Ethereum extended its upward momentum this week, gaining more than 20% in the last seven days, pushing it above $3,600 for the first time in months. At the time of writing, ETH traded at $3,617, showing a 5.4% increase within the last 24 hours.

The rally has attracted attention from analysts examining whether price movements are driven by sustainable investor demand or short-term speculative activity.

Ethereum Futures Market is leading, but spot demand is lagging

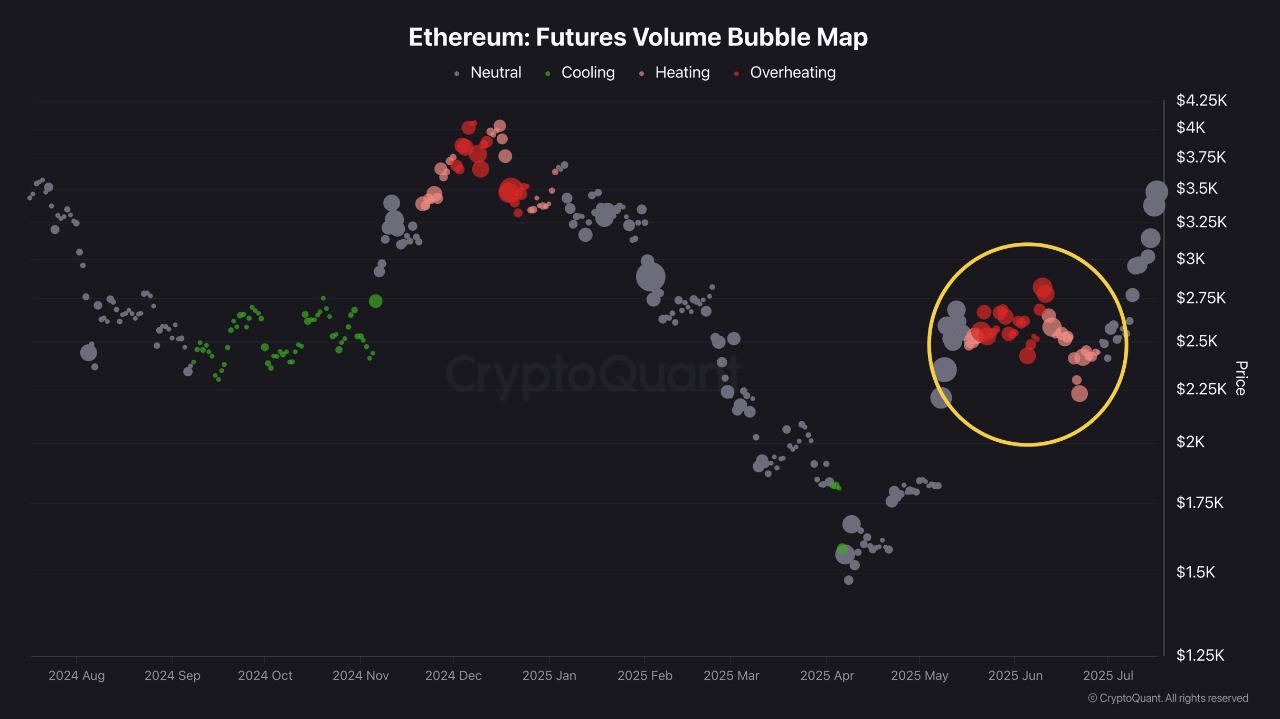

Data from on-chain analytics firm Cryptoquant suggests that the recent uptrend in Ethereum prices is driven primarily by the derivatives market. Contributor Avocado Onchain said that ETH continues to move higher, but the underlying source of momentum appears to be a future position with more leverage, rather than buying in the spot market.

This distinction raises questions about the durability of current gatherings and whether follow-through demand will emerge from spot buyers. Avocado further highlighted in his quick take analysis entitled “Ethereum’s Rally is driving the futures market – Will the demand for spots continue?” The Ethereum Futures Volume Bubble Map exhibits overheating conditions in a particular zone indicated by a volume surge.

This increase in futures, marked with a yellow circle on the map, is consistent with the price rise of ETH, meaning that leveraged positions are the main cause of the rise.

In contrast, spot market data shows relative stability, with no comparable volume spikes. This suggests that traditional investor pressure purchases have not yet been keeping up.

Analysts also pointed out that Ethereum’s open interest in futures (OI) has reached a new history high, reinforcing the idea that the current movement is inherently speculative.

According to Avocado, the future question is whether momentum from the derivatives market will ultimately match demand for real spot markets. If such demand is realized, it could contribute to the wider Altcoin market activity, he added.

