Bitcoin

BTC$102,590.63

It is ready to respond to developments in the Middle East.

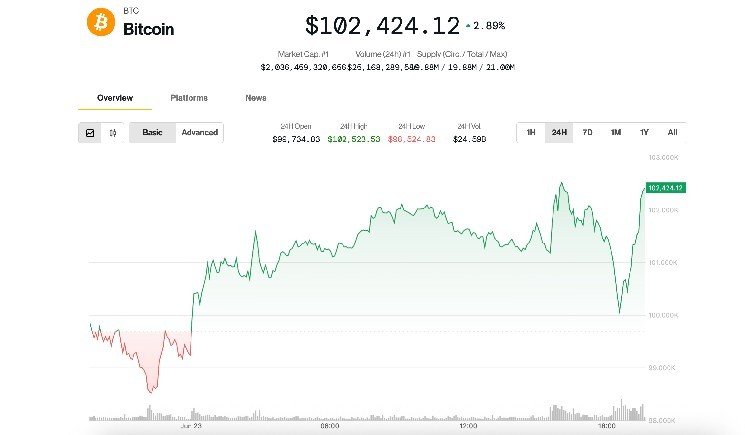

After temporarily sinking to $99,500, Bitcoin has been backed back to 2.9% in the past hour, and is currently trading at $102,400. Digital assets still have grown by 2.5% over the past 24 hours, but the top 20 cryptocurrency metrics by market capitalization excluding Coindesk 20 (Stablecoins, Memecoins and Exchange Coins) rose by 2.1% over the same period.

Bitcoin declines have occurred as Iran retaliated against President Donald Trump’s weekend bombardment on three nuclear sites. The Middle Eastern country has launched missile strikes against US bases in several Gulf countries, including Qatar, Kuwait, Bahrain and the United Arab Emirates. Qatar officials said the attack on Qatar did not result in casualties or injuries.

Investors appeared to be ecstatic about military action. Gold, a traditional shelter property, barely rose at around $3,380, with crude oil prices plummeting 4% during the day.

“Oil is being crushed. A good sign,” Sean Farrell, head of Fundstrat’s digital asset strategy, said in the X-Post.

“In general, when it comes to other external factors that disrupt things globally, there tends to be heavy, short-term dips that will later rebound depending on the severity and the way things are communicated.” “So far, I think we’re seeing the situation happening here as well.”

“Smart money still appears to be taking a little more risk,” he said, adding that there have been some notable spills on the exchange, suggesting that opportunistic investors have bought a price dip.