Important insights:

- Ethereum prices have not been far apart as ETF inflows reached $296 million in a day.

- Whale accumulation and user activity are the greatest ever story of Ethereum.

- Defi’s monthly growth of 40.43% means that Ethereum’s all-time high range is once again reached.

Ethereum prices may be trading below the peak, but beneath the surface, momentum is quietly built. From record-breaking ETF influx to whale purchases and sudden defi revivals, key data points are flashing in intensity.

Price action remains choppy, but drops by 2% a day, but the Ethereum foundations are moving in one direction.

Here’s why long-term breakout stories are rooted in not only hype, but also in the actual use of the chain and capital flows.

The agency is buying price dip for Ethereum, and they are not alone

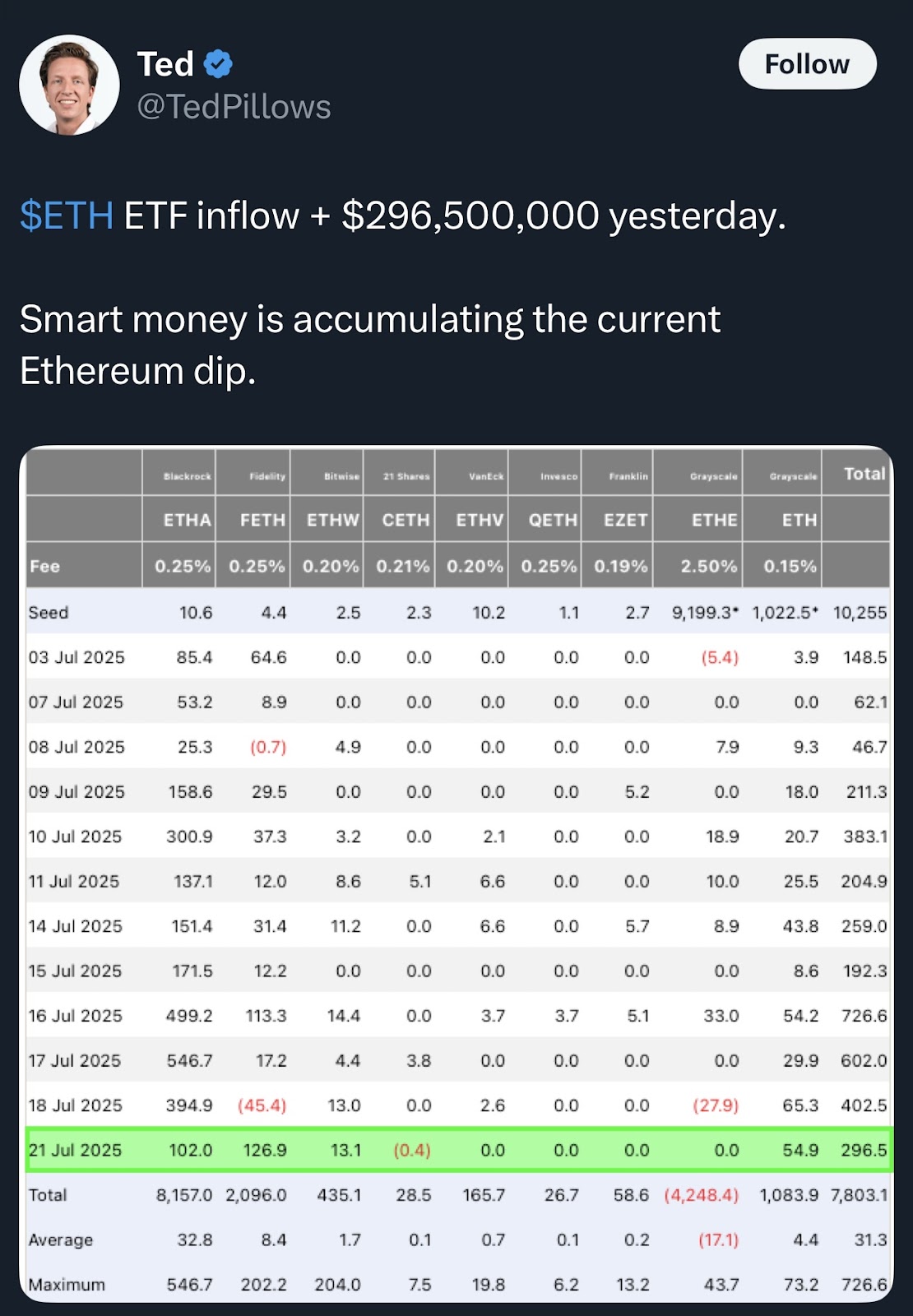

The influx of Ethereum ETFs exceeded $296.5 million in the day on July 21st, pouring into large quantities of products from Franklin, Bitwise and BlackRock.

Over the past two weeks, total ETF allocations now exceed $7.8 billion. This shows that big investors aren’t running away. They’re in.

Surging ETH ETF inflow – Source: Ted

Sharplink Gaming, one of the most offensive ETH Gobblers, has now increased its holdings by 29% at 360,807 ETH.

Sharplink continues to add ETH-source:WU blockchain

In the chains, whales do the same thing. One new wallet has withdrawn $267 million worth of ETH from Falconx over three days.

