MicroStrategy (MSTR) Insider has sold $40 million worth of stock over the past 90 days. On average, multiple sales per business day in the last three months, insider sales transactions outperform purchases 10:1.

Their sales are greater than any purchase, with around $44.3 million in sales for $2.3 million per data from insider screeners.

The sale of millions of dollars worth of stock is attributable to decisions made by our vice president, chief financial officer and director, among others. Many of their liquidation used MSTR at a much higher price than today.

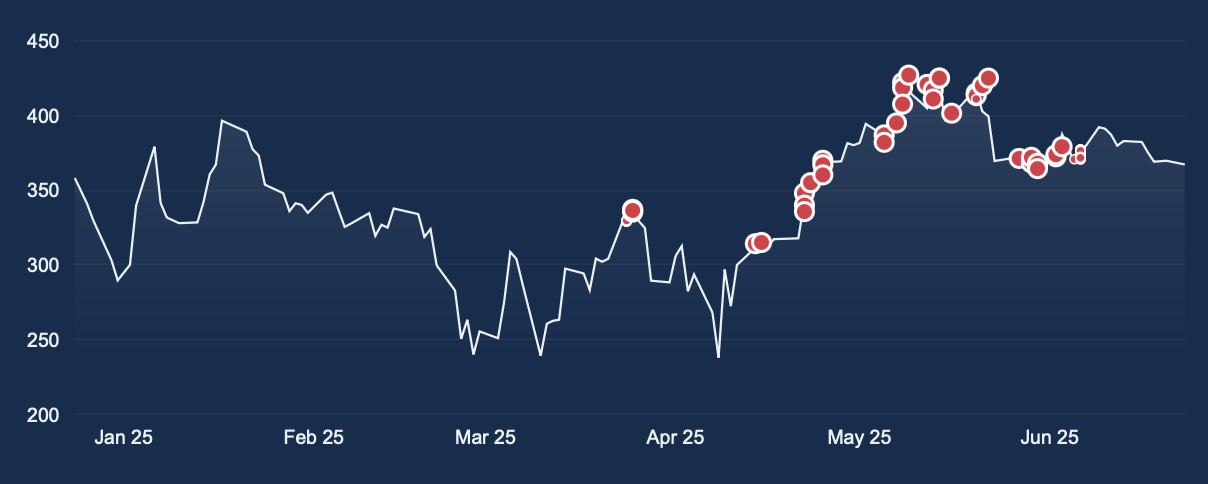

Certainly, insiders were sold Dozens or more times exceeding $400 per share.

Read more: I created a dictionary of invented terms for MicroStrategy

Available on MicroStrategy insiders

Accountants mark several transactions with planned sales codes on Securities and Exchange Commission Form 4, indicating that these insiders are dumping stocks in the program through stock options, directed stock programs, or other types of installment-based compensation packages.

Still other transactions have been coded as simple sales – Some of them coincided with the rally last month It temporarily maintained an MSTR of over $400.

A chart of micro strategic stock sales by company director (Insider Screener).

Still, these insider sales represent only a small percentage of executives’ overall and director ownership. For example, founder and executive Chairman Michael Saylor is worth billions of billions of dollars, including Class B shares and approximately 19.6 million shares of 382,000 Class A shares.

Overall, Bloomberg estimates it owns 8% of MicroStrategy’s fairness.

Saylor also told Bloomberg that he personally owns at least 17,732 bitcoins. Analysts estimate his total net worth $8 billion North.

While insiders are frequently sold at MicroStrategy, it’s not particularly unusual for public companies. In fact, dozens of executives from public companies sell shares every day. Most of it will be received through pre-planned reward packages.

For insiders, the decision to sell new vested stocks on a schedule or voluntarily waive their rights often comes down to an assessment of individual circumstances or family obligations that are not related to the company’s inventory itself.