Ethereum Network’s native cryptocurrency, ETH, shows a slight down sinking 0.4% during Monday’s trading session. The slower recovery momentum can be linked to witnessing Bitcoin’s overhead supply of $108,000, and whale investors liquidating assets. Is ETH prices poised for another fix, or can buyers maintain a recovery trend?

Ethereum whales block and deposit millions of exchanges

Over the past two weeks, Ethereum prices have bounced back to current trading prices between $2,115 and $2,495, forecasting a 18% spike. Despite the bullish surge, on-chain data shows substantial sales pressure from large investors.

According to LookonChain, two wallets that are likely to be controlled by the same entity, 0x14E4 and 0x26BB, have recently been unraveled and have withdrawn 95,920 ETH (worth around $237 million). Of the total, whales have deposited 62,289 ETH (~154 million) in central exchanges, including HTX, Bybit and OKX, over the past 20 days.

The whale still holds 33,631 ETH, currently worth around $83 million, which increases the risk of further sale. Historically, such a large exchange influx has resulted in bearish market signals and has strengthened downward pressure on prices.

ETH Price Eye Surges 15% Before Major Supply Testing

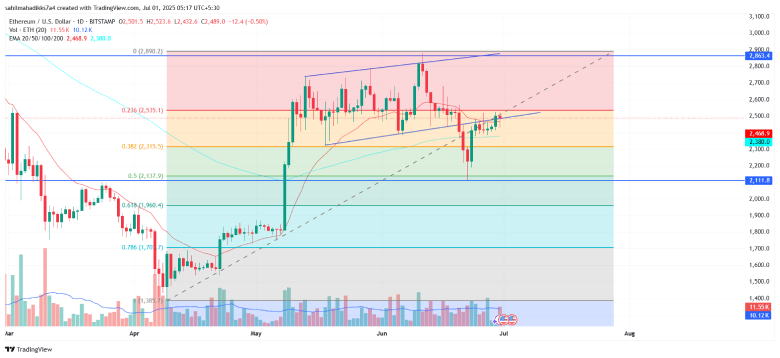

By press time, Ethereum prices were trading at $2,482, down 0.4% during the day. Despite the drawbacks, daily candles show a pronounced price refusal, indicating that demand pressure remains intact.

This long tail rejection candle highlights the sustainability of ETH above the index moving average for the last 20 days. A proper follow-up could cause a 15% price surge and challenge a $2,865 resistance.

However, since February 2025, overhead resistance has remained a high supplement region, potentially limiting buyer attempts before geopolitical tensions in the Middle East escalate or whale sales continue.

ETH/USDT – 1D Chart

Additionally, if the coin’s price is $2,500 below the 20-day EMA, sellers can enhance their grip on the assets. Potential downswing creates fresh, low, high-rise formations on your daily charts, informing you of sold-out feelings among investors.

Also Read: Bitcoin Exchange & OTC Reserve Hit Rate: Is supply-driven breakout next?