Base, a layer-to-blockchain developed by Coinbase, has seen a huge surge in total value locked (TVL) over the past 24 hours following important integration.

Amidst the changing US regulatory winds, President Trump’s pro-cryptic attitude stimulates bold movements amongst players in the sector.

Base TVL will rise by 20% as Binance.us adds support

Base TVL has increased by $557 million, according to data from Defillama. It has moved from $2.77 billion on Thursday to $3.335 billion at the time of writing, a 20% surge in the last 24 hours.

Base TVL. Source: Defilama

The surge in TVL suggests an increase in the amount of assets that have been stained, locked or deposited on the base blockchain. A higher TVL indicates an increase in user activity, trust, and adoption, and users commit capital to the protocol.

Meanwhile, the surge follows a notable announcement from Binance.us, the American Arm of Binance Exchange, the world’s largest crypto trading platform by Volume Metric.

According to the announcement, Binance.us now supports Base. Enables USDC (USD Coin) Stablecoin transfers for Ethereum (ETH) and Circle on Layer-2 networks.

“We look forward to announce that Binance.us supports the base! Starting today, we can deposit and withdraw Ethereum (ETH) and USDC via the base,” read an excerpt from the announcement.

The exchange emphasized that more assets are participating in Binance.us on the base network and showing interest in developing integrations. Meanwhile, using Base’s blockchain, users can directly deposit ETH and USDC with Binance.us and withdraw.

In the case of exchanges, this integration may enhance accessibility. Specifically, Binance.US users can interact with the Base ecosystem without filling their assets through Ethereum’s mainnet. This is among concerns that Ethereum’s mainnet will be slow and costly.

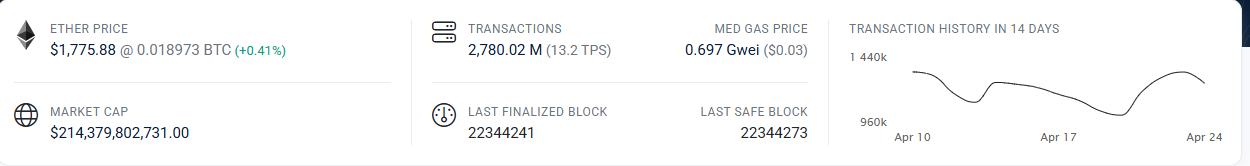

As an L2 scaling solution, the base offers faster Low-cost transactions compared to Ethereum’s mainnet. Etherscan data shows that Ethereum’s transaction throughput is approximately 13.2 TPS. This can lead to network congestion and high gas prices during peak periods.

Ethereum TP. Source: Etherscan

Meanwhile, base process transactions are chained off and bundled them before submitting to Ethereum. This method provides high throughput, significantly lower fees and is cost-effective for users.

Therefore, the integration allows Binance.us users to move ETH and USDC and are based on Defi activity at some cost.

Meanwhile, the development comes just a few months after Binance.US resumed USD deposits and withdrawals via bank transfer after a two-year hiatus.

Binance.US suspended USD deposits and withdrawal services in 2023 following the famous SEC lawsuit and rising regulatory pressure. But as political rhetoric has shifted to cryptography, the exchange appears to be taking bold steps.

“Now that we’ve survived, our goal is to help codes thrive and empower all Americans with freedom of choice,” said Norman Reed, interim CEO of Binance.us.

That coincides with recent developments from the Kraken Exchange. As reported by Beincrypto, the US-based exchange lists BNB in a move marking the strategic change in US crypto exchanges, potentially signaling the adoption of broader tokens within the country.