Huma Protocol, a platform for the emerging PAYFI sector, has officially announced the Huma Token Tokenomics and Season 1 Airdrop Plan.

The Payfi sector is considered to be extremely promising, and the project has attracted attention from many venture capital companies. However, the current market context shows that retail investors are less careful about traditional airdrop formats.

Huma Finance uses 5% airdrop for users

Payfi combines instant payments with distributed finance (DEFI) to use blockchain technology to enable fast, efficient and cost-effective financial transactions.

Huma Protocol aims to lead this trend by integrating Defi with real assets (RWA). The team designed the HUMA token to serve both utility and governance purposes, encouraging community participation to ensure long-term benefits for stakeholders such as users, liquidity providers (LPS), partners, developers and others.

Huma Protocol has revealed its Season 1 Airdrop Plan, allocating 5% of the total Huma supply (500 million tokens) to loyal users. However, many comment that this quota appears to be very low.

“5% of season 1 airdrops are just too few,” said investor Cryptostalker.

This is financial talk nemics. Source: They are finances.

Despite criticism, the Huma Foundation emphasized that this was just the beginning. The Foundation is planning a second airdrop, which allocates 2.1% of the total supply, approximately three months after the token generation event (TGE).

Furthermore, total Huma supply concludes with 10 billion tokens, with initial circulation supply at 17.33%.

