Q2 As 2025 concludes, Bitcoin (BTC) has recorded its highest quarterly returns since the second quarter of 2020. Hopes for the Federal Reserve’s interest rate cuts and the rise in M2 money supply have sparked optimism that this positive momentum could extend into the third quarter.

However, Bitcoin’s upward trajectory could face obstacles, such as the potential threat of trade wars and the weight of historical market patterns.

Can Bitcoin resist the historic slump of Q3 in 2025?

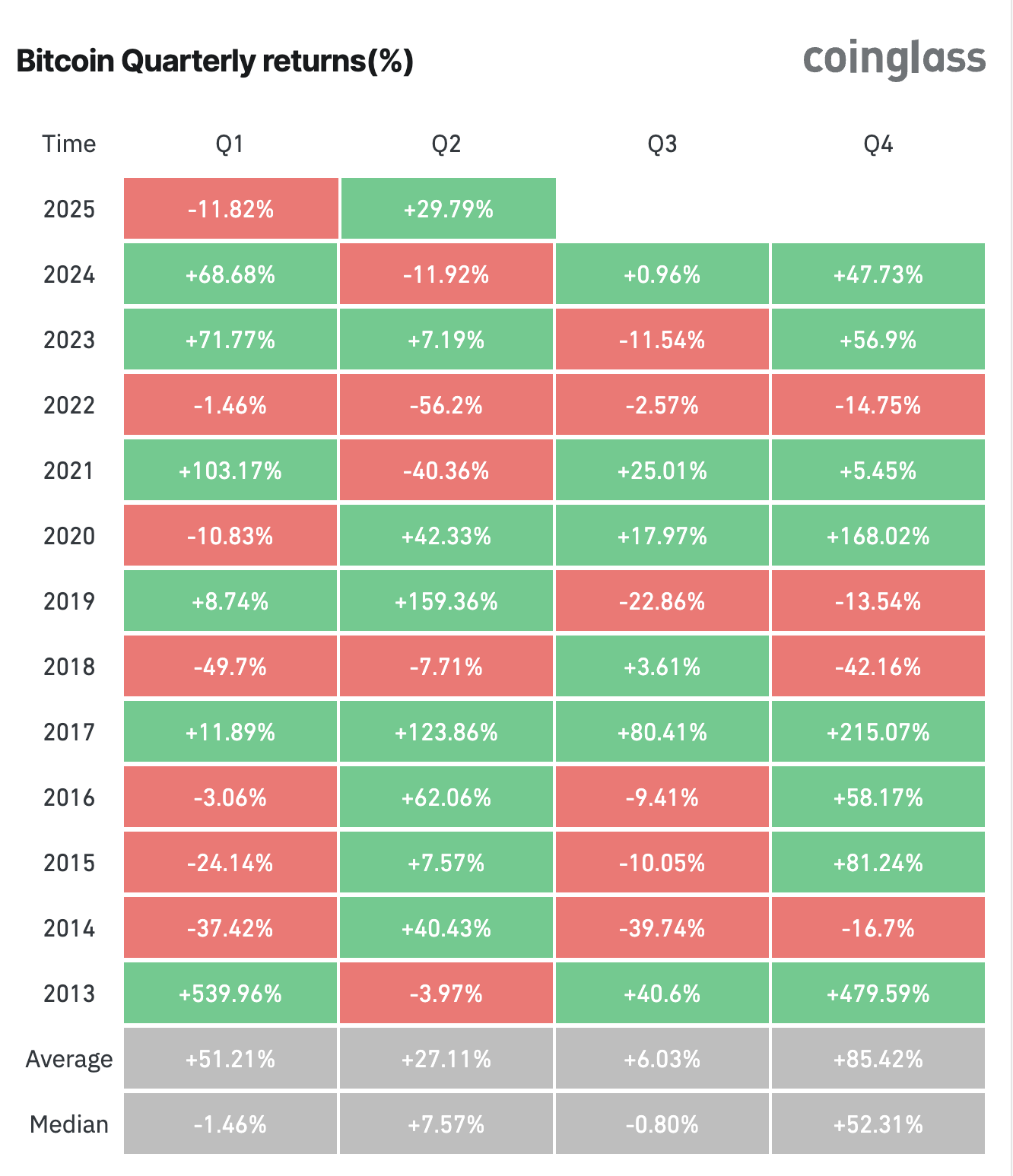

Coinglass data showed that Bitcoin experienced a recession at the beginning of the year but bounced strongly in the second quarter. In the second quarter, BTC recorded a return of 29.79%.

This marked one of the highest quarterly performances since the second quarter of 2020, when Bitcoin rose 42.33%.

Bitcoin Quarterly Returns. Source: Coinglass

Furthermore, Bitcoin reached an all-time high (ATH) in May, along with increased favorable macroeconomic factors and institutional adoption. Geopolitical tensions sparked a revision that drew Bitcoin to under $100,000, but remained resilient and recovered most of its losses.

Beincrypto data shows that at the time of writing, Bitcoin trading price was $107,383, up 3% over the past week. As Q2 approaches the end, all eyes are now in all eyes about how Bitcoin will work in the next quarter.

Bitcoin price performance. Source: Beincrypto

Historically, Q3 was Bitcoin’s weakest quarter, with an average of just 6.03%. Nevertheless, market watchers have different opinions about the potential performance of Bitcoin over the coming months.

In a recent X post, analyst Ether Wizz highlighted the increasing spot volume for Bitcoin. He noted that a similar pattern was observed in the third quarter of 2024, leading to price gatherings.

“I think BTC’s new ATH is now only a few weeks,” he said.

Meanwhile, Benjamin Cowen, CEO of Into the Cryptoverse, predicts that Bitcoin will be able to hit the next low around August or September. This suggests a more cautious outlook for the coming months.

“Bitcoin will begin to show some weaknesses around mid-June as the weaknesses in Q3 began to appear. The same thing happened in the last few years,” Cowen wrote.

Bitcoin price forecast for the third quarter of 2025. Source: X/Benjamincowen

3 Macroeconomic Powers that Can Determine the Fate of Bitcoin Q3

As Bitcoin’s outlook is controversial, several upcoming macroeconomic events and factors could affect the trajectory of the third quarter 2025. The first important event will be the expected Federal Reserve cuts.

