Solana’s latest Meme Coin, Boop, quickly surpassed its $500 million market capitalization just hours after its launch on May 1, 2025, attracting great interest from the Crypto community.

But behind the explosive price surge lies significant risks related to volatility, regulatory pressures and long-term sustainability of the Boop.Fun ecosystem that investors must consider carefully.

Boops and Boops Surges at Solana Ecosystem

Boop, Meme Coin Launch Platform Token for Boop.fun’s Meme Coin Launch Platory. It caused a frenzy as its market capitalization went past $500 million shortly after its release on May 1, 2025, settling at $421 million, causing its market capitalization to skyrocket above $500 million.

The token trading volume reached $63.9 million within the first 1.5 hours, reflecting strong interest from the Meme Coin community. At the time of writing, it rose to $112 million.

Boop market capitalization. Source: GMGN

Reports show that boop.fun was founded by Dingaling, a prominent figure in the NFT community known for successful projects such as Moonbirds and Invisible Friends. Dingaling’s involvement gave it credibility, and Boop.Fun has attracted a lot of attention since his debut.

Factors that support a surge in Boop prices

Several positive factors have contributed to Boop’s price rise. First, Moonshot, a platform for supporting memecoin, has announced Boop’s integration into the ecosystem.

Furthermore, the actions of key investors played a key role. The smart wallet established a $0.07115 boop position using 2,500 SOLs worth $37.7 million. It currently has a profit of $600,000 with a 159% return.

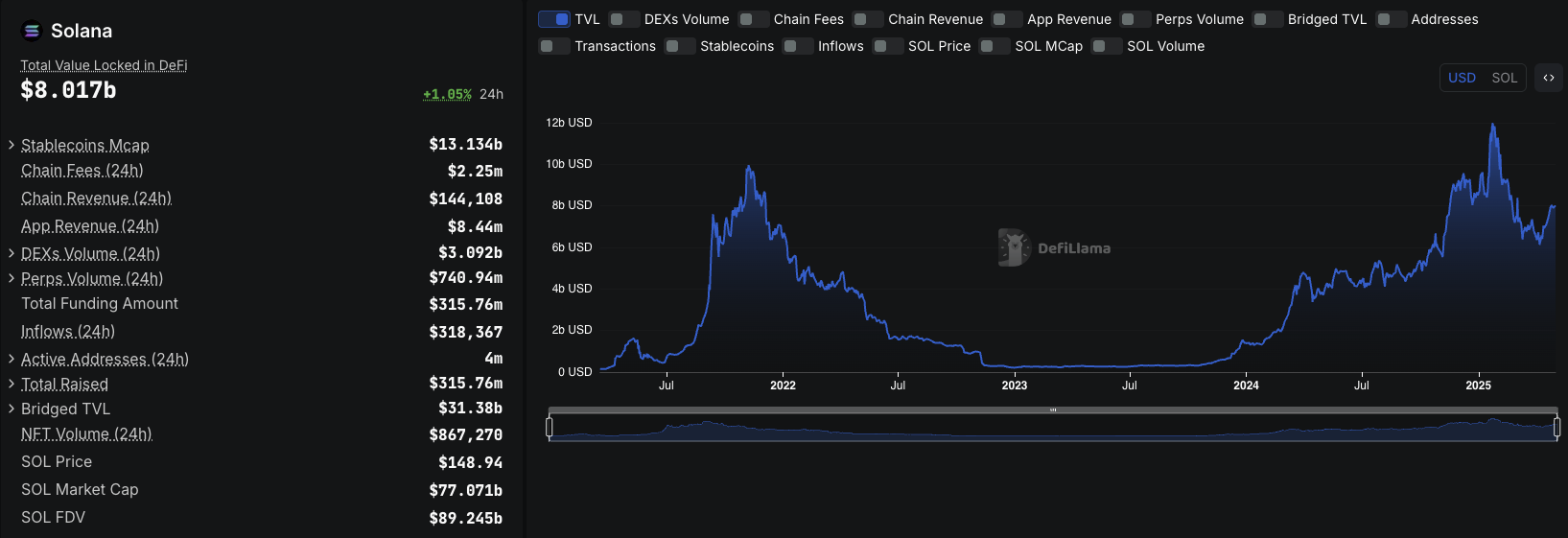

Solana TVL. Source: Defilama

Large investor participation shows confidence in the Boop’s potential, especially as Solana’s ecosystem is experiencing a boom. Solana’s total value is locked (TVL) reached $8.1 billion in May 2025, an increase of $2 billion since October 2024.

Additionally, institutional investors are beginning to focus on Solana. Defi Development Corp (formerly Janover), known as the “Sol version of MicroStrategy,” announced on Thursday it expects to receive private equity investments (PIPEs) that support general corporate purposes, including obtaining more Solana.

“This salary increase is a milestone in our mission to build the most transparent cryptocurrency financial vehicles in the open market.” This allows us to scale our SOL position at speed and will continue to provide investors with SolperShare growth. ” said Joseph Onorati, the company’s CEO.

The custody policy from the Trump administration is also strengthening market sentiment. The Solana community hopes that Boop will become “Next Bonk,” the meme coin that has been a hugely successful ecosystem success in 2023. However, Boop faces several risks behind this rapid growth and needs to be carefully considered to assess its long-term potential.

Boop risks and challenges

Despite their impressive achievements, Boop and Boop.fun face many challenges. First, the boop shows signs of high volatility driven by the market FOMO. A rapid price surge could indicate overbought, pose the risk of sudden corrections.

Solana’s meme coin history reveals that many tokens have surged rapidly later, such as Bonk, which lost 70% of its value since its December 2023 peak.

Second, regulatory pressure is a serious concern. The EU MICA regulations, which have been in effect since June 2024, impose strict standards on token issuing platforms such as Boop.fun. This could affect the global expansion plan for boop.fun.

Finally, Boop.Fun is a newcomer on the Solana Meme Coin Launch platform. Competition with platforms like Pump.fun, auto.fun, or recently Launchlab creates many barriers to this platform.

Given these risks and challenges, if Boop.Fun fails to build a sustainable user base, Boop, like other meme coins from Solana, could face considerable priced volatility. This requires Boop.fun to develop a clear strategy to expand its ecosystem and maintain investor interest.