After a sudden hideout from the $2,640 zone earlier this week, Ethereum prices today have been consolidated nearly $2,523. The wider chart structure shows that the ETH is compressed within a symmetrical triangle, with a major support of nearly $2,480 and a visible resistance of $2,560. Multiple indicators suggest that the asset is ready for the next direction of movement, but can the bull maintain control?

What will be the price of Ethereum?

Ethusd Price Dynamics (Source: TradingView)

On the four-hour chart, Ethereum rebounds from the $2,450 zone, reclaims the mid-bollinger band and remains stable at $2,486 just above the 100 EMA. All four EMAs (20/50/100/200) are firmly clustered between $2,486 and $2,525, indicating the key areas of ETH. A critical move from this level could determine whether Ethereum’s price action is bullish or retreat.

Ethusd Price Dynamics (Source: TradingView)

Structurally, ETH continues to honor the widespread rise triangle that has formed since early June, with a higher lower value at nearly $2,240, with a horizontal ceiling of nearly $2,560. Current candle structures show a reduction in volatility and tightening of price action. This is a classic setup for continuing breakouts or reversing failures.

Why are Ethereum prices falling today?

Ethusd Price Dynamics (Source: TradingView)

The recent decline in Ethereum prices could be attributed to overhead rejection from the $2,640-$2,660 resistance band. The momentum dwindled sharply as it failed to exceed $2,630, as seen on the RSI and MACD on the 30-minute chart.

The reason why today’s Ethereum prices are also linked to the bearish release discovered earlier this week is that RSI formed a lower high, while price action attempted a higher high. This was followed by a downward crossover on MACD and dropping under the VWAP zone.

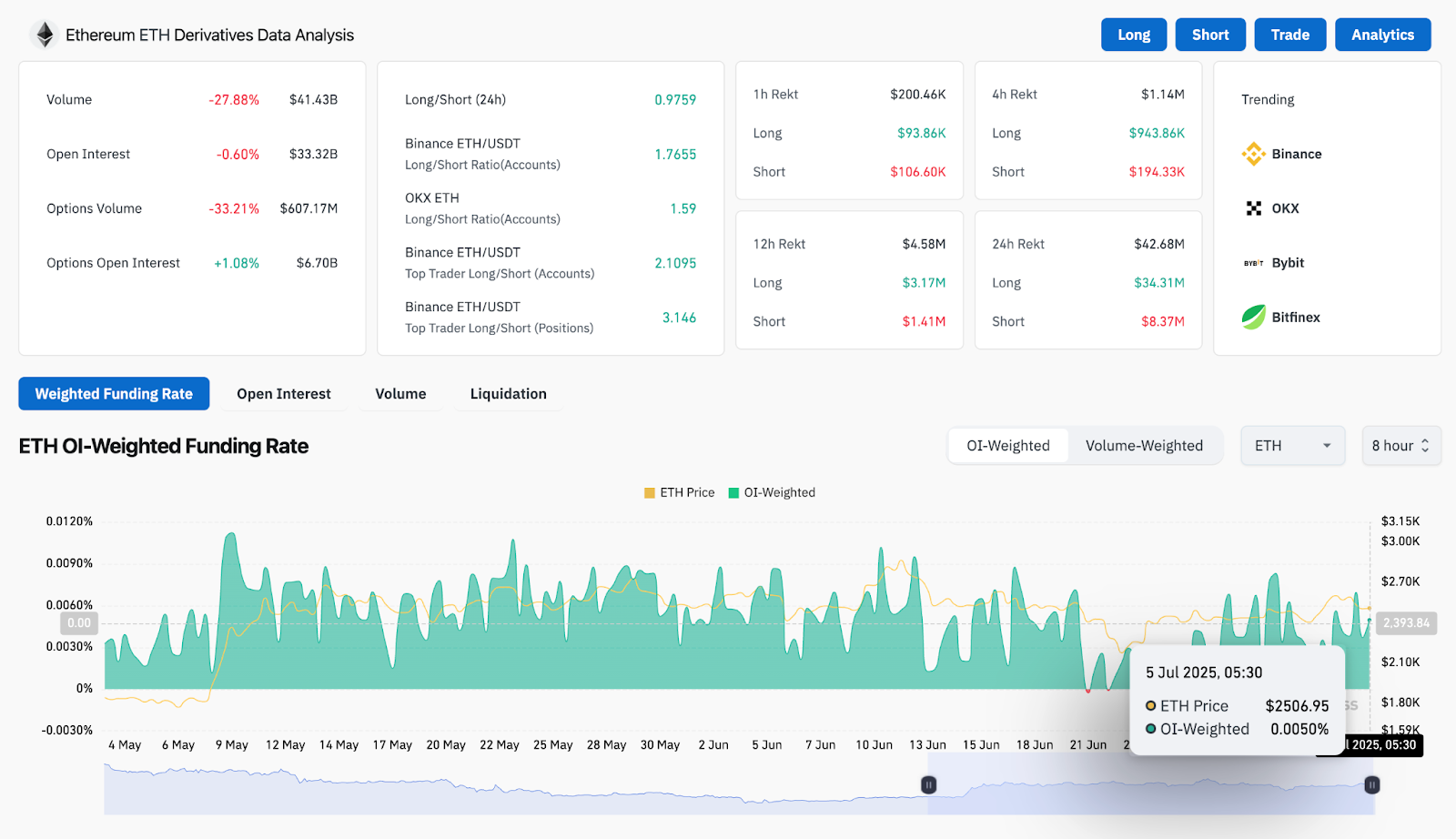

ETH derivative analysis (source: Coinglass)

Open interest data show a small contraction of -0.6%, with a 24-hour liquidation totaling $4,268 million, with shorter pressure than long support. The long/short ratio of benance remains slightly bullish (2.10), but breakdowns below $2,480 could invite another round of stop trigger sales.

Important signals from price indicators and volatility charts

Ethusd Price Dynamics (Source: TradingView)

On the one-day chart, Ethereum is still in a large symmetrical triangle surrounded by nearly $2,760 in resistance and over $2,240 in support. The Fibonacci level depicted in the $4,100 to $1,385 height bottom show was ETH regaining 0.382 zones ($2,424), with the next major hurdle being $2,745 at the 0.5 retracement level.

Zooming out, the monthly chart reveals long-term symmetrical triangles that have been developing since the second half of 2021. ETH is testing this structure’s upper limit for the third time after bounces back from a multi-year ascending trend line. In particular, the triangle contains two important lower highs along the $3,465 and $4,096 rejection zones. This is the main macro resistance level. A critical breakout on top of this triangle could mark a major trend reversal and potentially set Ethereum for its highest ever retest.

ETH Price Forecast: Short-term Outlook (24 hours)

Ethusd Price Dynamics (Source: TradingView)

As long as ETH is above $2,480, the short-term outlook remains cautiously bullish. Recalling $2,560 with volume checks could open a retest of liquidity pockets between $2,600 and $2,640. A clean closure beyond that level suggests a breakout from the triangle and a continuation to $2,745.

On the downside, the previous breakout could drop rapidly towards the previously held $2,360, towards $2,424 support (FIB 0.382).

Given the low current volatility, we expect Ethereum price volatility to increase as the triangle vertices approach. Traders should watch carefully the $2,480-$2,560 zones, as breakouts and breakdowns from this range can cause trends for several days.

Ethereum price forecast table: July 6, 2025

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.