Bitcoin’s powerful July rally may give the Bulls a reason to smile, but the next page on the calendar brings a very different tone. From a statistical perspective, August is Bitcoin’s worst-performing month, and price history suggests that trouble could be on the horizon.

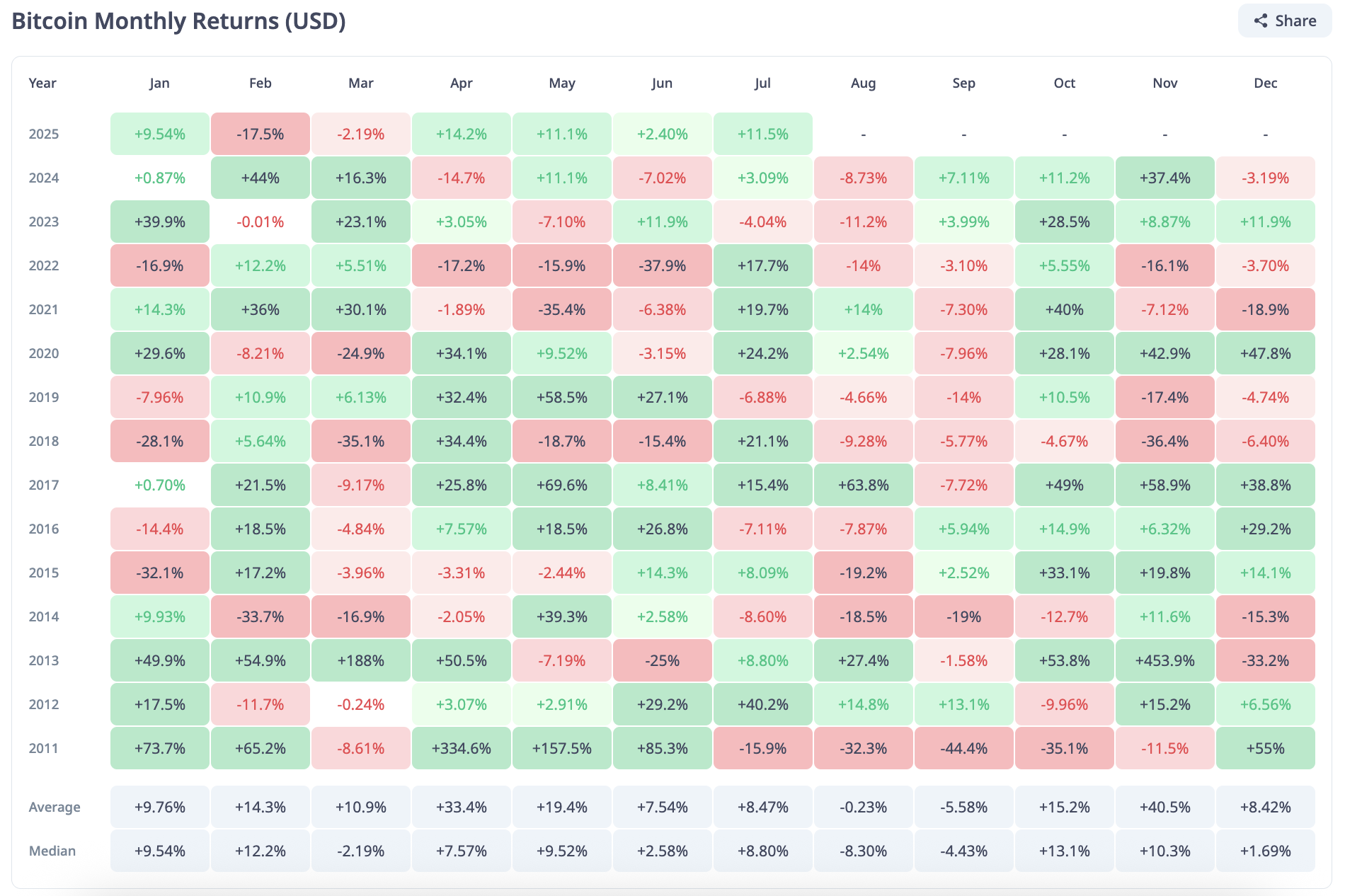

Of all months, August has the lowest median return, at -8.3%. The average return rate is not just -0.23%, and the sale will be repeated during this period, causing dampers to occur.

Numbers don’t lie. In 2024, BTC fell by 8.73% in August. In 2023, the decline was 11.2%. And in 2022? Another 14%. This is a big loss for the third year in a row, wiping out profits and turning the upward trend around.

Historically, the only hope for a better August, such as +14% in 2021 and +2.54% in 2020, has come in the middle of the bull cycle, just like the current market conditions.

BTC is currently trading at around $119,000, ending July and is up 11.3% per month. Nevertheless, the chart has already been flattened under the $120,000 resistance zone. Without new catalysts and volume spikes, the outlook is heading towards the end of the month.

What’s particularly dangerous in August is that sales usually start quickly. Historically, early August often brings sharp pullbacks, especially with strong jurisses over the years. This is a classic average reversal setup.

So, while July may close on the green, August has a long track record of changing moods. Unless Bitcoin breaks this pattern, the next 30 days will allow BTC to enter the weakest seasonal period, perhaps rewriting the record book for all the wrong reasons.

For now, the Bulls have nine days left until the calendar turns against them.