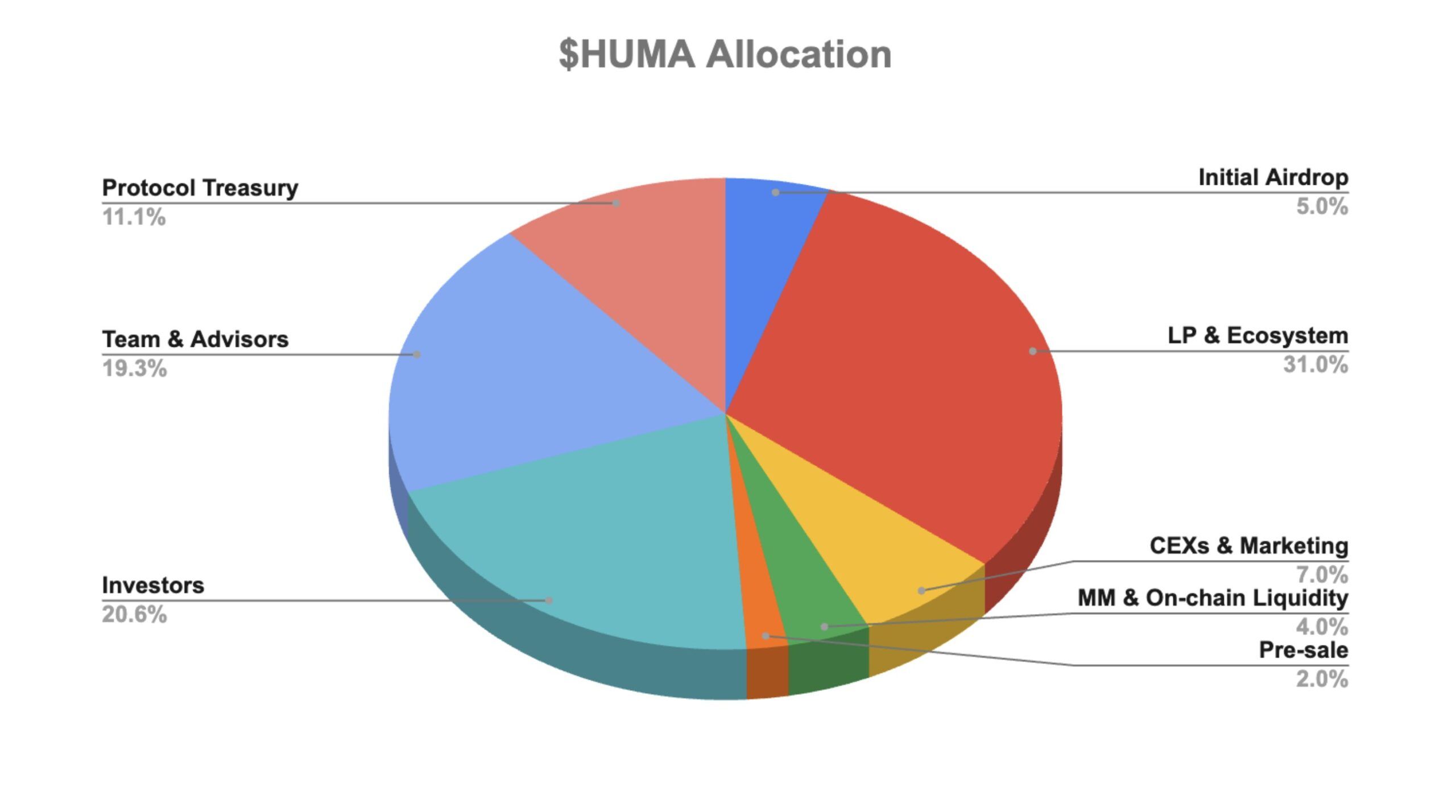

Token distribution includes:

- 31% of liquidity providers and ecosystems;

- 20.6% of investors,

- 19.3% of teams and advisors;

- Protocol Treasury’s 11.1%.

