Ether’s recent price action can be driven by more than just feelings. According to Matthew Hougan, Chief Investment Officer of Bitwise Asset Management, the world’s second-largest crypto assets are receiving what he calls a “demand shock” by surges inflows into exchange-selling products and new corporate financial strategies.

In a thread posted on X on Tuesday, Hougan unraveled why he believes that the etheric rally is only beginning. Since mid-May, he estimates that the SPOT ETH EMXACTER-TRADED products (ETP) and the Ministry of Finance of the Company have acquired a total of 2.83 million ether. This is 32 times the amount of net new ETH issued over the same period.

“Sometimes, it’s really easy,” Hogan wrote, referring to the role of supply and demand in determining short-term prices. He pointed out that Bitcoin has benefited from this dynamic for over a year, but ETH has only recently begun to experience the same effects.

The Spot Ether ETP, released in July 2024, had limited traction by the first half of 2025. By May 15th, the total inflow was only $2.5 billion, with ETP earning around 660,000 ETH. During this period, ETH says it lacked the same support that drove Bitcoin high. “There were no major Ethereum finance companies.”

That has changed over the past two months. Hougan pointed to the emergence of public financial owners such as Bitmine Immersion Technologies (BMNR) and Sharplink Gaming (SBET). The momentum of ETP also accelerated, resulting in structural supply imbalances due to the combined pressure.

Looking ahead, Hougan predicts demand could increase even more. It amounts to around 5.33 million ETH at today’s prices, as he believes he can if the finance company and ETPS buy $2 billion in ETH over the next 12 months. By comparison, Etherfeum is expected to issue just 800,000 ETH in the same time frame.

“Of course, ETH is different from BTC,” he admitted. “The price is not set purely by supply and demand, it doesn’t share the long-term issuance of BTC caps. But it’s not a problem now.”

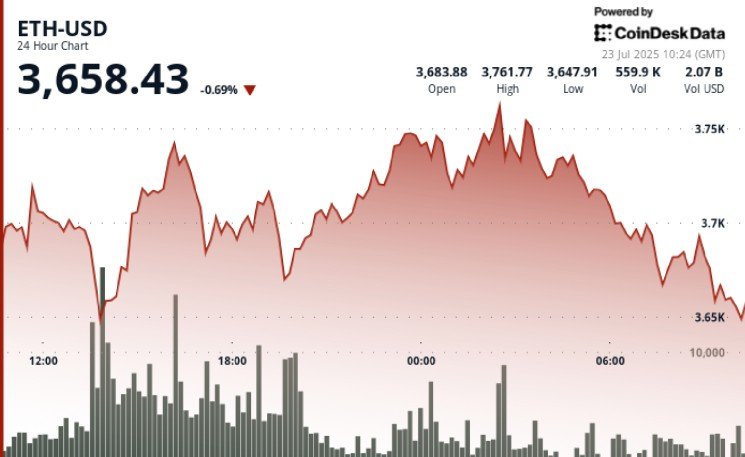

At the time of writing, ETH is trading at $3,658, a 0.69% decrease over the past 24 hours, according to Coindesk data. Over the past 7, 14 and 30 days, the number has increased by 15.8%, 40.1%, and 62.5%, respectively.

Technical Analysis Highlights

- According to Coindesk Research’s technical analytics data model, ETH traded between $134.34 from 10:00 UTC on July 22 to 09:00 UTC on July 23, swinging between $3,763.70 and $3,629.35.

- During the evening session of July 22nd, institutional resistance emerged near the $3,750 to $3,760 zone, with volume peaking at 445,297 contracts.

- Ether slid 1% during the last trading hours and ended at $3,661.35.

- The $3,700 mark becomes a critical pivot and acts as both support and resistance to flattening the company’s positioning.

- Volume spikes above $3,740 suggest large distribution and potential short-term integration.

Disclaimer: Part of this article is generated with the support of AI tools and reviewed by the editorial team to ensure accuracy and compliance Our standards. For more information, please refer Coindesk’s complete AI policy.