Bitcoin prices have recently been rebounded, bringing closer to the significant $108,000 level. This recovery offers hope, but no significant resistance has been billed as support.

Adding to concerns is a noticeable change in investor behavior, fatigue in the signal market, and could set a stage of price declines below $100,000.

Bitcoin profits slow down

In the previous market cycle (2020-2022), Bitcoin investors realized a total of around $550 billion in profits during multiple gatherings, including two major waves. Fast forward to the current cycle and realized profits have already exceeded $6500 billion, exceeding the previous cycle total. This indicates that while significant profits are being made, the market may be in the cooling phase.

Latest data suggests that profits have peaked, and after the third major wave of profit realization, the market has become a cool period. While profits are secured, the momentum driving Bitcoin’s upward movement appears to be waning. To keep the profitability realized, investors’ feelings change, leading to lower buying pressure.

Bitcoin Bull Market’s profits are realized trend. Source: GlassNode

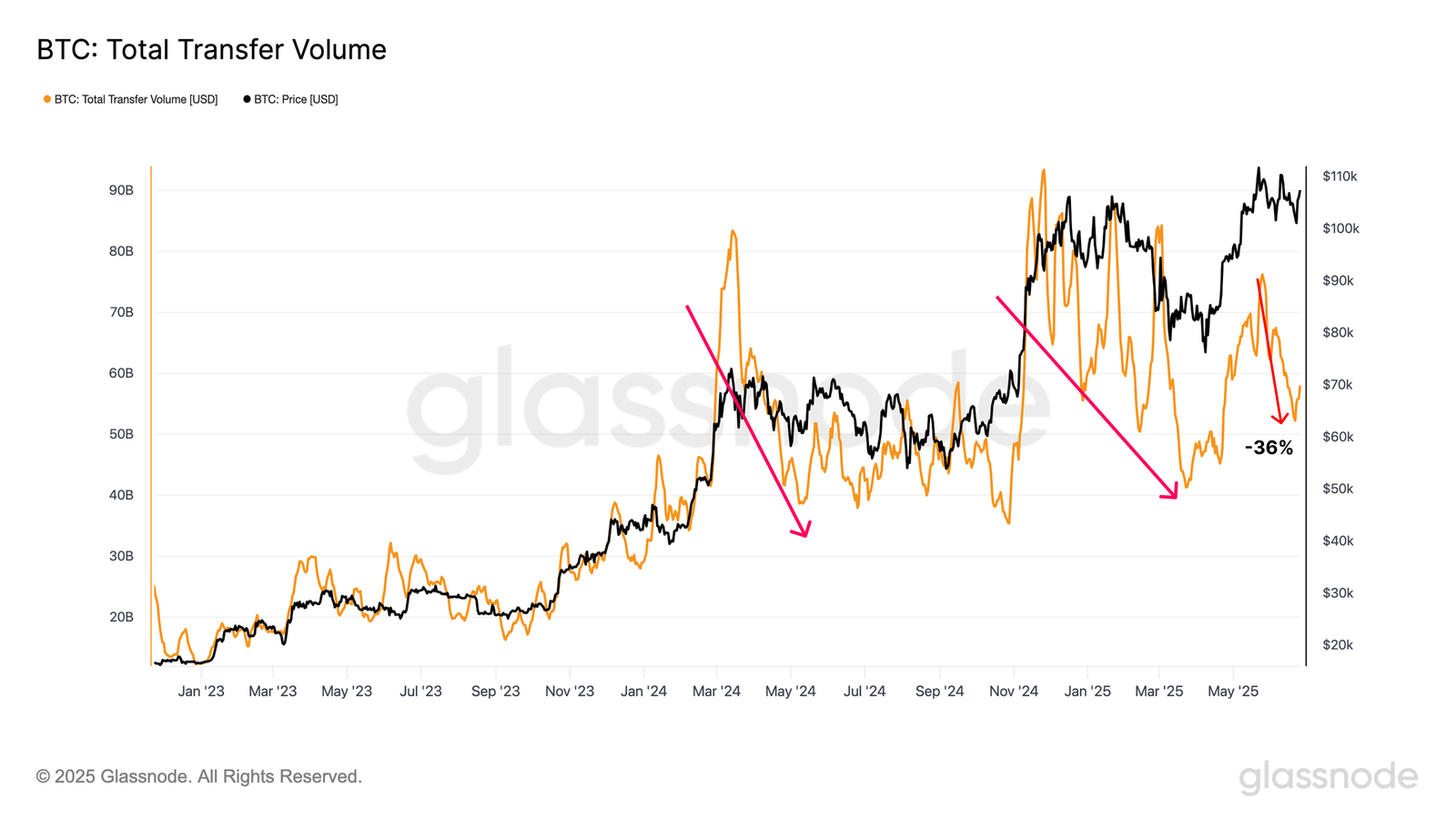

The total amount of Bitcoin transfers also shows signs of cooling. The seven-day moving average of chain travel fell by about 32%, down from $76 billion in late May to $52 billion last weekend. This decline coincides with a broader pattern of market cooling, indicating that Bitcoin’s bullish momentum may be losing steam.

The slowdown in transfer volume reflects the general loss of activity across key Bitcoin metrics, reinforcing the notion that market participants are taking a cautious approach. As the market eases, Bitcoin prices could face downward pressure.

Total Bitcoin transfer amount. Source: GlassNode

BTC price should ensure support

Bitcoin currently costs $106,907, just below the $108,000 resistance. BTC needs to support $108,000 to continue its upward trend. This sets the stage for further profits, with Bitcoin potentially heading towards the $110,000 mark. However, current market sentiment remains vulnerable.

Given the signs of rising market fatigue and cooling of key activity metrics, it is likely to decrease in the short term. If demand does not revive, Bitcoin’s price could fall below $105,000, potentially testing a critical $100,000 support level. Further losses in momentum can cause a deeper reduction.

Bitcoin price analysis. Source: TradingView

Alternatively, if Bitcoin prices succeed in exceeding the main support level, the bullish trend remains. A successful recovery of $108,000 in support will clear the pass that will increase Bitcoin to $110,000. A break above this level could move towards an all-time high of $111,980, potentially maintaining upward momentum and investor optimism.