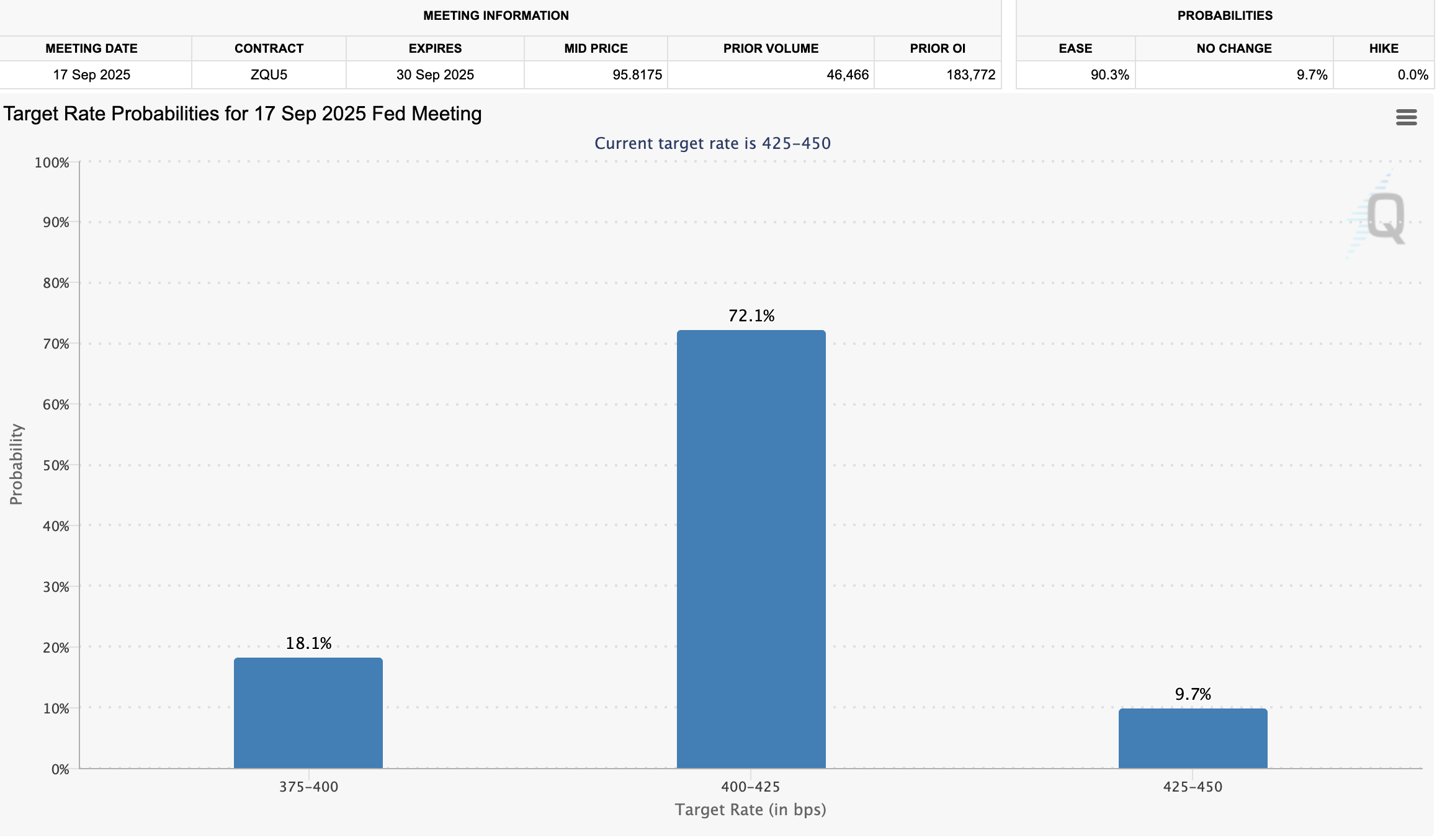

According to data from CME FedWatch, only 20.7% of market participants expect the Federal Reserve to cut interest rates in July, but will fall to 90.3% in September.

Possibility of reducing Fed rates in September. Source: CME

This sharp shift in expectations reflects the growing confidence that the Fed will ease its third quarter monetary policy. It could be a key bullish driver for the crypto market, including Bitcoin.

Additionally, M2 money supply is expected to continue to increase in the third quarter. According to analyst CasAbbé, the People’s Bank of China injected 1.5 trillion yuan into the economy this week through the operation of the reverse report.

This move is part of a broader effort to stimulate economic growth and could lead to more market liquidity. This can drive demand for assets like Bitcoin as investors are looking for alternatives within the growing money supply.

“And the biggest reason behind this is the DXY dump. This gives other countries the freedom to print more countries without worrying about devaluing their currency. All this is to push the world’s M2 supply to new highs. That means the BTC pump will be even bigger.

Meanwhile, rising US debt positions BTC as an attractive hedge. Institutional and retail profits can be drawn out as investors seek to replace traditional assets amid growing financial uncertainty.

But once Trump’s 90-day tariff freeze expires, a serious uprising is upon us.

“Trump’s 90-day tariff suspension is only 13 days left, meaning that tariff rates will rise on July 9th, without any new trade deals.

The potential returns of the trade war could introduce volatility, a historical challenge for Bitcoin. Past trade tensions have led to a sudden price correction. Thus, the story of a new trade war in the third quarter could undermine the positive effects of interest rate reductions and money supply growth.