Institutional benefits and ETF inflows

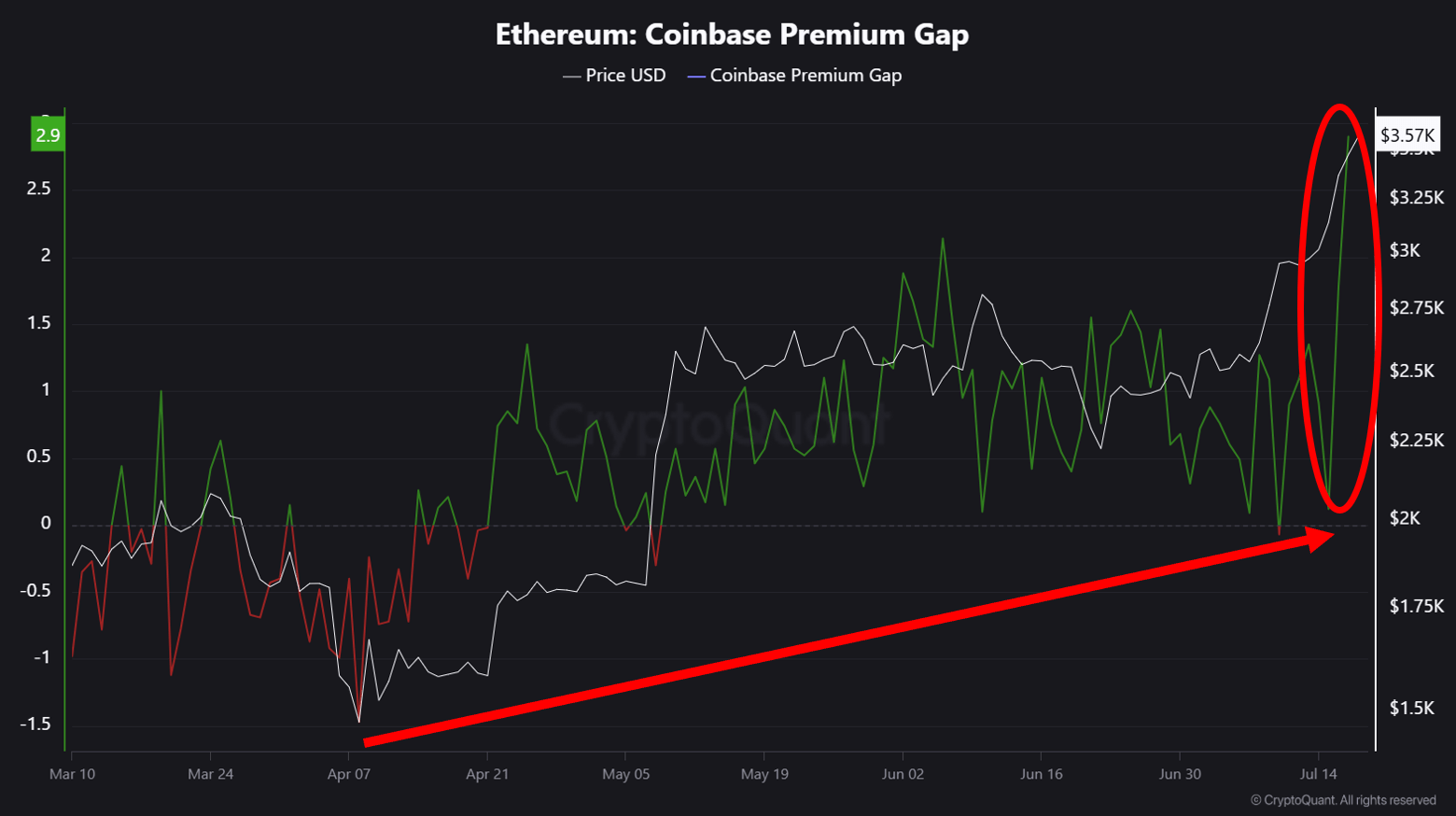

In another insight, another cryptographic analyst, Crypto Dan, noted an increase indication of institutional participation in Ethereum accumulation. His analysis shows that ETH is trading on the premium of Coinbase, a platform frequently used by US-based institutions and large investors, indicating an increase in shopping from whales.

The premium, which has been described as rare these days, is in line with a wider trend in capital inflows into Ethereum-centric spot ETFs, which have recently reached record daily highs.

Dan said current indicators do not show overheating, but investors should recognize potential risks if strong upward activity occurs in the second half of 2025.

For now, however, the combination of increased institutional demand and increased ETF allocations could provide structural support for Ethereum, especially when the spot market begins to reinforce futures momentum.

Special images created with Dall-E, TradingView chart