The bullish trend remains intact, but Ethereum is in a critical consolidation range. A successful retest of $2.8k could ignite the next wave of over $300,000.

Technical Analysis

Shayan Market

Daily Charts

ETH has recently seen a significant influx of purchase pressure, surpassing the key $2.8k resistance that has served as a sustained barrier in recent months. This breakout leads to the formation of higher prices, indicating a shift towards bullish market structures in daily time frames.

However, we have noticed that Ethereum is currently trading within a significant range of between 2.8k and 3.33 million. The upper limit of this range is also consistent with the bearish order block, suggesting potential supply and sales pressures at this level.

If Ethereum succeeds in exceeding $3.3,000 in resistance, the next bullish target is probably the psychological threshold of 4K, and the main technical and psychological level.

4-hour chart

In the lower time frame, Eth’s impulsive gatherings were stopped near the $3K level as momentum cooled. The 2.8k zone, which was previously strong resistance, is now being retested as support. A proper pullback to this region will help you validate your breakout and establish a stronger base for your next leg up.

0.5-0.618 Fibonacci retracement levels also serve as a potential target for this continuous revision, providing convergence with short-term demand zones.

In the coming days, Ethereum is expected to consolidate and fix, setting the stage for another bullish rally towards a potential $3.3,000 resistance.

Emotional analysis

Shayan Market

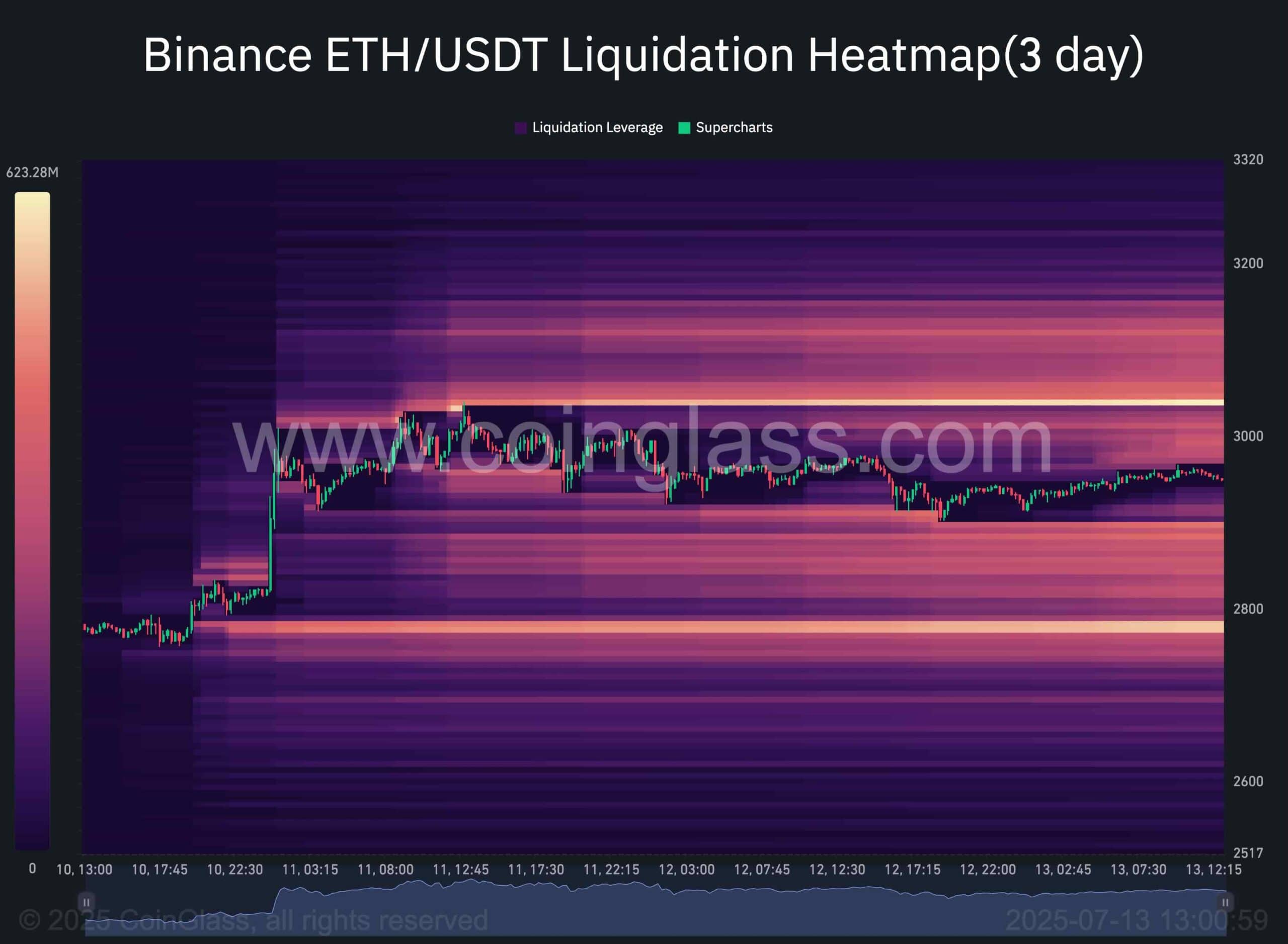

This chart visualizes a binance clearing heatmap that identifies zones where important clearing events are likely to be unfolded. These regions often act as flowable magnets and attract price action due to concentration of leveraged positions. In such a scenario, large players or “whales” tend to take advantage of these zones to efficiently put out or close trades.

Currently, the prominent liquidation cluster is just below the $2.8,000 mark, meaning that Ethereum prices are likely to attract this level. If this scenario is played, ETH could complete a pullback to this critical support, rekindling bullish momentum and setting the rally’s stage towards a $3.3,000 resistance.

Conversely, another rather vast liquidity pool is above the $3K level, indicating that following the pullback, Ethereum could move high in the short term to tap this zone, potentially causing short syeeze and even more fuel.