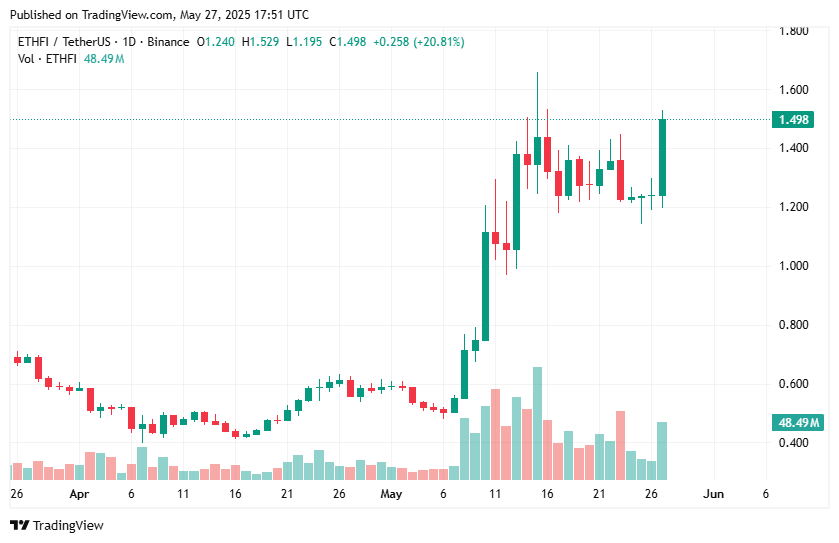

As the top cryptocurrency appears to surpass key levels amid fresh market optimism, Ether.fi is Ethereum’s liquid staking protocol, with its native tokens rising by more than 21% to reach two-week highs.

Ether.fi (ETHFI) prices surpassed most top altcoins, including Ethereum (ETH), which surged more than 5% in adoption news, as Sharplink Gaming announced plans to buy a $425 million Ethereum.

Ethfi also outperformed Bitcoin (BTC), with BTC hovering for nearly $110,000 with a 21% spike in distributed staking protocols above $1.51 and Bitcoin’s modest 0.7% acquisition. In particular, the announcement of $2.5 billion in funding from Trump Media to acquire Bitcoin has not yet triggered a major price movement.

ethfi price chart. Source: crypto.news

Ether.fi is well below the all-time high of $8.57, reaching March 2024, but the latest rally reflects strong bullish momentum. The tokens recovered sharply from their low of $0.40 on April 7, 2025, showing a 263% increase in just one month.

You might like it too: Here’s why ETHFI prices have become parabolic

EthFi benefits from the protocol-driven buyback initiative in addition to improving sentiment around Ethereum driven by the Sharplink Eth Treasury strategy. On May 24, 2025, the Ether.fi Foundation announced that a total of 105 ETH, about 267k, had been used to buy back the 206K ETHFI.

Since launching the program, non-lawful ETH staking platforms have used withdrawal fees to fund regular token buybacks. In addition to weekly repurchases, the project will perform monthly repurchases, repurchases of Esfi tokens and re-delive them to Stackers.

The revenue from the protocol is to staking and relocating the rewards, similar to liquid vault fees. In April, the platform’s revenue reached $2.4 million, with the Ether.fi Foundation noting that some of this will be used to buy back native tokens.

According to Defillama, the platform’s annual fees and annual revenues are $179 million and $24 million, respectively.

The price of Ether.fi native tokens has risen amid these initiatives. In recent weeks, the total has been locked to the protocol rebound, reaching $6.7 billion.

You might like it too: Hyper Lane prices jump 10% on the upbitlist, with bullish momentum building at $0.25