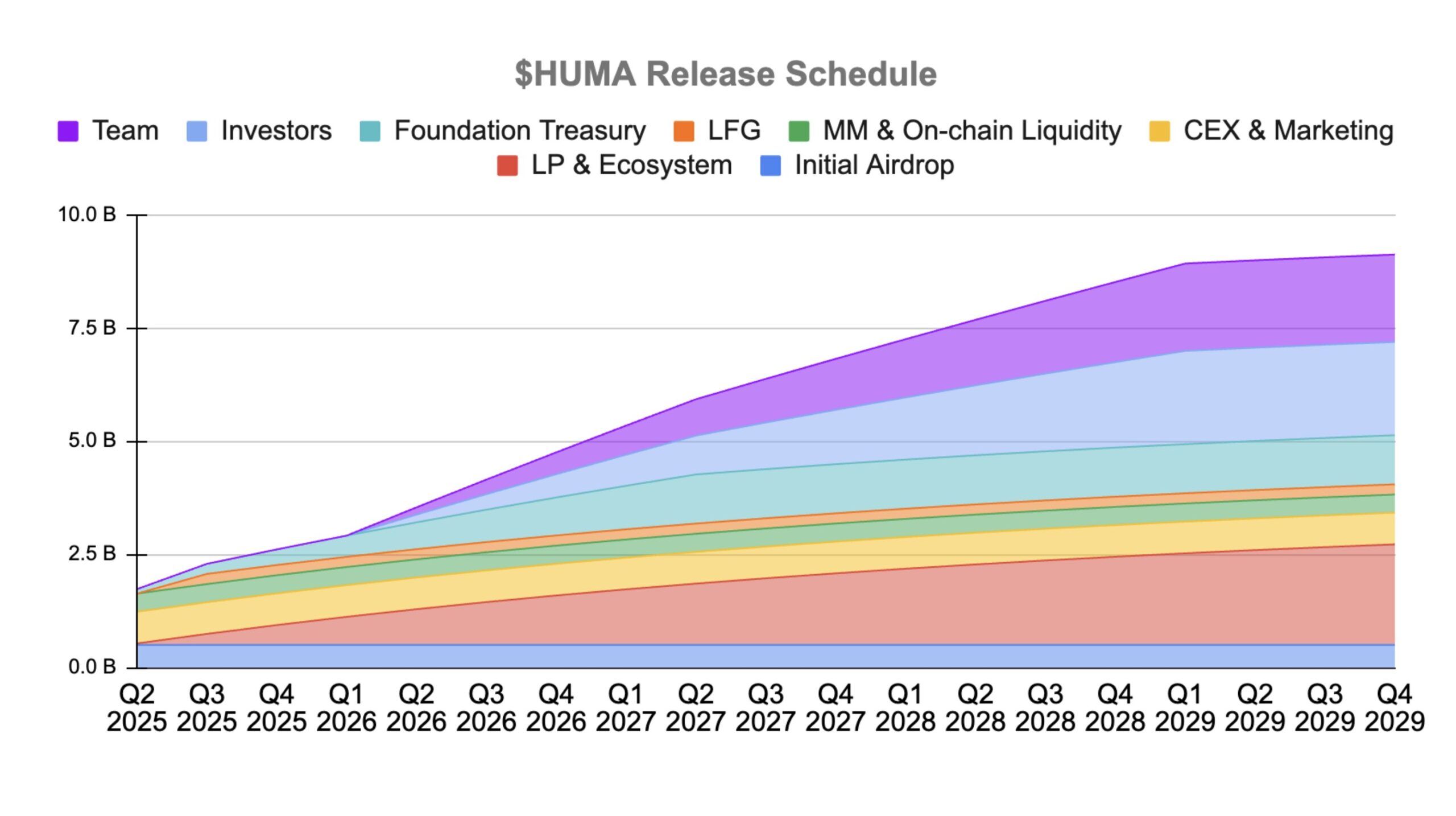

Additionally, the release schedule will continue until the end of 2029. Tokens and investors assigned to the team will be locked for 12 months, followed by a 3-year vesting period.

Huma Token release schedule. Source: Huma Finance.

LPS and ecosystem allocations decrease by 7% per quarter. These rates may be adjusted through protocol governance.

Huma Finance faces both potential and challenges

As PayFi gains traction, the HUMA protocol is expanding. As governments develop encryption and stable policies and stable policies, crypto-based payments could emerge as a mainstream alternative to traditional systems.

“Web2 has many issues, and centralized payment networks are one of them. There is no slow transaction, high fees, no user control. But now there is a solution. HumaFinance aims to accelerate global payments with immediate access to liquidity at any time,” investor Neals said.

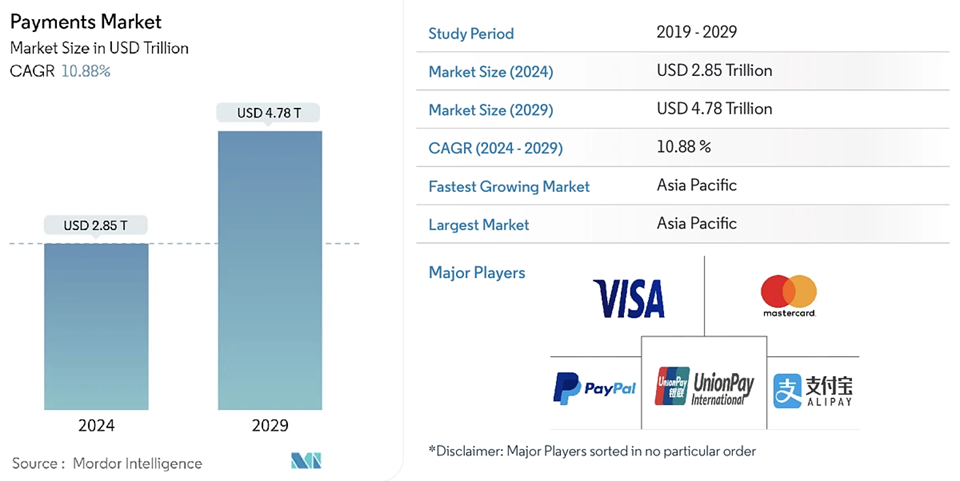

According to a Coingecko report, which references a Mordor Intelligence study, the global payment financing market is expected to reach $2.85 trillion in 2024 and grow to $4.78 trillion by 2029.

Prediction of payment market size. Source: Mordor Intelligence

“This massive growth underscores the urgent need for scalable, efficient and accessible financial infrastructure.

For this reason, first movers like the Huma protocol enjoy a competitive advantage. The project has raised more than $46 million from investors such as Haskey Capital and Circle.

However, the current market situation has not been able to give HUMA a strong initial momentum. Due to the low airdrop allocation and interest of shift users driven by newer models like Binance Alpha, traditional airdrops have not been appealing.