Another took $72 million from Binance. These are not retail purchases. These are the big bets often placed by large players on the basis of long-term convictions.

Whales continue to accumulate again. Source: LookonChain

These movements suggest that accumulation is a way for ETH. And everything that’s happening with Ethereum prices unfixed by more than 2% a day. An unusual trend in cryptography.

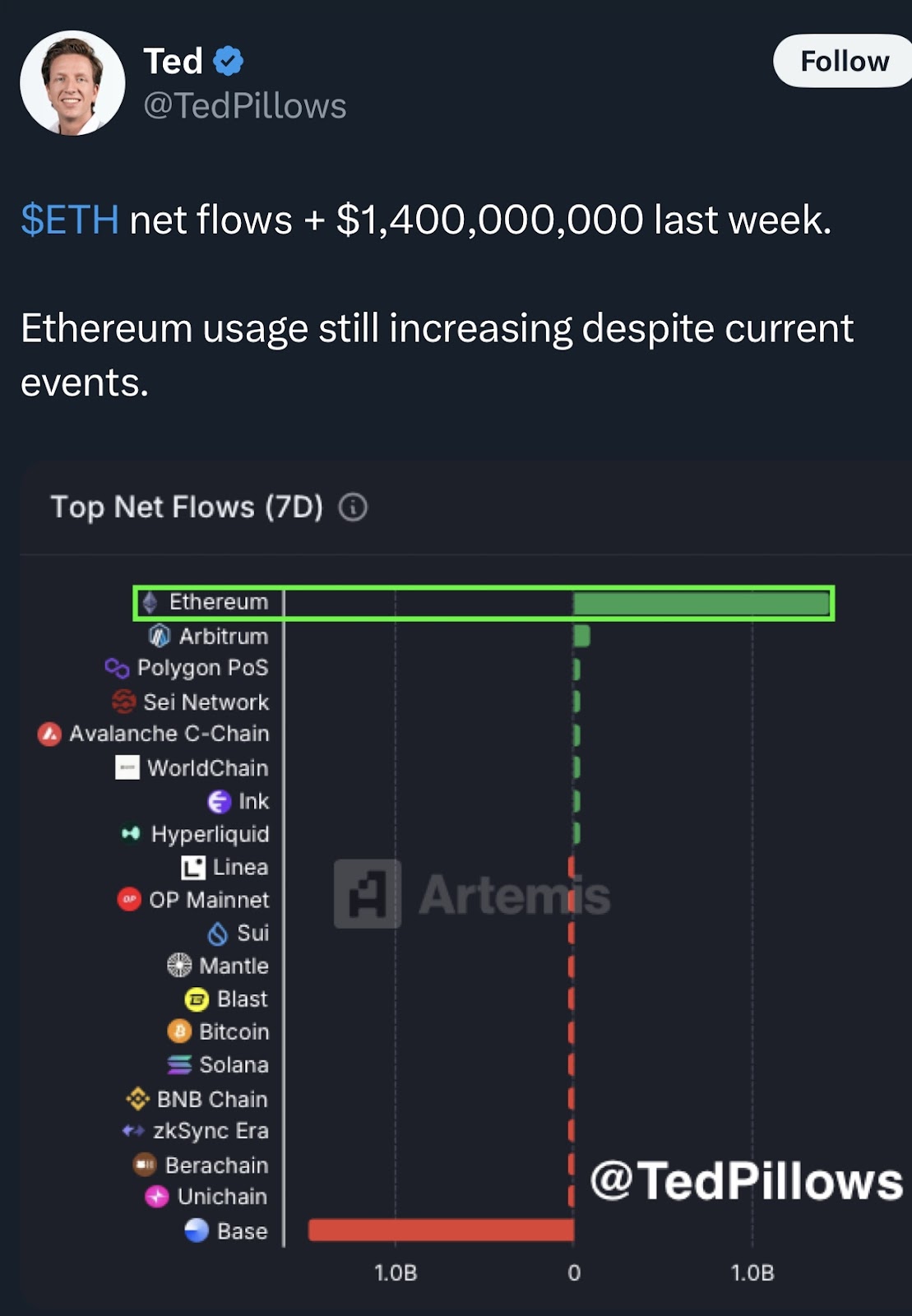

Ethereum influx has skyrocketed – Source: Ted

Ethereum also saw a net inflow of $1.4 billion in seven days, breaking all other chains. Netflow tracks how much money travels from major players to the blockchain.

A high positive number suggests that people are moving ETH to hold rather than selling.

