In 2021, the Impossible Token (NFT) sector experienced explosive growth. But that meteor rise followed by a recession, prompting questions about sector sustainability.

Alexander Salnikov, co-founder of Rarible, believes the market is facing a shift, not a collapse. In an exclusive interview with Beincrypto, Salnikov offered his perspective on the state of the NFTS and its role in 2025.

Is NFT still relevant in 2025 or is it running the course?

The rise of NFTs, fueled by excitement and speculation, was inevitable for a market experiencing such rapid innovation. Nevertheless, as with many emerging technologies, this early surge followed by revisions. The hype has given way to the reality of market maturity and sustainability.

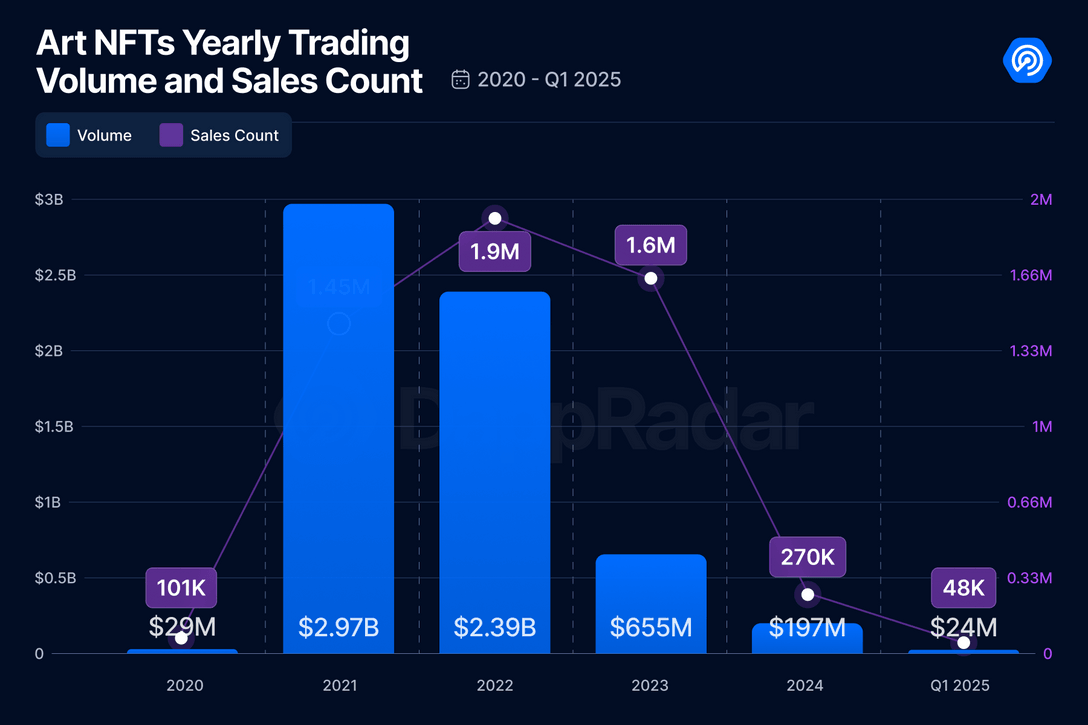

According to the latest report from Dappradar, the ART NFT market saw an impressive surge in 2021, with trading volumes reaching $2.9 billion. However, by the first quarter of 2025, trading volume had recorded just $23.8 million, a 93% decline.

NFTS trading volume over the years. Source: Dappradar

Similarly, the number of active traders peaked in 2022 at a record high of 529,101. However, this figure fell 96%, with 19,575 active traders remaining by the first quarter of 2025.

Previous industry reports from Dappradar revealed that overwhelming performance is not just a trend towards 2025 trends. In fact, 2024 was one of the worst years for the NFT market since 2020. Additionally, Beincrypto reported on a study that revealed that 98% of the NFT projects launched in 2024 were essentially “dead.”

Despite the decline, Rarible’s Salnikov maintains a positive outlook for the sector. He emphasized the importance of a clear purpose when it comes to NFTS.

