Import taxes reach 46% and miners are facing tightness in both costs and financing as capital flows through ETFs into low-risk Bitcoin exposure.

According to a new Bitwise report, US Bitcoin (BTC) miners face two major challenges at once.

In the report, Bitwise’s research director André Dragosch and research analyst Ayush Tripathi note that with an estimated 40% of the global hash rate run by American mining companies, the industry is “facing a 24-46% tax on imported mining in Vietnam, Thailand and Malaysia.” These tariffs come when the miners’ main profitability metric, hashprice, is at a “history low,” reads the report.

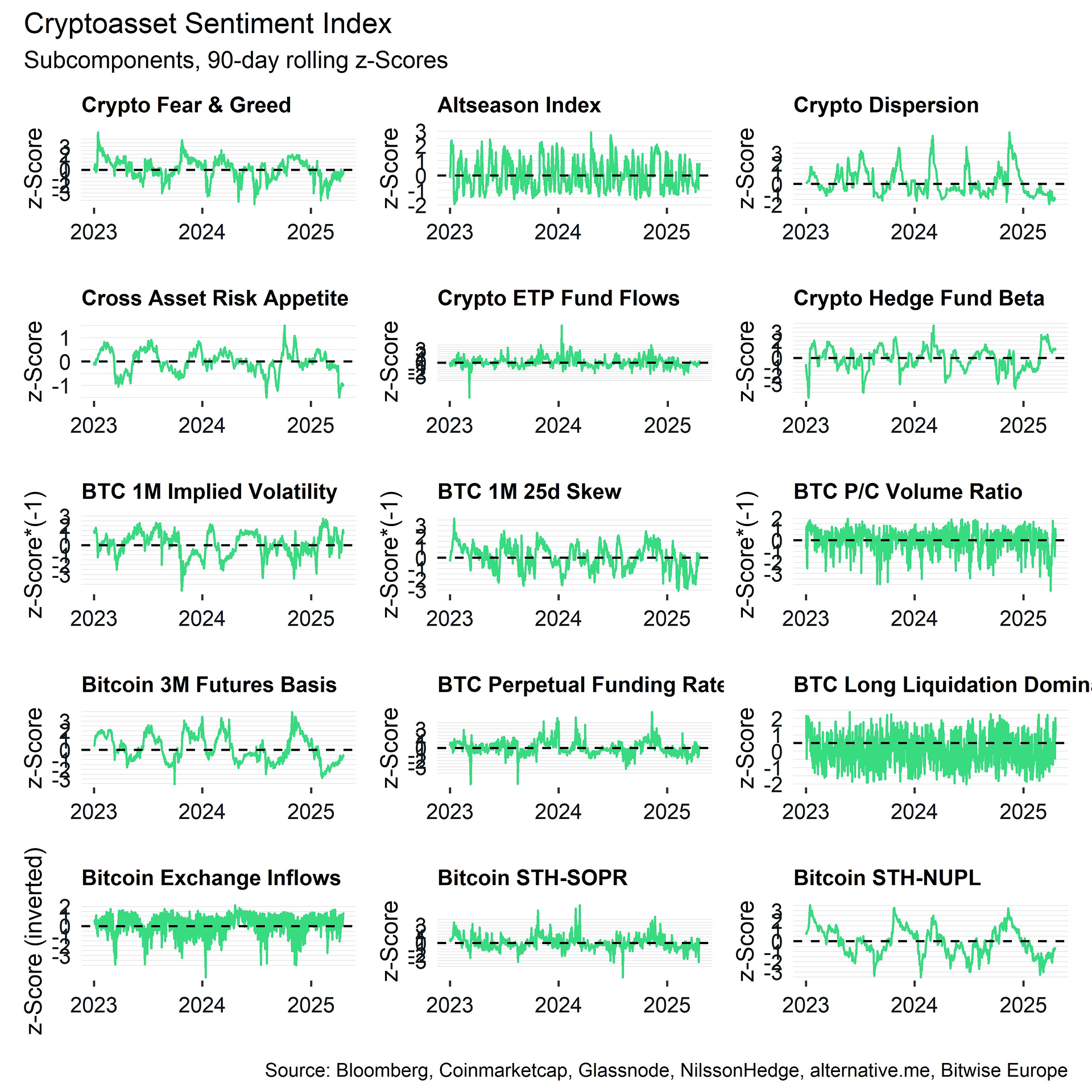

Crypto’s Emotion Index | Source: Bitwise

You might like it too: Bitcoin hashrate hits hit high amid minor sales

Investor interest is also shifting away from miners. According to analysts, the Ministry of Corporate Treasury, including the demand for Spot Crypto Exchange-Tradeds Funds, Strategy and Metaplanet Assocling Investor, “currently we are facing fierce competition in the capital,” Bitcoin Miner said.

“These companies can accumulate BTC using low-cost stock issuance or convertible obligations, providing investors with immediate exposure to price increases without risks in mining operations, which requires them to fund heavy upfront capital expenditures, navigate uncertain regulatory topography, and wait for investments to wait months or years.

Bitwise

However, some companies are adapting to new terms. For example, Bitmain-backed Crypto Miner Bitfufu is considering a redirect machine to Ethiopia, while Bitdeer prioritizes Norway and Bhutan.

Two US registered miners, Riot and Cleanspark, absorbed the effects of early tariffs by accelerating shipments before shipments. Yet despite these efforts, the outlook remains difficult as miners clearly “have more pain.”

read more: Bitcoin Minor Hive Digital stock jumps 2% when completing a 100 MW site in Paraguay