Bitcoin (BTC) is taking on around $117,000 after recently tapping on a new all-time high, but beneath this mild surface, analyst and trader Amr Taha has brought a noticeable change in the retail behavior of Crypto Exchange Binance’s major Binance.

Powerful Retailers

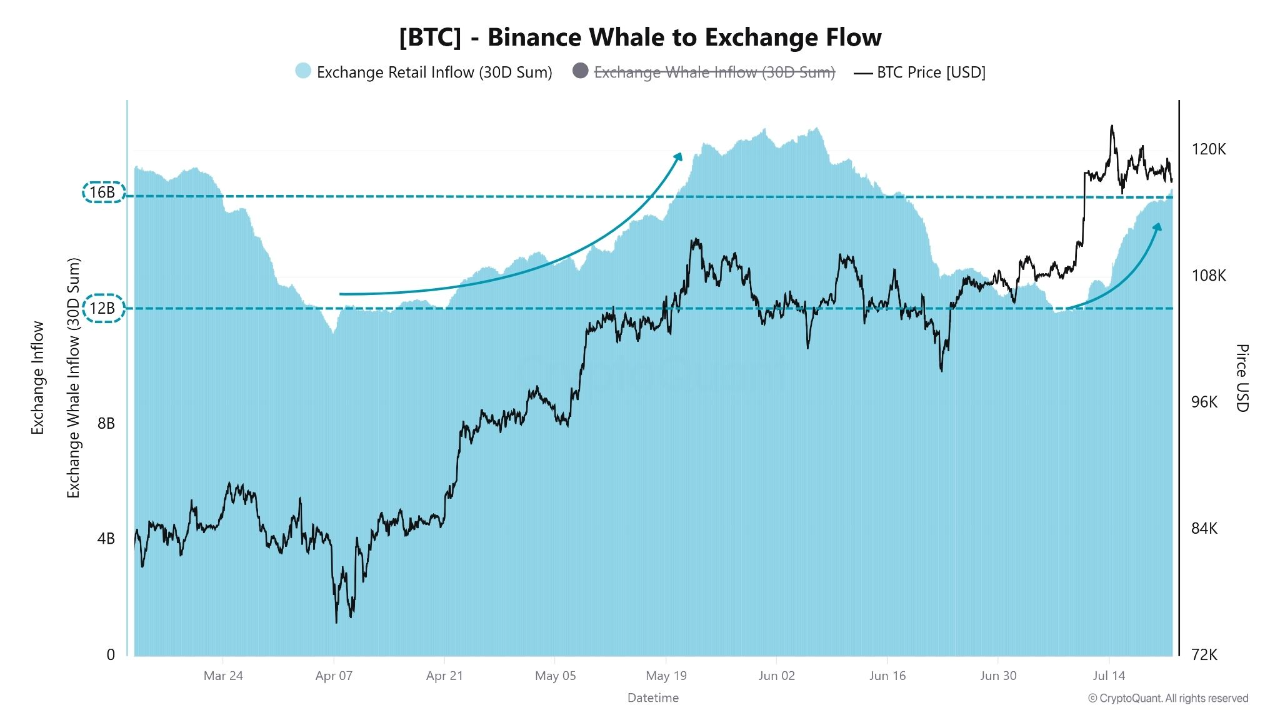

In the last 30 days, retail inflows to exchanges have skyrocketed from $12 billion to over $16 billion. This is a sign of aggressive sales.

Historically, retailers have shown the same trend during a strong upward trend, often out early and lacked substantial advantages.

Source: Cryptoquant

Similar behaviour from retail investors was seen when BTC surged from $78,000 to $111,000 in early April 2025, causing retailers to be sold prematurely, motivated by short-term profit-taking.

