Ethereum went through a week-long rally and pushed prices up to the expected $3,000 milestone.

However, this surge has put pressure on the continued upward momentum of crypto assets, facing resistance from sales by well-known investors.

Ethereum investors increase sales pressure

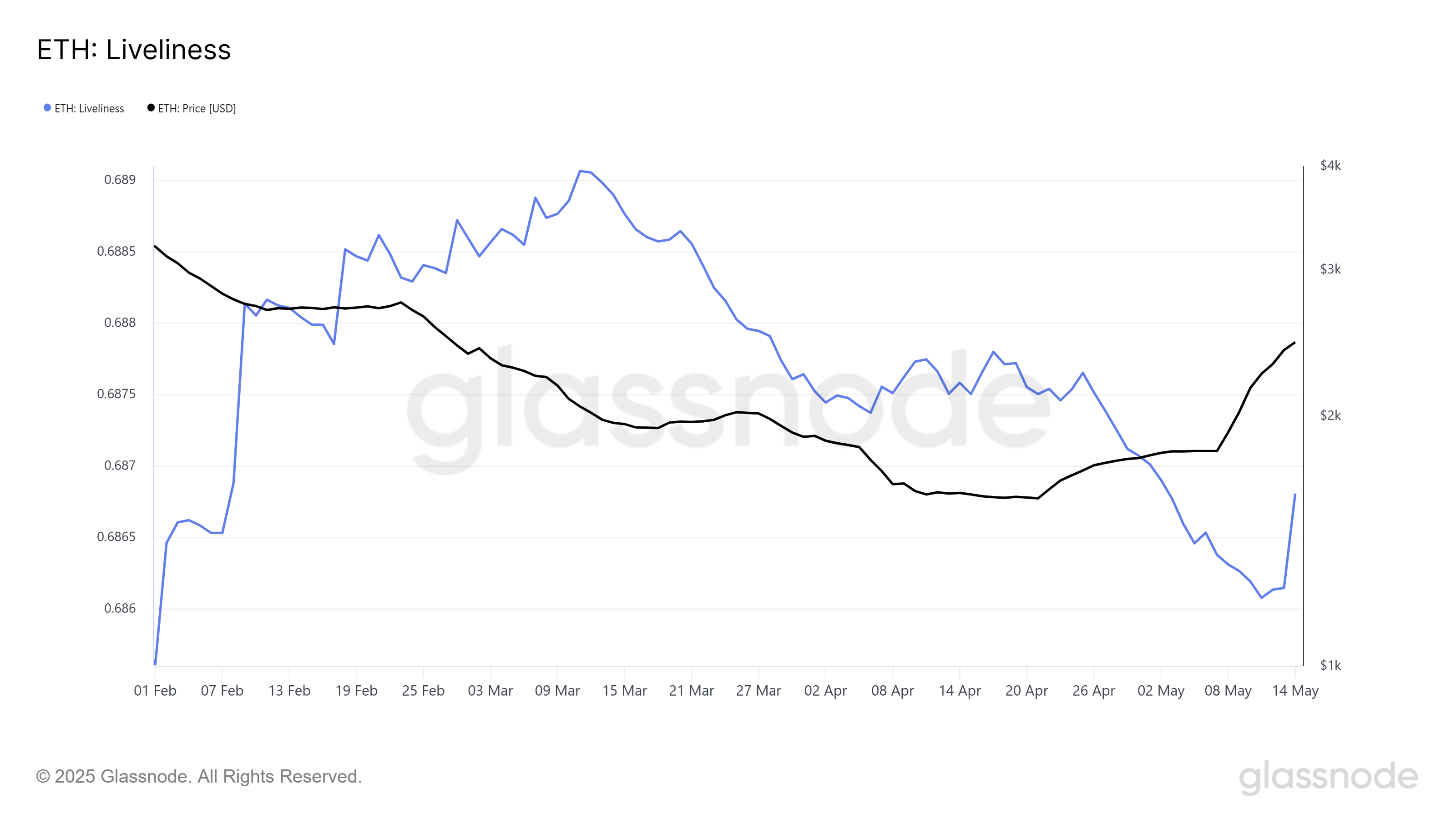

Ethereum’s vibrant indicators show a sharp increase, indicating an increase in sales activity for long-term holders (LTHS). This surge was the first significant increase in three months, suggesting that key investors are booking profits at current price levels. Because LTH is considered the backbone of assets, their sales could put pressure on Ethereum prices downwards.

