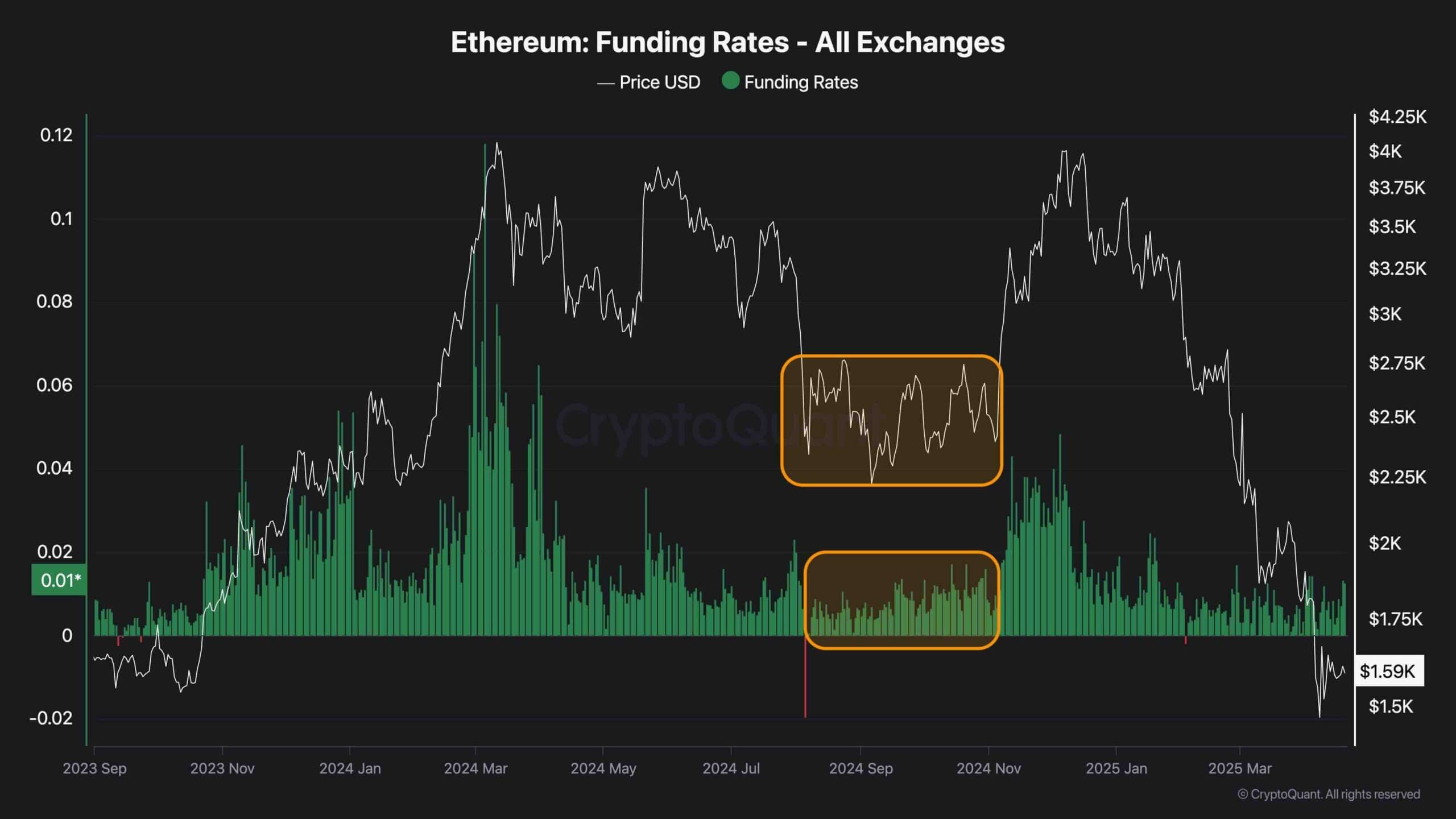

Funding rate indicators serve as important indicators of sentiment in the futures market. Analyzing recent behaviors provides important insight into the possibility of Ethereum’s next move. In particular, both prices and funding rates reflect patterns observed during the September-November 2024 period. This is a stage characterized by long-term integration and deep revisions that ultimately precede a strong bullish gathering.

This market situation often reflects a smart money accumulation, as informed investors take advantage of panic-driven sales and widespread distribution among retail participants. Currently, funding rates have fallen to near zero and are consolidated, suggesting that the market may once again enter the accumulation phase.

However, it is important to note that further drawbacks are still possible at such stages. Prices can drop before meaningful rebounds occur, providing an even more attractive level for accumulation by long-term investors.