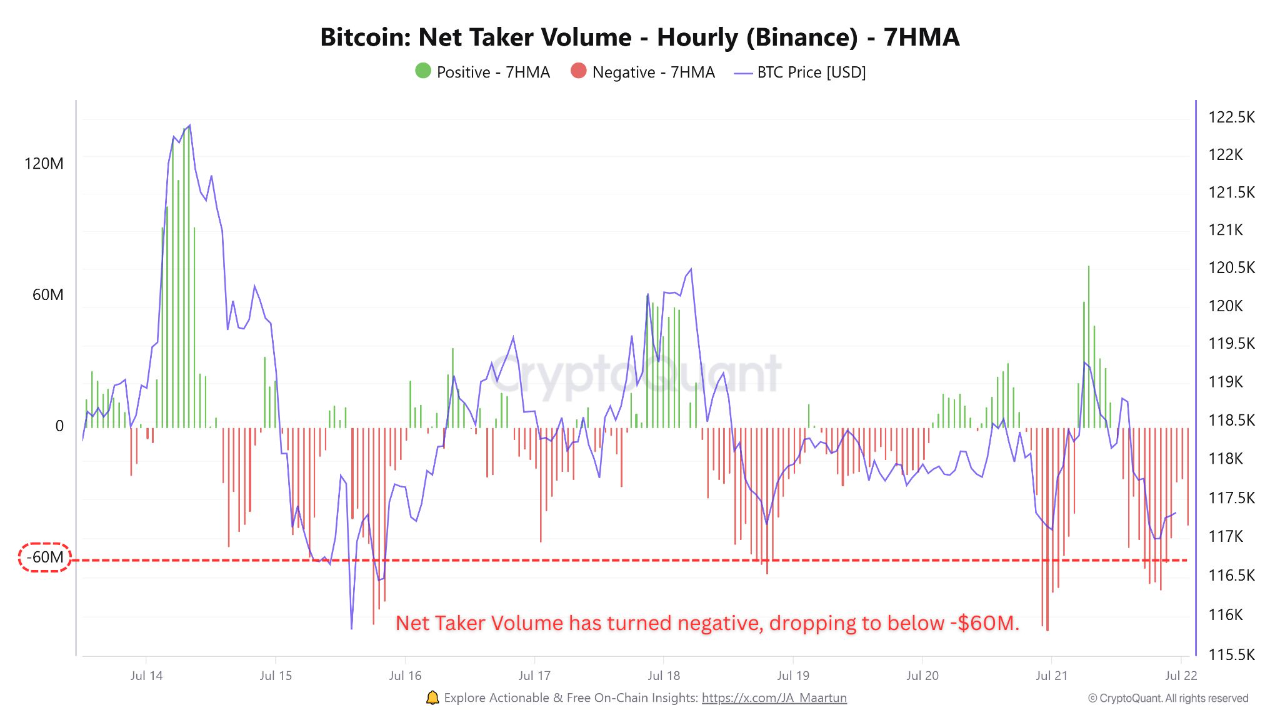

This trend is further confirmed by the negative change in Binance’s nettaker volume.

Source: Cryptoquant

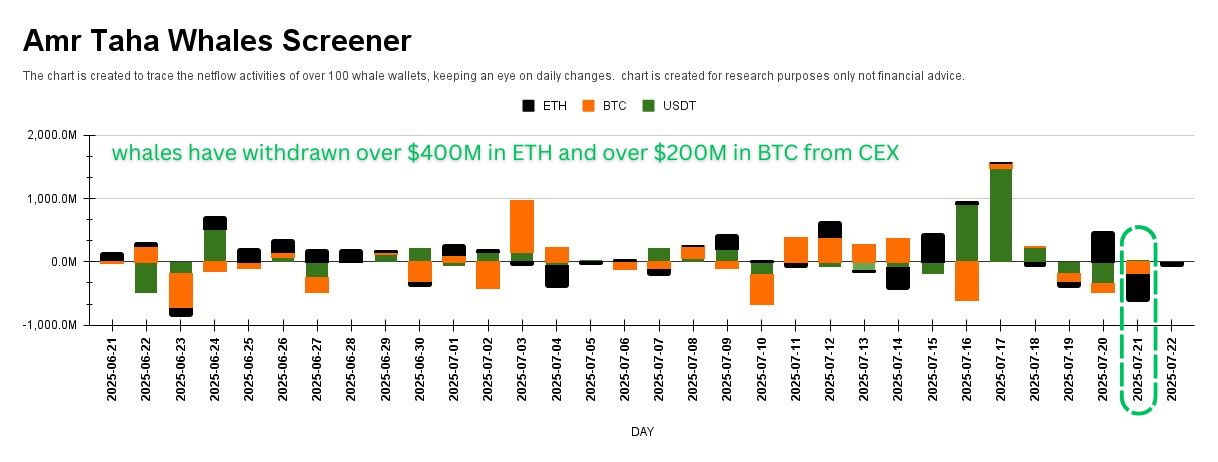

At the same time, whales are purchased at high prices

The whales continue to pile up while the retailer heads towards the exit. Data from AMR Taha’s whale cleaners show that over $600 million in crypto, $400 million in ETH and $200 million in BTC have been withdrawn from centralized exchanges in the last 24 hours.

Source: Cryptoquant

The withdrawal shows a shift from trading to long-term retention despite the shaking of retail, and further reflects a strong belief in the benefits.

BTC Price Analysis: A Fragile but Balanced Market

According to GlassNode, the Bitcoin market remains fundamentally strong, but signs of cooling are emerging.

Spot Bitcoin ETFs registered in the US have seen net inflows and revival of volume. This indicates that demand for the system remains strong. However, we see some minor benefits realizations, as suggested by the slight DIP of the ETF MVRV.

The recently overheated RSI is currently cooled from the excess zone to 63.11, but it is still bullish. The MACD histogram also shows a decline in bullish momentum, which could suggest a short-term integration or pullback before the next breakout.

Source: TradingView

The Bollinger band indicates that if BTC holds the midline at 114.8K, a breakout to the upper band and a retest of 123.5k is likely. Above this level, it could open the door to a fresh gathering. Conversely, a drop below $114.8K could expose a negative side target over the 106K Bollinger band base.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.