Such sales behavior from long-term holders often reflects skepticism about further price growth in short-term prices. This cautious attitude could create headwinds and limit Ethereum’s ability to maintain recent rallies and challenge higher levels of resistance.

The vibrancy of Ethereum. Source: GlassNode

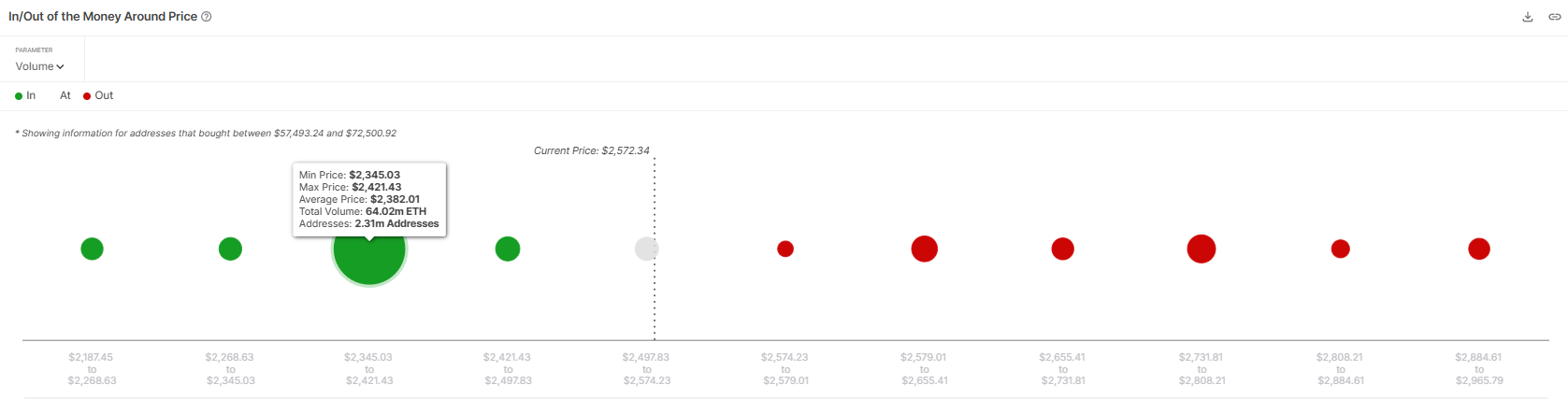

Ethereum’s In/Out of the Money About Price (IOMAP) analysis identifies key support zones ranging from $2,345 to $2,421. Over 64 million ETKENs have been acquired, worth around $164 billion in this price range. Holders of this concentration are unlikely to sell at loss and offer strong price support.

This level of support is important as it can prevent Ethereum from dropping sharply, even if short-term sales increase. Investors who purchase within this range have little incentive to settle their holdings, helping to stabilize price action and contain negative movements.

Ethereum iomap. Source: IntotheBlock

ETH Prices Should Find Support

Ethereum prices have skyrocketed 42% over the past seven days and are currently trading at $2,577. With a stable presence beyond $2,500 in support, Ethereum aims to overcome resistance at $2,654 to continue its upward momentum.

ETH, just 16% off after reaching $3,000, faces challenges with LTH sales, but the solid support range above could prevent prices from falling. So, once sales stop, ETH will rise further and get another shot, as long as it can secure $2,814 in support.

Ethereum price analysis. Source: TradingView

If the broader market situation is sour, Ethereum will increase sales pressure as investors try to minimize losses. A drop below $2,344 could drop to another $2,141, damaging bullish outlook and halting the rally.