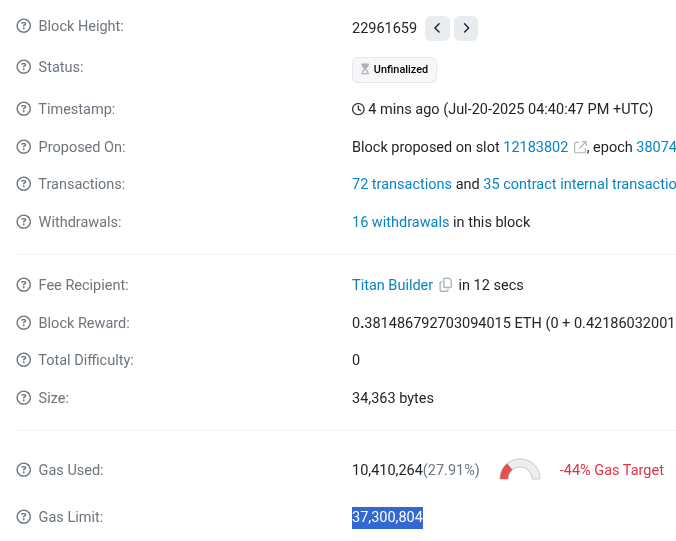

Voting to increase your ETH gas fees – Source: Etherscan

Can the on-chain boom always make Ethereum prices higher?

Ethereum Daily Transactions reached an annual high of 1.47 million based on a seven-day average. It’s the best activity since last year, indicating that Ethereum is more than just sitting idle. It is used every day.

And despite the talk that the town is linked to a gas rate hike.

Everyday ETH transactions are growing. Source: Ted

Another signal comes from a high value transaction. According to Sentora data, it increased $100 billion, more than $100,000 last week, the highest since 2021.

This suggests that large institutions and whales are running ETH again. This usually happens before the bulk price changes.

As ETH is currently trading within the $3,600-$3,800 range, a massive number of transactions could push beyond $4,000.

This activity boost does not occur alone. It lined up with everything else, including ETF influx, whale accumulation, and rising net flow. Together, they refer to a powerful and continuous wave of interest.

Ethereum’s Defi comeback out the market

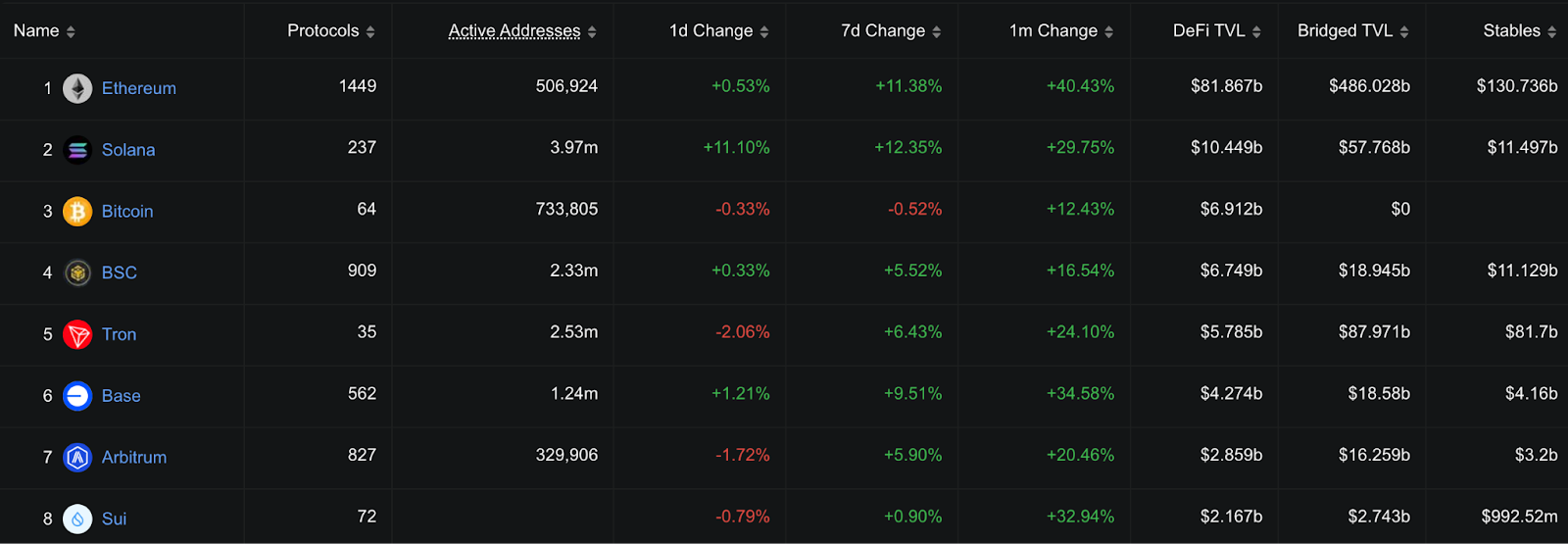

Defi’s total Ethereum value (TVL) increased by 40.43% per month. This is the best growth of any blockchain. It’s even higher than layer 2 chains like Arbitrum and Base.

Defi Revival for Ethereum – Source: x

TVL is an easy way to track how much money is locked to your Defi app. If numbers are growing rapidly, that means more people trust the chain to run financial apps.

For Ethereum to lead this category, it means that capital is spinning back into the ecosystem and not leaving it.

Even with new blockchains that promise faster speeds, Ethereum’s Defi is growing faster. This suggests that users still trust security, developer tools, and network effects.

Following all these basic moves, bullish crypto market sentiment and the possibility of the coming Altcoin season could drive ETH through the new all-time high.