“Once upon a time, after .com burst, the headline rang out saying that the internet is just a trend. But as more companies integrated technology into everyday use cases, it became ingrained as a part of their lives,” he told Beincrypto.

Salnikov argued that trust would rapidly decrease when NFTs are considered merely a speculative asset. In contrast, projects rooted in real-world community engagement or offering concrete utilities provide clear value and it is easy to understand.

Meanwhile, rather than viewing sector decline as a collapse, executives view it as a market readjustment, with the focus shifting from speculative hype to a more sustainable and valuable project.

“There was a moment in the speculative phase, but now we see NFTs evolve into real infrastructure, a tool that creators use to build communities, products, and new digital economies,” he said.

NFT Beyond Hype: Unlock real-world utility

Sarnikov emphasized that the utility of NFT spaces is no longer a distant concept. Creators use NFT, loyalty program brands, and player identity games for membership.

He pointed out that NFTs are linked to goods, events and even real-world assets, which has led to a growing convergence between the digital and physical worlds. Binance Research’s April 2025 report further supports this trend.

This report focuses on several real-world partnerships and demonstrates interest in NFTS. Examples include Azuki’s physical NFT and animated characters with Michael Lau, Sandbox’s Jurassic World Collaboration, Eggrypto’s Eparida, and Sony’s Soneium Platform will partner with Line to create Web3 Mini-Apps.

“The next wave of growth isn’t about chasing trends, but about unlocking the new kind of ownership and access that we feel is native to the Internet generation,” Sarnikov said.

This perspective offers optimism, but the reality of many companies is quite different. Due to low trading volumes, major platforms such as BYBIT, X2Y2 and Kraken have resorted to discontinuing NFT services.

Those who didn’t shut down explored alternatives. For example, Magic Eden expanded beyond NFT with the acquisition of Slingshot. Nevertheless, Sarnikov dismissed this strategy and commented,

“We’re not trying to bolt non-NFT features just to stay busy. We’re actually building NFT commerce that fits the community.”

He explained that this approach uses a modular, customizable on-chain market. Creators can tailor to a specific audience, such as game projects, L3s, and legacy brands.

“NFT is a feature. It requires proper framing,” said the co-founder of Rarible.

When fame fades away: Celebrity-supported NFTs Reduced

Back, an interesting trend in the NFT hype era was celebrity involvement. Famous figures like Justin Bieber, Madonna and Neymar jumped on the bandwagon and attracted considerable attention in the sector. Despite this, their investment strategies have not been particularly successful.

In January 2022, Bieber spent 500 ETH (about $1.3 million at the time) on the boring APE #3001. This NFT is from Yuga Labs’ boring APE Yacht Club (BAYC) collection.

However, according to the latest data, the NFT is worth just 13.51 weeks (approximately $24,174), a 98.1% drop. The singer doesn’t sell his NFTs, but he’s been receiving little attention these days, with no promotional efforts or noticeable debate.

Thus, celebrities can turn their attention to NFTs, which underscores the need for substances beyond the name itself. As Sarnikov pointed out, celebrity involvement in the sector is fleeting.

According to him, celebrities’ names alone cannot replace genuine creative directions or strong communities.

“Celebrity drops come and go, and that’s the culture behind them that decides whether or not they stick,” he said.

He claimed that celebrities who treat NFTs as mere products would block the audience. Nevertheless, if the NFT drop is intentional and you truly tap on something meaningful like music, fashion, fandom, it finds its lasting value.

“We’re more interested in working with creators who are building over the long term than simply chasing headlines,” Sarnikov revealed to Beincrypto.

The executive also outlined the need for a more accessible and user-friendly approach to attracting interested users. He detailed that onboarding users shouldn’t feel “like a tech demo.” Salnikov pointed out Rarible as an example.

According to him, Rarible focuses on ensuring that each market built on the platform is the product people really want to use. This includes features such as Fiat Onramps, low-cost mint, a clean user interface, and most importantly, content that resonates with the user.

“We don’t sell NFTs, we’re promoting the experience that happened to be on-chain,” concluded Sarnikov.

The NFT market faces ongoing challenges, but it is still unclear whether the industry is entering a new phase of growth or whether there will be further obstacles to evolution ahead.