As traditional finance and crypto converge, more and more products emerge, spanning the shrinking gap between the two.

Crypto credit cards are one such product and offer users a variety of perks, benefits and rewards linked to crypto exchange accounts.

However, there are no cards like other cards. For example, some crypto cards offer flat cashback rewards, while others offer a percentage that fluctuates based on their spending category.

This article explains some of the most popular Crypto credit cards available to users in 2025.

Gemini Credit Card

Image: Gemini

American Crypto Exchange Gemini offers Crypto MasterCard credit cards to curiosity crypto.

Available in all 50 US states, this card offers 4% for gas, 3% for meals, 2% for groceries and 1% for all other purchases. The top rewards card will close up to $300 a month. At that point, all other over-purchases will be paid at 1%.

Gemini Credit Card requires no annual or foreign transaction fees, a verified Gemini account and you will be deposited with rewards.

Avalanche Card

Image: Avalanche

Avalanche cards offer debit cards that users can use by merchants that Visa accepts using USDC or Avax tokens.

Avalanche cards available in most US states do not provide direct rewards and carry 0% APR, but may apply to foreign transactions, late payments, and return payment fees.

This card does not require credit checking and can be used by users after completing the KYC check via the Avalanche Card Mobile Application.

Meta Mask Card

Image: Meta Mask

A Metamask card is a debit card that can be accessed early by users outside of New York and Vermont, as well as by users from countries from all over the world.

Although MasterCard can be used anywhere if accepted, the card is currently on the waitlist and offers cashback rewards, exclusive event access, and “surprise” perks.

Users must complete KYC to use the card and connect the Metamask wallet.

Fold your credit card

Image: Collapse

The Fold Credit Card is an upcoming Bitcoin reward credit card with an open email waitlist. Unlike other Bitcoin credit cards, Fold offers users a flat Bitcoin reward rate for every purchase. 2% for Fold+ subscribers and 1.5% for free users.

Fold manages fold debit cards that offer sign-up bonuses of up to $250 with credit card sign-up bonuses and offer Fold+ subscribers a Bitcoin cashback reward.

crypto.com credit card

Image: crypto.com

crypto.com offers signature visa credit cards at multiple levels. crypto.com offers signature visa credit cards available across multiple tiers, with different rewards and welcoming bonuses for each tier.

The card is active and offers up to 8% in CRO tokens, depending on the stake level of the CRO. Foreign transaction fees vary depending on the tier, but annual fees are not charged. Users can unlock perks such as free Spotify, Netflix, lounge access and more on the higher Steak Kitia. The card combines the benefits of cashback with the premium lifestyle and appeals to those who have invested in the crypto.com ecosystem.

Nexo Card

Image: Nexo

The Nexo Card is a crypto card with dual debit and credit capabilities, and is primarily available to users in the EU and the UK.

In debit mode, users can accept MasterCard and choose to use Stablecoins or other supported assets of their choice. Credit mode cards can offer up to 2% cashback, Nexo tokens or 0.5% in Bitcoin to top members of the loyalty program under Nexo Token Holdings. At the lowest tier, users can earn 0.5% on Nexo tokens or 0.1% on BTC.

There are no annual or foreign transaction fees, but cardholders must use Nexo’s cryptographic platform to retain their collateral assets.

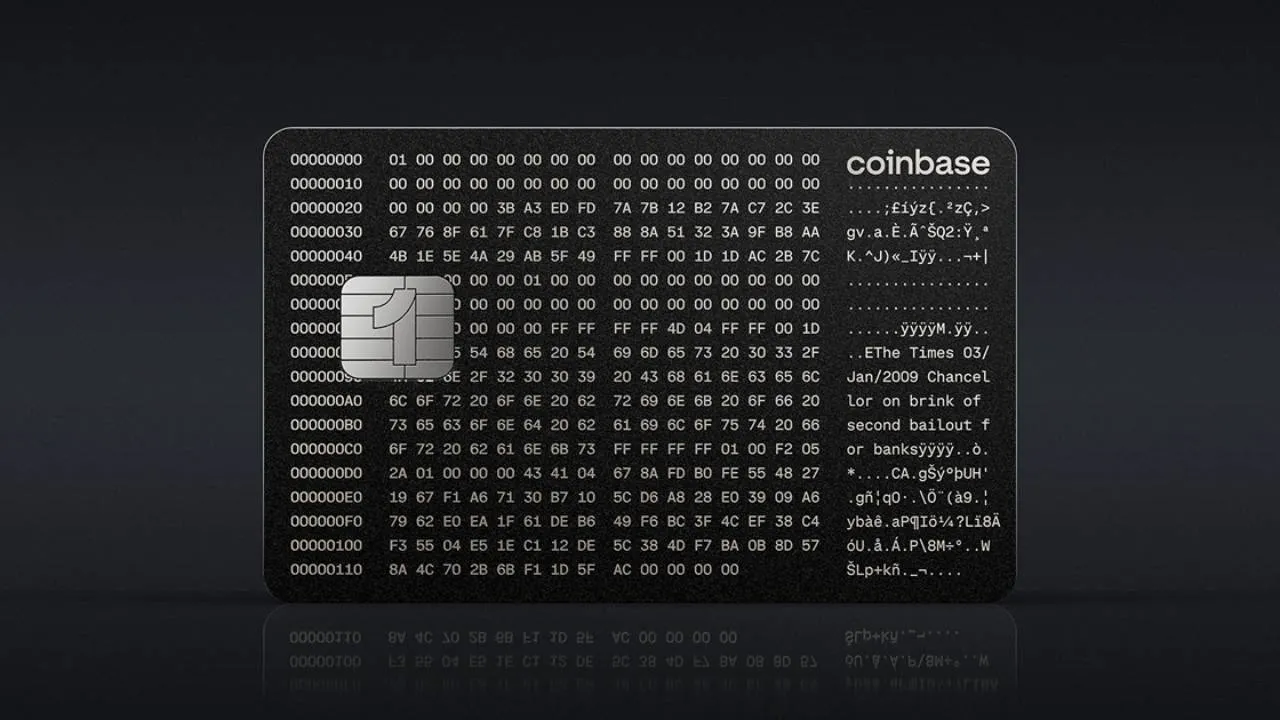

Coinbase One Card

Image: Coinbase

Coinbase announced its first branded credit card in June, hoping for a fall launch.

Launched in a partnership with American Express, the Coinbase One card offers users Bitcoin rewards when they purchase, offering up to 4% back and potential for different Crypto token rewards in the future.

This card is only available for US-based Coinbase One subscribers.

Additionally, Coinbase has debit card product products for users. Like any other crypto debit card, Coinbase seamlessly exchanges Crypto-to-Fiat at the point of sale where Visa is accepted.

Robin Hood Gold Card

Image: Robin Hood

Robinhood Gold Card, exclusively for members of the Robinhood Gold subscription service, offers 3% cashback per purchase, allowing users to choose Crypto instead of cash as a choice reward in the second half of 2025.

Visa Signature Card does not have annual fees, foreign transaction fees, other perks, or traveler perks. Robinhood Gold subscribers can book via their email waitlist.